- Canada

- /

- Food and Staples Retail

- /

- TSX:CRP

Those Who Purchased Ceres Global Ag (TSE:CRP) Shares Five Years Ago Have A 37% Loss To Show For It

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

For many, the main point of investing is to generate higher returns than the overall market. But in any portfolio, there will be mixed results between individual stocks. So we wouldn't blame long term Ceres Global Ag Corp. (TSE:CRP) shareholders for doubting their decision to hold, with the stock down 37% over a half decade. It's up 4.4% in the last seven days.

See our latest analysis for Ceres Global Ag

Ceres Global Ag isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over five years, Ceres Global Ag grew its revenue at 21% per year. That's well above most other pre-profit companies. Shareholders are no doubt disappointed with the loss of 8.9%, each year, in that time. You could say that the market has been harsh, given the top line growth. If that's the case, now might be the smart time to take a close look at it.

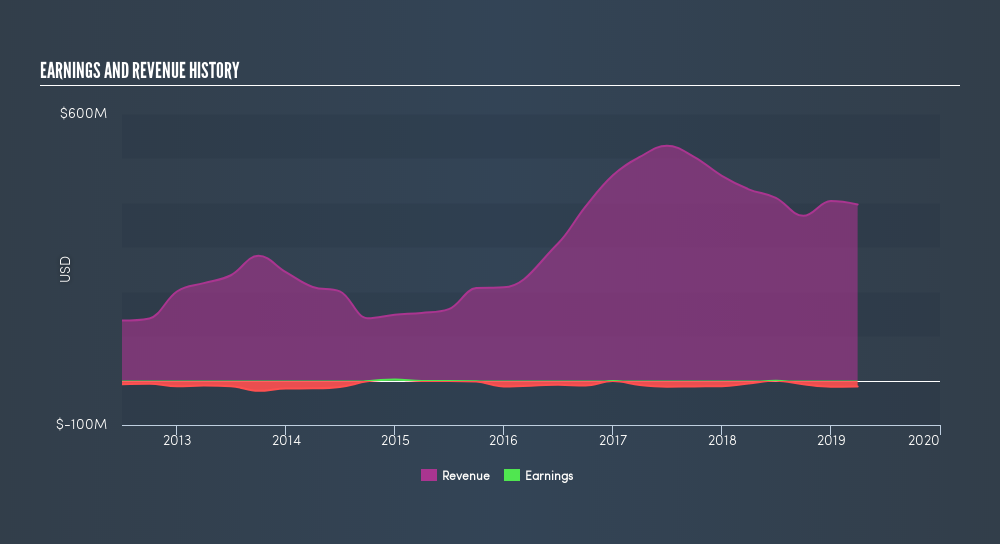

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

Take a more thorough look at Ceres Global Ag's financial health with this free report on its balance sheet.

A Different Perspective

We're pleased to report that Ceres Global Ag shareholders have received a total shareholder return of 4.9% over one year. That certainly beats the loss of about 8.9% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:CRP

Ceres Global Ag

Provides agricultural commodities and value-added products, industrial products, fertilizers, energy products, and supply chain logistics services.

Adequate balance sheet with questionable track record.

Market Insights

Community Narratives