- Canada

- /

- Commercial Services

- /

- TSX:BDI

We Take A Look At Why Black Diamond Group Limited's (TSE:BDI) CEO Compensation Is Well Earned

Key Insights

- Black Diamond Group's Annual General Meeting to take place on 9th of May

- CEO Trevor Haynes' total compensation includes salary of CA$600.0k

- The overall pay is comparable to the industry average

- Black Diamond Group's total shareholder return over the past three years was 117% while its EPS grew by 62% over the past three years

We have been pretty impressed with the performance at Black Diamond Group Limited (TSE:BDI) recently and CEO Trevor Haynes deserves a mention for their role in it. Shareholders will have this at the front of their minds in the upcoming AGM on 9th of May. It is likely that the focus will be on company strategy going forward as shareholders hear from the board and cast their votes on resolutions such as executive remuneration and other matters. Here is our take on why we think CEO compensation is not extravagant.

Check out our latest analysis for Black Diamond Group

How Does Total Compensation For Trevor Haynes Compare With Other Companies In The Industry?

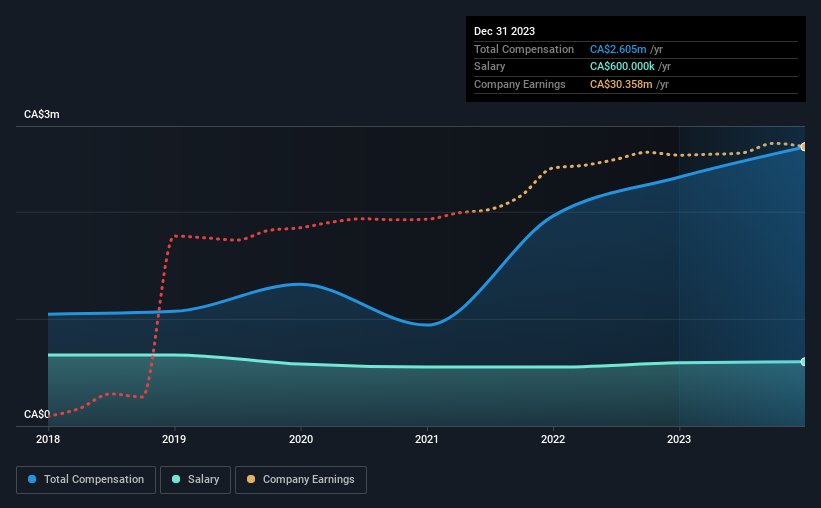

According to our data, Black Diamond Group Limited has a market capitalization of CA$523m, and paid its CEO total annual compensation worth CA$2.6m over the year to December 2023. We note that's an increase of 12% above last year. We think total compensation is more important but our data shows that the CEO salary is lower, at CA$600k.

On comparing similar companies from the Canadian Commercial Services industry with market caps ranging from CA$274m to CA$1.1b, we found that the median CEO total compensation was CA$2.3m. From this we gather that Trevor Haynes is paid around the median for CEOs in the industry. Moreover, Trevor Haynes also holds CA$39m worth of Black Diamond Group stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CA$600k | CA$590k | 23% |

| Other | CA$2.0m | CA$1.7m | 77% |

| Total Compensation | CA$2.6m | CA$2.3m | 100% |

Talking in terms of the industry, salary represented approximately 40% of total compensation out of all the companies we analyzed, while other remuneration made up 60% of the pie. It's interesting to note that Black Diamond Group allocates a smaller portion of compensation to salary in comparison to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Black Diamond Group Limited's Growth

Black Diamond Group Limited has seen its earnings per share (EPS) increase by 62% a year over the past three years. In the last year, its revenue is up 21%.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's also good to see decent revenue growth in the last year, suggesting the business is healthy and growing. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Black Diamond Group Limited Been A Good Investment?

Most shareholders would probably be pleased with Black Diamond Group Limited for providing a total return of 117% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

The company's solid performance might have made most shareholders happy, possibly making CEO remuneration the least of the matters to be discussed in the AGM. In fact, strategic decisions that could impact the future of the business might be a far more interesting topic for investors as it would help them set their longer-term expectations.

CEO compensation can have a massive impact on performance, but it's just one element. We did our research and spotted 2 warning signs for Black Diamond Group that investors should look into moving forward.

Important note: Black Diamond Group is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Black Diamond Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:BDI

Black Diamond Group

Black Diamond Group Limited rents and sells modular space and workforce accommodation solutions in Canada, the United States, and Australia.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success