Stock Analysis

- Canada

- /

- Energy Services

- /

- TSX:PHX

TSX Dividend Stocks: PHX Energy Services And Two Others To Consider

Reviewed by Simply Wall St

As the U.S. presidential campaign unfolds, discussions around government debt, Federal Reserve policies, and trade are poised to influence market sentiments and economic conditions. These broader economic factors are crucial when considering investments in dividend stocks on the TSX, as they offer potential stability in a landscape marked by fiscal and trade uncertainties.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Bank of Nova Scotia (TSX:BNS) | 6.53% | ★★★★★★ |

| Whitecap Resources (TSX:WCP) | 7.15% | ★★★★★★ |

| Secure Energy Services (TSX:SES) | 3.44% | ★★★★★☆ |

| Boston Pizza Royalties Income Fund (TSX:BPF.UN) | 8.17% | ★★★★★☆ |

| Enghouse Systems (TSX:ENGH) | 3.44% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.69% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 8.62% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.38% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.29% | ★★★★★☆ |

| Canadian Western Bank (TSX:CWB) | 3.06% | ★★★★★☆ |

Click here to see the full list of 34 stocks from our Top TSX Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

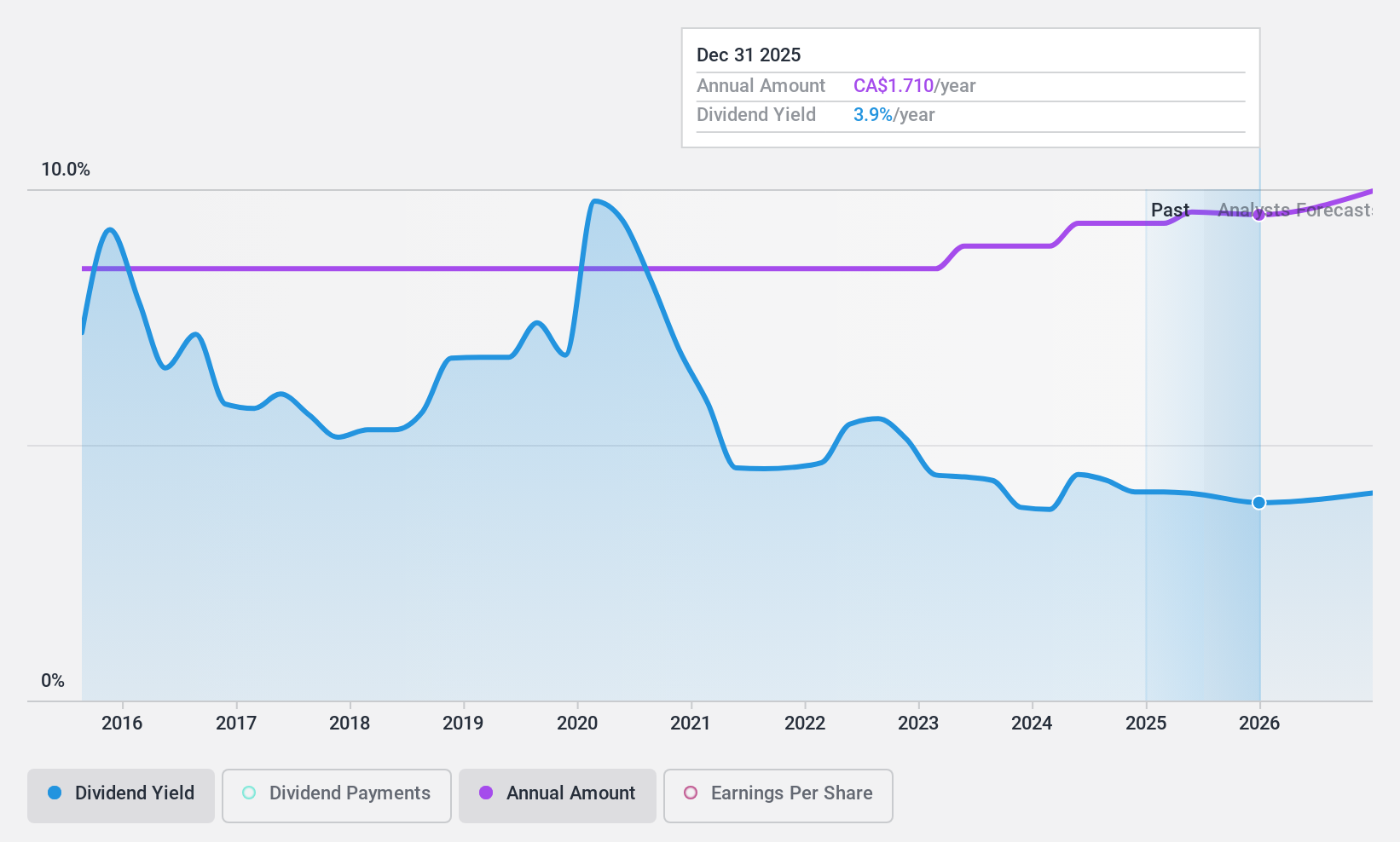

PHX Energy Services (TSX:PHX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PHX Energy Services Corp. offers horizontal and directional drilling services, along with renting and selling performance drilling motors and equipment to oil and natural gas companies in Canada, the U.S., Albania, the Middle East, and globally, with a market cap of CA$485.48 million.

Operations: PHX Energy Services Corp. generates CA$656.44 million from its horizontal oil and natural gas well drilling services.

Dividend Yield: 7.8%

PHX Energy Services offers a dividend yield of 7.78%, ranking in the top 25% of Canadian dividend payers, but its sustainability is questionable as dividends are not well covered by free cash flow or earnings, with a high cash payout ratio of 138.2%. Despite a historical increase in dividends over the past decade, payments have been volatile. Recently, PHX declared a quarterly dividend of CA$0.20 per share payable on July 15, 2024, affirming its commitment to returning value to shareholders amidst financial challenges indicated by an expected average earnings decline of 4.3% annually over the next three years and recent underwhelming quarterly results with net income dropping from CA$22.42 million to CA$17.45 million year-over-year.

- Get an in-depth perspective on PHX Energy Services' performance by reading our dividend report here.

- The analysis detailed in our PHX Energy Services valuation report hints at an deflated share price compared to its estimated value.

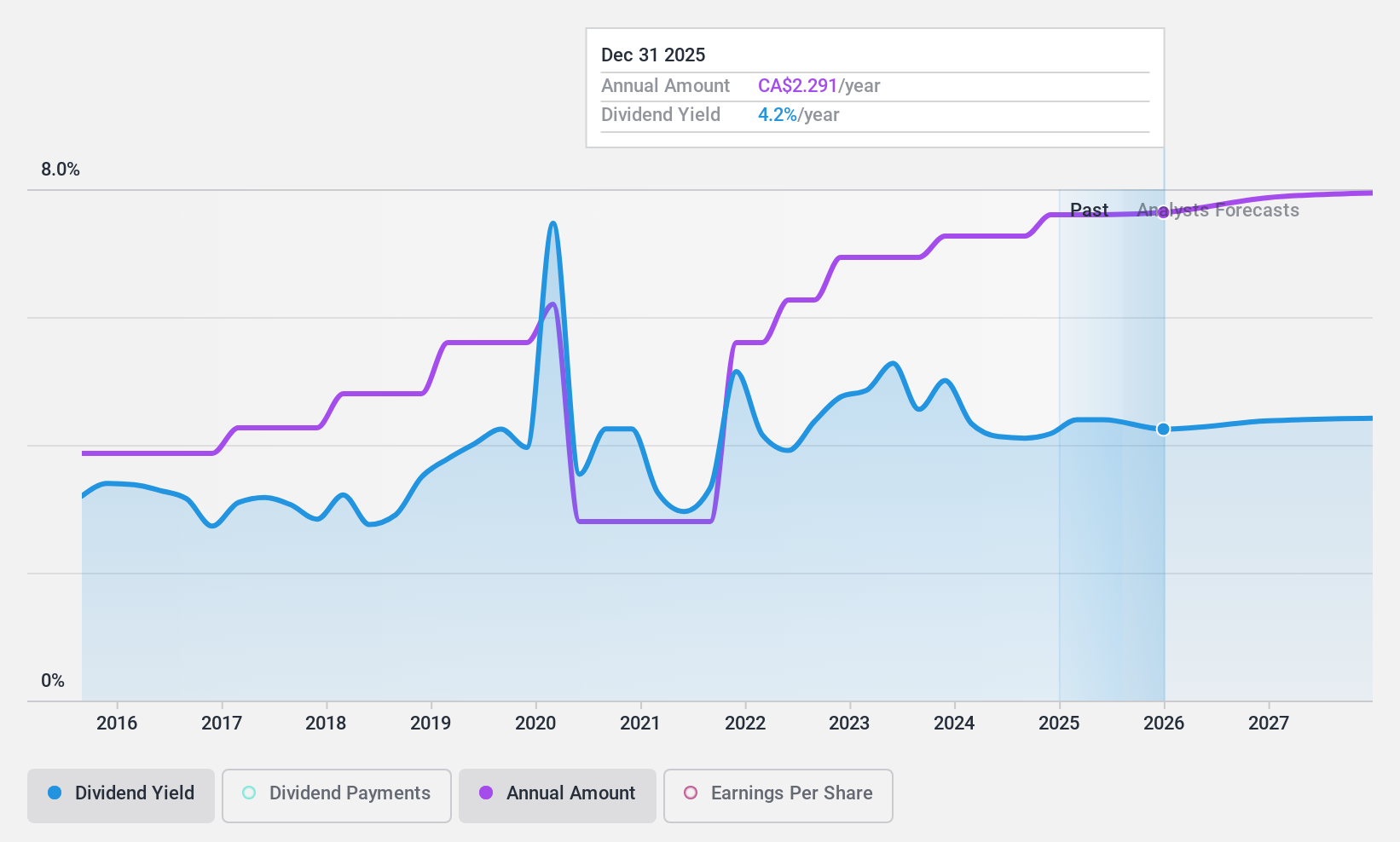

Russel Metals (TSX:RUS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Russel Metals Inc. is a metal distribution and processing company operating in Canada and the United States, with a market capitalization of approximately CA$2.26 billion.

Operations: Russel Metals Inc. generates its revenue primarily from three segments: Metals Service Centers (CA$2.95 billion), Energy Field Stores (CA$982.20 million), and Steel Distributors (CA$429 million).

Dividend Yield: 4.4%

Russel Metals maintains a stable dividend profile, with a 10-year history of reliable and growing payments. The dividends, yielding 4.38%, are supported by a low payout ratio from earnings (40.3%) and cash flows (31.4%), indicating sustainability despite the yield being below the top quartile in the Canadian market (6.41%). Recent developments include a 5% dividend increase to CA$0.42 per share and an ongoing acquisition expected to close in Q3 2024, which could influence future financial stability.

- Click here to discover the nuances of Russel Metals with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Russel Metals is priced lower than what may be justified by its financials.

Suncor Energy (TSX:SU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Suncor Energy Inc. is an integrated energy company with operations in Canada, the United States, and internationally, boasting a market capitalization of approximately CA$68.14 billion.

Operations: Suncor Energy's revenue is primarily derived from its Oil Sands segment, generating CA$23.76 billion, and its Refining and Marketing operations, which contribute CA$31.51 billion, alongside a smaller contribution of CA$2.17 billion from Exploration and Production.

Dividend Yield: 4.1%

Suncor Energy has demonstrated a mixed track record with its dividend, showing both growth and volatility over the past decade. Despite trading at 48% below estimated fair value and aligning well with industry valuations, concerns arise from its unstable dividends and low yield of 4.1%, underperforming against top Canadian dividend payers. Dividends are supported by a sustainable payout ratio from earnings (35.2%) and cash flows (35%). However, earnings are expected to decline by an average of 9.3% annually over the next three years, posing potential challenges ahead for maintaining its dividend levels.

- Dive into the specifics of Suncor Energy here with our thorough dividend report.

- According our valuation report, there's an indication that Suncor Energy's share price might be on the cheaper side.

Taking Advantage

- Embark on your investment journey to our 34 Top TSX Dividend Stocks selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether PHX Energy Services is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PHX

PHX Energy Services

Provides horizontal and directional drilling services, rents performance drilling motors, and sells motor equipment and parts to oil and natural gas exploration and development companies in Canada, the United States, Albania, the Middle East regions, and internationally.

Flawless balance sheet, undervalued and pays a dividend.