Stock Analysis

- Canada

- /

- Capital Markets

- /

- TSX:BAM

Exploring Three TSX Stocks That May Be Trading Below Their Estimated Intrinsic Value With Discounts Ranging From 15.1% To 28.8%

Reviewed by Simply Wall St

As the U.S. presidential campaign unfolds, key economic issues such as government debt, Fed policy, and trade are poised to influence market conditions significantly. These factors underscore the importance of prudent investment choices in potentially undervalued stocks that may offer a buffer against market volatility and align with current economic trends. Identifying stocks trading below their estimated intrinsic value could provide investors with opportunities for growth amidst these uncertain times.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| goeasy (TSX:GSY) | CA$181.75 | CA$312.61 | 41.9% |

| Decisive Dividend (TSXV:DE) | CA$7.01 | CA$11.76 | 40.4% |

| B2Gold (TSX:BTO) | CA$4.09 | CA$8.07 | 49.3% |

| Trisura Group (TSX:TSU) | CA$42.46 | CA$80.18 | 47% |

| Kraken Robotics (TSXV:PNG) | CA$1.14 | CA$2.24 | 49.1% |

| Kinaxis (TSX:KXS) | CA$164.65 | CA$263.81 | 37.6% |

| Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

| Amerigo Resources (TSX:ARG) | CA$1.59 | CA$2.73 | 41.8% |

| Green Thumb Industries (CNSX:GTII) | CA$15.97 | CA$28.38 | 43.7% |

| Opsens (TSX:OPS) | CA$2.90 | CA$4.64 | 37.5% |

Let's uncover some gems from our specialized screener.

Brookfield Asset Management (TSX:BAM)

Overview: Brookfield Asset Management Ltd. is a real estate investment firm specializing in alternative asset management, with a market capitalization of CA$23.89 billion.

Operations: The firm operates primarily in the alternative asset management sector, focusing on real estate investments.

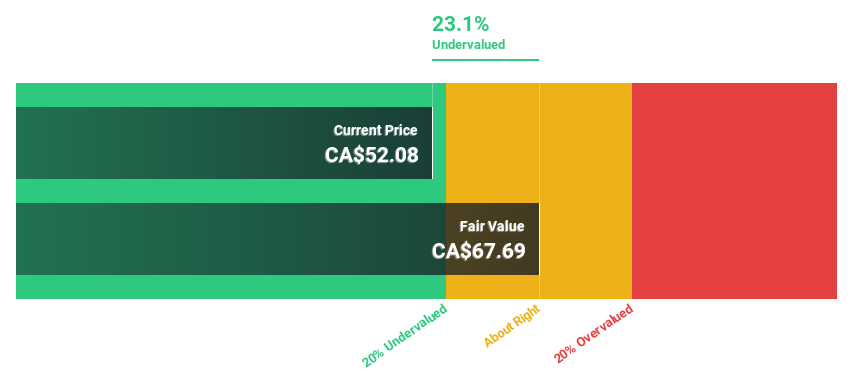

Estimated Discount To Fair Value: 15.1%

Brookfield Asset Management's recent M&A activity, including a possible cash offer for Tritax EuroBox and selling parts of its Indian renewable portfolio, highlights strategic asset realignment. Despite trading 15.1% below its estimated fair value at CA$56.89, concerns arise from a dividend coverage issue with earnings not sufficiently covering a 3.66% yield. However, the company is poised for substantial growth with forecasted annual earnings increase of 74.4%, significantly outpacing the Canadian market's 14.7%.

- According our earnings growth report, there's an indication that Brookfield Asset Management might be ready to expand.

- Dive into the specifics of Brookfield Asset Management here with our thorough financial health report.

Boyd Group Services (TSX:BYD)

Overview: Boyd Group Services Inc., together with its subsidiaries, operates non-franchised collision repair centers across North America, boasting a market capitalization of approximately CA$5.63 billion.

Operations: The company generates CA$3.02 billion from automotive collision repair and related services.

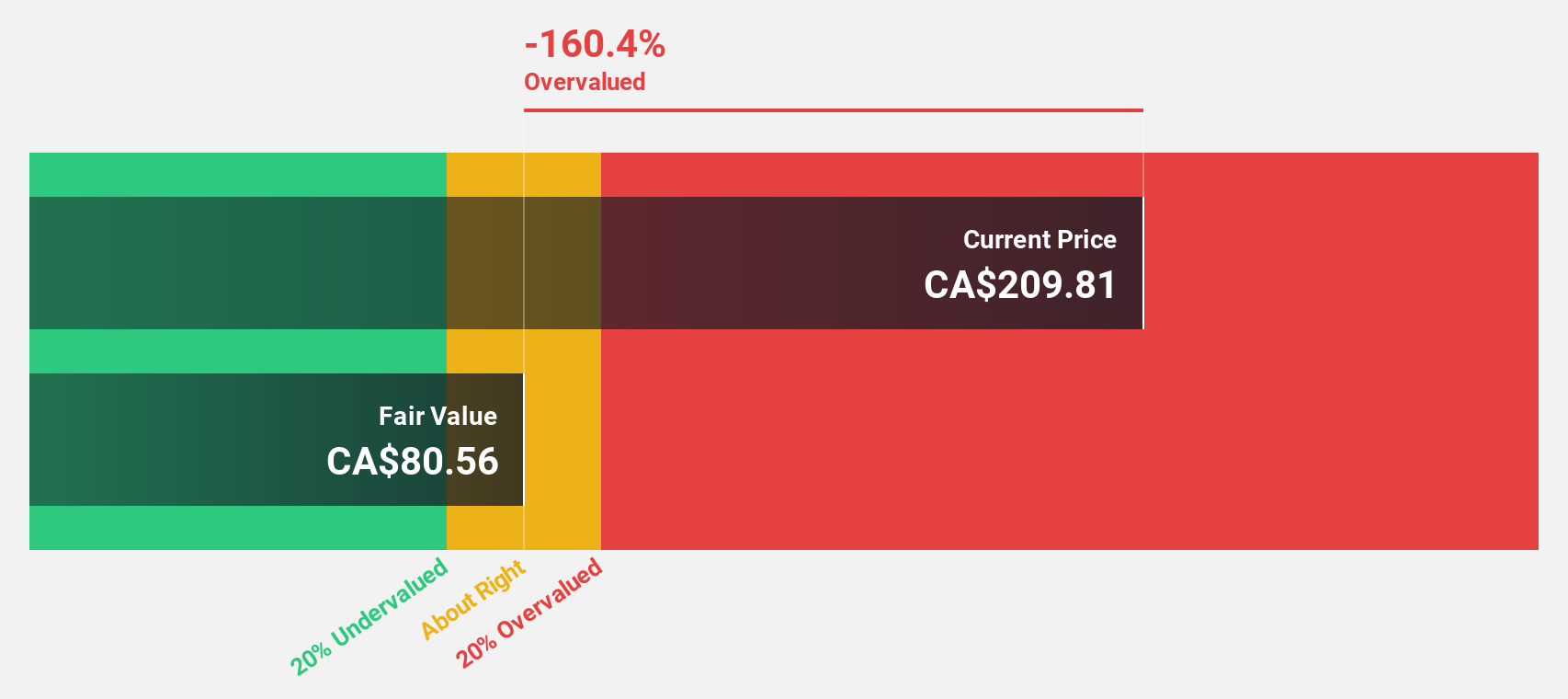

Estimated Discount To Fair Value: 28.8%

Boyd Group Services Inc. reported a substantial decline in net income for Q1 2024, with earnings of US$8.38 million compared to US$20.82 million the previous year, despite an increase in sales to US$786.55 million from US$714.94 million. However, Boyd is considered undervalued based on discounted cash flow analysis, trading at CA$261.37 against a fair value estimate of CA$367.09, reflecting a 28.8% undervaluation. Additionally, Boyd's revenue and earnings are expected to grow faster than the market average over the next three years.

- Our comprehensive growth report raises the possibility that Boyd Group Services is poised for substantial financial growth.

- Take a closer look at Boyd Group Services' balance sheet health here in our report.

Constellation Software (TSX:CSU)

Overview: Constellation Software Inc. operates globally, focusing on acquiring, building, and managing vertical market software businesses primarily in Canada, the United States, and Europe, with a market capitalization of approximately CA$88.73 billion.

Operations: The company's revenue from its software and programming segment amounts to CA$8.84 billion.

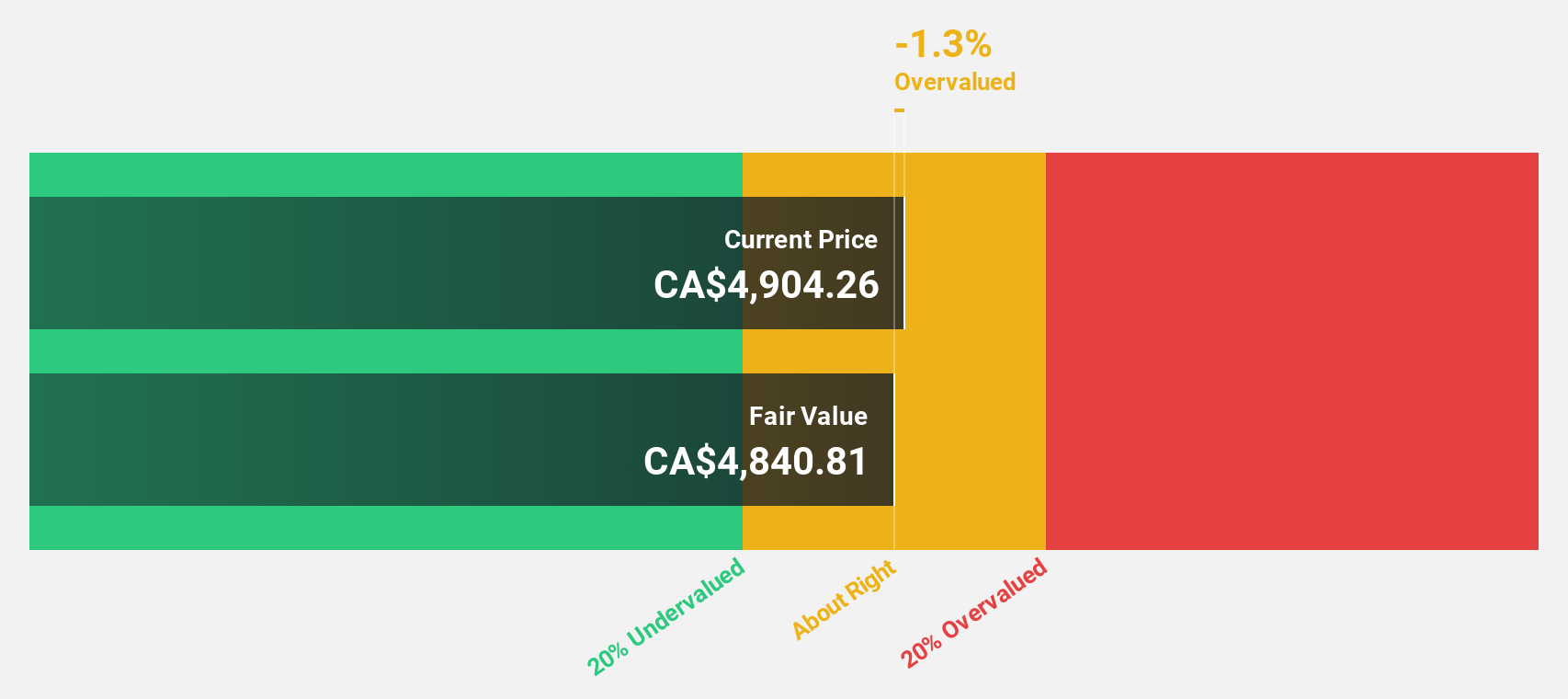

Estimated Discount To Fair Value: 25%

Constellation Software, valued at CA$4197.86, trades below its estimated fair value of CA$5598.1, indicating a significant undervaluation based on discounted cash flow analysis. Despite a high level of debt, the company's robust forecast includes revenue growth at 16.1% per year—outpacing the Canadian market—and earnings expected to rise by 24.4% annually. Recent strategic expansions and leadership changes, like the launch of Omegro and executive shifts within Harris operating group, underscore its proactive approach in enhancing operational scope and efficiency.

- The analysis detailed in our Constellation Software growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Constellation Software.

Taking Advantage

- Take a closer look at our Undervalued TSX Stocks Based On Cash Flows list of 20 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Brookfield Asset Management is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BAM

Brookfield Asset Management

A real estate investment firm specializing in alternative asset management services.

High growth potential and fair value.