- Canada

- /

- Professional Services

- /

- TSX:CWL

The Caldwell Partners International Inc.'s (TSE:CWL) Stock Has Been Sliding But Fundamentals Look Strong: Is The Market Wrong?

With its stock down 26% over the past three months, it is easy to disregard Caldwell Partners International (TSE:CWL). But if you pay close attention, you might gather that its strong financials could mean that the stock could potentially see an increase in value in the long-term, given how markets usually reward companies with good financial health. Particularly, we will be paying attention to Caldwell Partners International's ROE today.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

View our latest analysis for Caldwell Partners International

How Do You Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Caldwell Partners International is:

16% = CA$4.3m ÷ CA$27m (Based on the trailing twelve months to November 2021).

The 'return' is the yearly profit. Another way to think of that is that for every CA$1 worth of equity, the company was able to earn CA$0.16 in profit.

Why Is ROE Important For Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Caldwell Partners International's Earnings Growth And 16% ROE

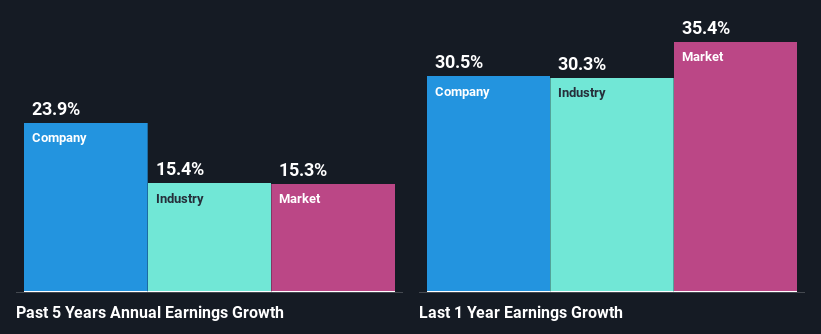

To begin with, Caldwell Partners International seems to have a respectable ROE. Even when compared to the industry average of 15% the company's ROE looks quite decent. This certainly adds some context to Caldwell Partners International's exceptional 24% net income growth seen over the past five years. We reckon that there could also be other factors at play here. Such as - high earnings retention or an efficient management in place.

Next, on comparing Caldwell Partners International's net income growth with the industry, we found that the company's reported growth is similar to the industry average growth rate of 21% in the same period.

Earnings growth is an important metric to consider when valuing a stock. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). This then helps them determine if the stock is placed for a bright or bleak future. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Caldwell Partners International is trading on a high P/E or a low P/E, relative to its industry.

Is Caldwell Partners International Making Efficient Use Of Its Profits?

While the company did pay out a portion of its dividend in the past, it currently doesn't pay a dividend. This is likely what's driving the high earnings growth number discussed above.

Summary

On the whole, we feel that Caldwell Partners International's performance has been quite good. Specifically, we like that the company is reinvesting a huge chunk of its profits at a high rate of return. This of course has caused the company to see substantial growth in its earnings. So far, we've only made a quick discussion around the company's earnings growth. To gain further insights into Caldwell Partners International's past profit growth, check out this visualization of past earnings, revenue and cash flows.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CWL

Caldwell Partners International

Provides candidate research and sourcing services in Canada, the United States, the United Kingdom, and other European countries.

Flawless balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives