Stock Analysis

July 2024 Insight Into TSX Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As the U.S. presidential campaign unfolds, key economic issues such as government debt, Fed policy, and trade are poised to influence market sentiments significantly. While these factors might not drastically alter the market's course, they underscore the importance of robust fiscal management and strategic investment choices. In this context, growth companies on the TSX with high insider ownership could offer a compelling narrative of stability and committed leadership amidst broader market uncertainties.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Vox Royalty (TSX:VOXR) | 12.6% | 55.0% |

| goeasy (TSX:GSY) | 21.5% | 15.5% |

| Payfare (TSX:PAY) | 14.8% | 38.6% |

| Allied Gold (TSX:AAUC) | 22.5% | 68.4% |

| Ivanhoe Mines (TSX:IVN) | 12.4% | 67.3% |

| Alpha Cognition (CNSX:ACOG) | 18% | 66.5% |

| Artemis Gold (TSXV:ARTG) | 31.4% | 45.6% |

| Aya Gold & Silver (TSX:AYA) | 10.3% | 51.6% |

| Silver X Mining (TSXV:AGX) | 14.1% | 144.2% |

| Almonty Industries (TSX:AII) | 17.7% | 105% |

Let's review some notable picks from our screened stocks.

Colliers International Group (TSX:CIGI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Colliers International Group Inc. is a global provider of commercial real estate professional and investment management services, with a market capitalization of approximately CA$8.94 billion.

Operations: The company generates revenue through its operations in the Americas (CA$2.53 billion), Asia Pacific (CA$616.58 million), Investment Management (CA$489.23 million), and Europe, Middle East & Africa (EMEA) (CA$730.10 million).

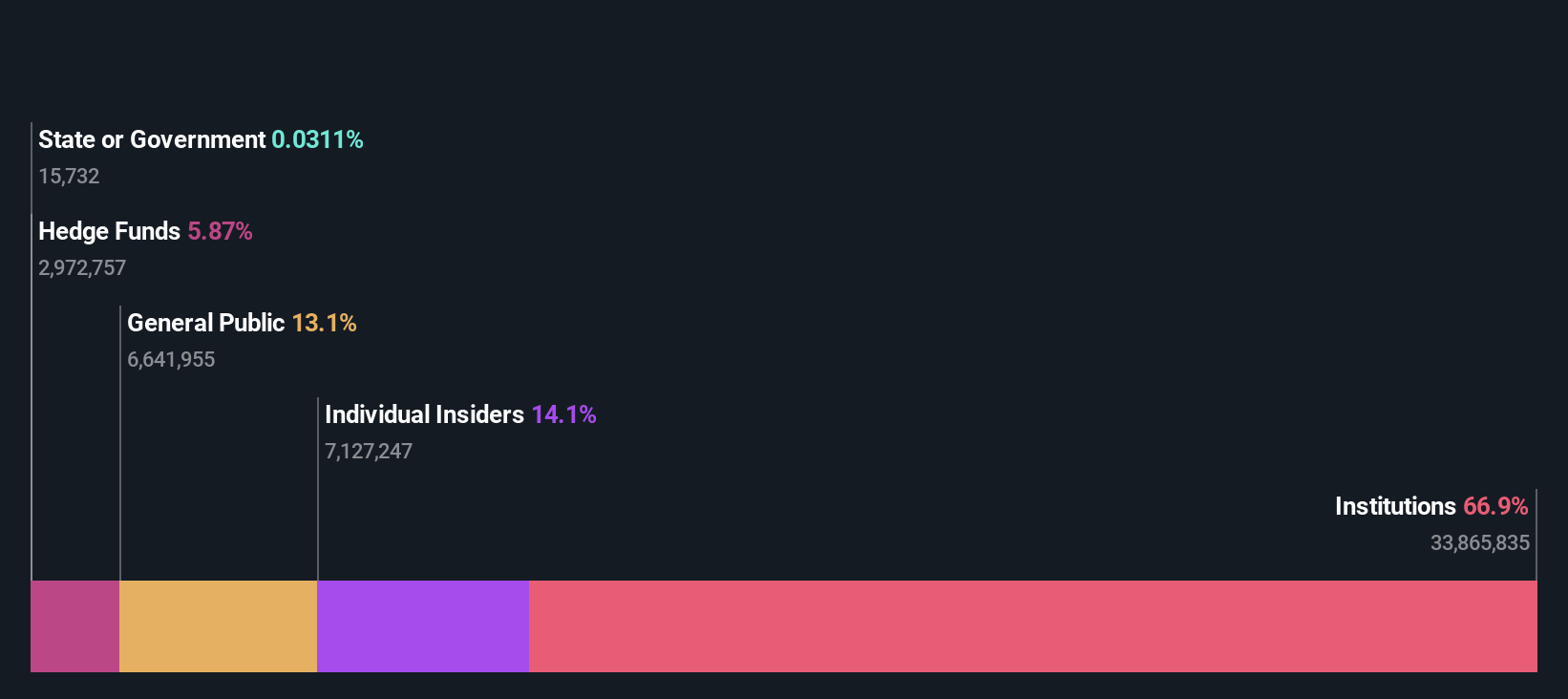

Insider Ownership: 14.2%

Colliers International Group has seen a notable uptick in insider buying over the past three months, indicating strong confidence from those closest to the company. Despite recent shareholder dilution, Colliers is actively expanding its global footprint, exemplified by a new partnership with SPGI Zurich AG to strengthen its EMEA presence. Financially, Colliers reported significant earnings growth last year and anticipates continued revenue and profit increases, although at rates below some market expectations.

- Delve into the full analysis future growth report here for a deeper understanding of Colliers International Group.

- Our expertly prepared valuation report Colliers International Group implies its share price may be lower than expected.

Savaria (TSX:SIS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Savaria Corporation specializes in accessibility solutions for the elderly and physically challenged, operating across Canada, the United States, Europe, and internationally, with a market cap of approximately CA$1.35 billion.

Operations: The company generates revenue primarily from its Patient Care segment, which reported CA$183.82 million in sales.

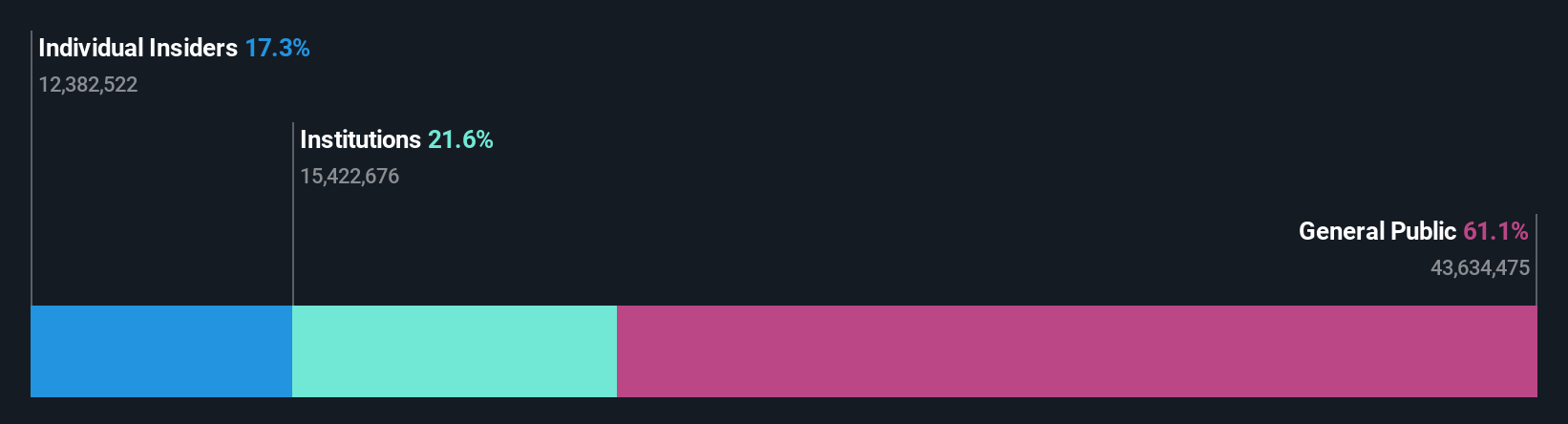

Insider Ownership: 19.6%

Savaria, a Canadian firm with high insider ownership, has demonstrated consistent financial growth, with a notable increase in net income from CAD 6.04 million to CAD 11.05 million in the first quarter of 2024. Despite substantial insider selling recently, the company maintains a steady dividend payout and is projected to reach revenues of approximately CAD 1 billion by 2025. However, its revenue growth forecast of 7.4% annually lags behind more aggressive market benchmarks.

- Get an in-depth perspective on Savaria's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Savaria shares in the market.

Vitalhub (TSX:VHI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vitalhub Corp. offers technology solutions for health and human service providers across Canada, the US, the UK, Australia, Western Asia, and other international markets, with a market capitalization of CA$354.95 million.

Operations: The company generates CA$55.17 million in revenue from its healthcare software segment.

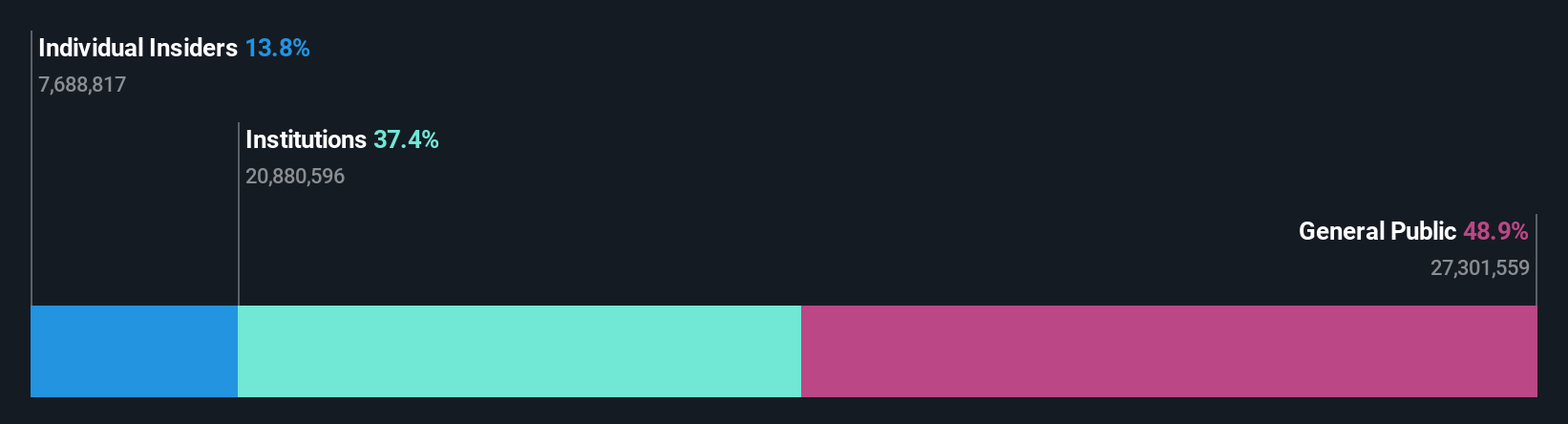

Insider Ownership: 15.1%

Vitalhub, showcasing high insider ownership, recently announced a significant partnership with Lumenus Community Services to deploy TREAT, enhancing data management and outcome reporting. This strategic move aligns with Vitalhub's first-quarter revenue growth to CAD 15.26 million and a net income increase to CAD 1.32 million. Despite shareholder dilution over the past year, the company is trading at a substantial discount to its fair value and anticipates robust annual earnings growth of 38.12%.

- Click to explore a detailed breakdown of our findings in Vitalhub's earnings growth report.

- Our comprehensive valuation report raises the possibility that Vitalhub is priced lower than what may be justified by its financials.

Seize The Opportunity

- Click here to access our complete index of 29 Fast Growing TSX Companies With High Insider Ownership.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Savaria is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SIS

Savaria

Provides accessibility solutions for the elderly and physically challenged people in Canada, the United States, Europe, and internationally.

Excellent balance sheet established dividend payer.