- Canada

- /

- Commercial Services

- /

- TSX:GFL

Does Strong Guidance and Buybacks Mark a Strategic Turning Point for GFL Environmental (TSX:GFL)?

Reviewed by Sasha Jovanovic

- GFL Environmental Inc. recently reported strong third-quarter results, including increased sales to CA$1.69 billion and net income of CA$114.3 million, along with raised full-year revenue guidance to between CA$6.58 billion and CA$6.60 billion.

- The company also completed significant share buybacks and highlighted an ongoing focus on opportunistic acquisitions and strategic reinvestment.

- We'll explore how GFL Environmental's improved earnings outlook and guidance adjustment may influence its long-term investment narrative.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

GFL Environmental Investment Narrative Recap

GFL Environmental’s investment story centers on its aim to drive consistent margin expansion through higher-quality volumes, strategic reinvestment, and M&A, all while managing risks from commodity cycles and cost pressures. The recent boost in revenue guidance and solid third-quarter earnings reinforce the narrative but do not materially change the primary short-term catalyst of sustainable margin growth or address the ongoing risk of volatility in commodity prices and input costs.

The announcement of further share buybacks, repurchasing over 5.1 million shares for CA$342.5 million last quarter, stands out as the most relevant to recent earnings news. This move underscores capital return efforts following improved financial performance, yet the links between such buybacks and underlying operational catalysts like margin expansion remain nuanced amid potential headwinds.

On the other hand, investors should be aware that underlying commodity price volatility continues to pose a risk...

Read the full narrative on GFL Environmental (it's free!)

GFL Environmental's narrative projects CA$8.0 billion revenue and CA$111.1 million earnings by 2028. This requires a 0.2% yearly revenue decline and a CA$924.6 million earnings increase from CA$-813.5 million.

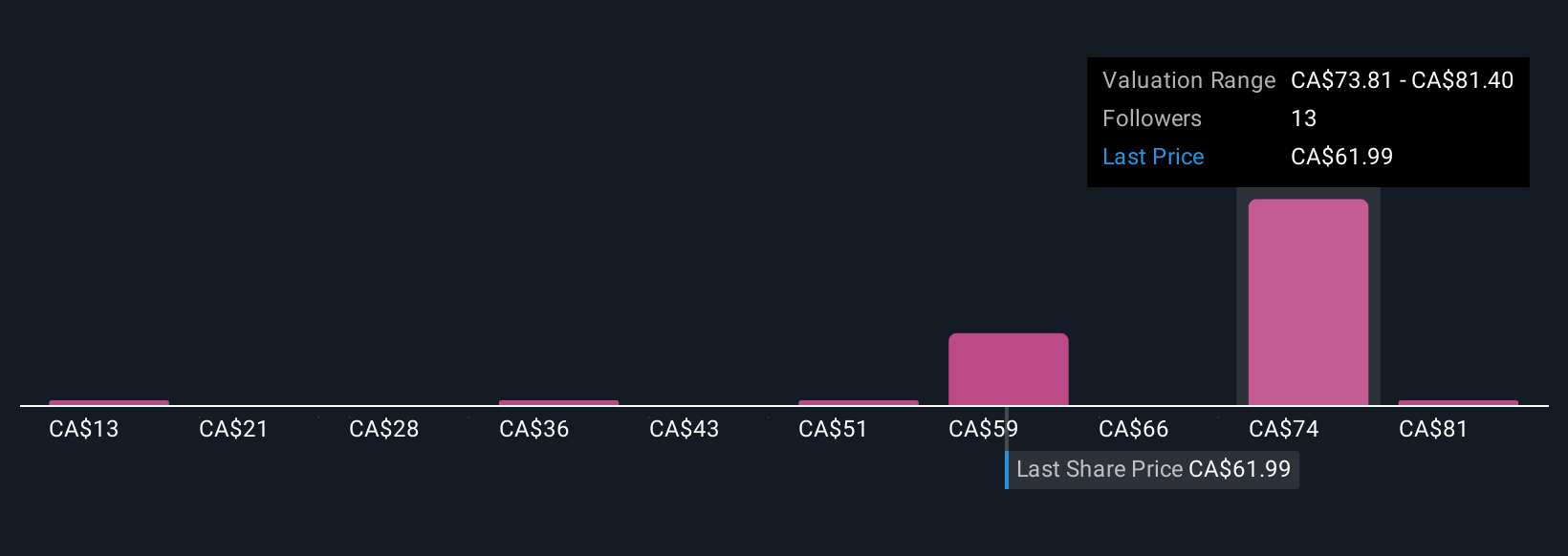

Uncover how GFL Environmental's forecasts yield a CA$75.52 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members published five fair value estimates for GFL Environmental ranging from CA$13.04 to CA$89 per share. With this broad spread in viewpoints, it is important to remember that the core driver highlighted by many analysts remains the company’s ability to generate a durable price-cost spread, a factor that could meaningfully influence outcomes in the months ahead.

Explore 5 other fair value estimates on GFL Environmental - why the stock might be worth as much as 43% more than the current price!

Build Your Own GFL Environmental Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your GFL Environmental research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free GFL Environmental research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate GFL Environmental's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GFL

GFL Environmental

Provides non-hazardous solid waste management and environmental services in Canada and the United States.

Slight risk and fair value.

Similar Companies

Market Insights

Community Narratives