For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In contrast to all that, I prefer to spend time on companies like IBI Group (TSE:IBG), which has not only revenues, but also profits. Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for IBI Group

IBI Group's Improving Profits

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So it's no surprise that some investors are more inclined to invest in profitable businesses. Like a firecracker arcing through the night sky, IBI Group's EPS shot from CA$0.30 to CA$0.55, over the last year. Year on year growth of 80% is certainly a sight to behold.

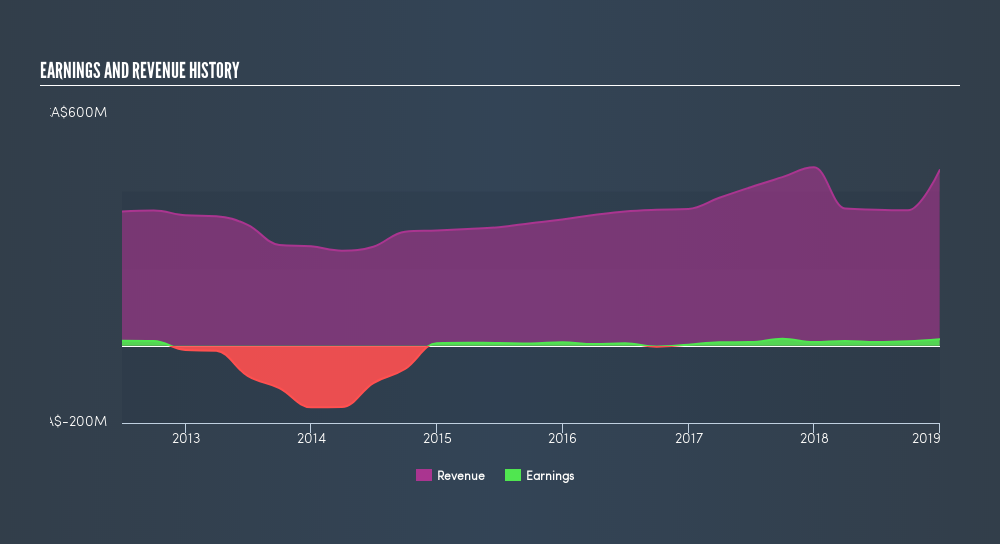

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. It seems IBI Group is pretty stable, since revenue and EBIT margins are pretty flat year on year. That's not a major concern but nor does it point to the long term growth we like to see.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this freereport showing analyst forecasts for IBI Group's future profits.

Are IBI Group Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Insiders both bought and sold IBI Group shares in the last year, but the good news is they spent CA$59k more buying than they netted selling. So, on balance, insider transaction are mildly encouraging. Zooming in, we can see that the biggest insider purchase was by Independent Director Michael Nobrega for CA$99k worth of shares, at about CA$5.29 per share.

Does IBI Group Deserve A Spot On Your Watchlist?

IBI Group's earnings per share have taken off like a rocket aimed right at the moon. If you're like me, you'll find it hard to ignore that sort of explosive EPS growth. And indeed, it could be a sign that the business is at an inflection point. If that's the case, you may regret neglecting to put IBI Group on your watchlist. Now, you could try to make up your mind on IBI Group by focusing on just these factors, oryou could also consider how its price-to-earnings ratio compares to other companies in its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of IBI Group, you'll probably love this freelist of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdictionWe aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:IBG

IBI Group

IBI Group Inc. provides various professional services in Canada, the United States, the United Kingdom, and internationally.

Outstanding track record with excellent balance sheet.

Market Insights

Community Narratives