- Canada

- /

- Commercial Services

- /

- TSX:GDI

We Think GDI Integrated Facility Services (TSE:GDI) Can Stay On Top Of Its Debt

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies GDI Integrated Facility Services Inc. (TSE:GDI) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for GDI Integrated Facility Services

What Is GDI Integrated Facility Services's Debt?

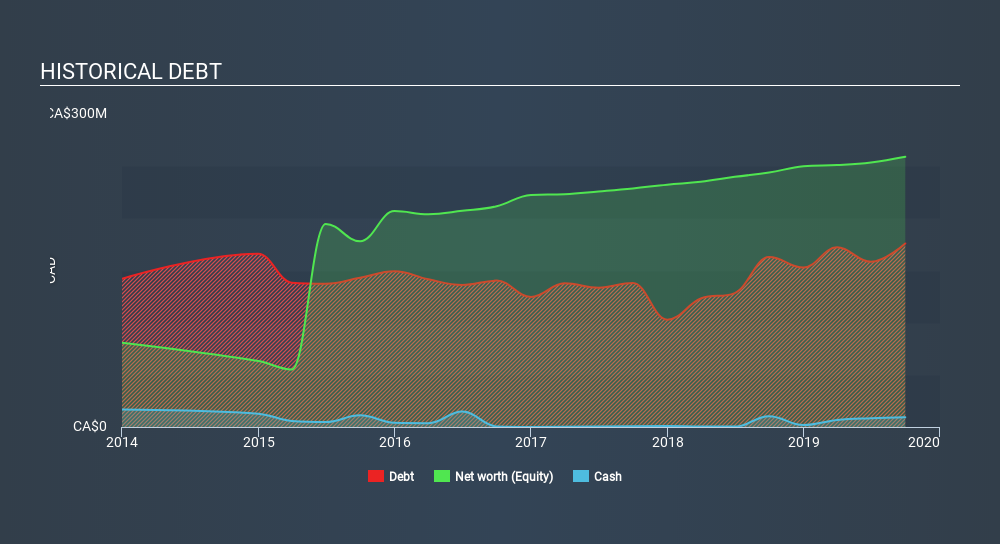

You can click the graphic below for the historical numbers, but it shows that as of September 2019 GDI Integrated Facility Services had CA$175.9m of debt, an increase on CA$163, over one year. On the flip side, it has CA$9.26m in cash leading to net debt of about CA$166.6m.

How Healthy Is GDI Integrated Facility Services's Balance Sheet?

The latest balance sheet data shows that GDI Integrated Facility Services had liabilities of CA$181.6m due within a year, and liabilities of CA$199.7m falling due after that. Offsetting this, it had CA$9.26m in cash and CA$264.4m in receivables that were due within 12 months. So it has liabilities totalling CA$107.6m more than its cash and near-term receivables, combined.

Since publicly traded GDI Integrated Facility Services shares are worth a total of CA$747.5m, it seems unlikely that this level of liabilities would be a major threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

GDI Integrated Facility Services's debt is 2.7 times its EBITDA, and its EBIT cover its interest expense 3.0 times over. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. However, one redeeming factor is that GDI Integrated Facility Services grew its EBIT at 14% over the last 12 months, boosting its ability to handle its debt. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine GDI Integrated Facility Services's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, GDI Integrated Facility Services actually produced more free cash flow than EBIT. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

The good news is that GDI Integrated Facility Services's demonstrated ability to convert EBIT to free cash flow delights us like a fluffy puppy does a toddler. But the stark truth is that we are concerned by its interest cover. Looking at all the aforementioned factors together, it strikes us that GDI Integrated Facility Services can handle its debt fairly comfortably. On the plus side, this leverage can boost shareholder returns, but the potential downside is more risk of loss, so it's worth monitoring the balance sheet. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 1 warning sign for GDI Integrated Facility Services that you should be aware of before investing here.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:GDI

GDI Integrated Facility Services

Operates in the outsourced facility services industry in Canada and the United States.

Good value with adequate balance sheet.

Market Insights

Community Narratives