- Canada

- /

- Commercial Services

- /

- TSX:BDI

Did Changing Sentiment Drive Black Diamond Group's (TSE:BDI) Share Price Down A Painful 94%?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Black Diamond Group Limited (TSE:BDI) shareholders should be happy to see the share price up 18% in the last quarter. But spare a thought for the long term holders, who have held the stock as it bled value over the last five years. In fact, the share price has tumbled down a mountain to land 94% lower after that period. So we don't gain too much confidence from the recent recovery. The fundamental business performance will ultimately determine if the turnaround can be sustained.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

See our latest analysis for Black Diamond Group

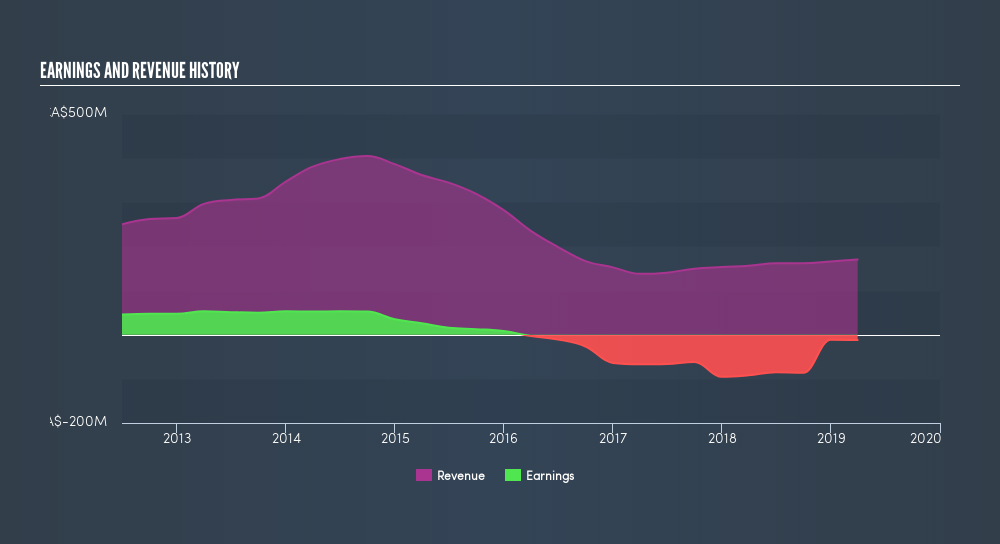

Because Black Diamond Group is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last five years Black Diamond Group saw its revenue shrink by 24% per year. That's definitely a weaker result than most pre-profit companies report. So it's not altogether surprising to see the share price down 43% per year in the same time period. We don't think this is a particularly promising picture. Of course, the poor performance could mean the market has been too severe selling down. That can happen.

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

This free interactive report on Black Diamond Group's balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We've already covered Black Diamond Group's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Black Diamond Group shareholders, and that cash payout explains why its total shareholder loss of 92%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

Black Diamond Group shareholders are down 43% for the year, but the market itself is up 1.6%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 40% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. If you would like to research Black Diamond Group in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

We will like Black Diamond Group better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:BDI

Black Diamond Group

Black Diamond Group Limited rents and sells modular space and workforce accommodation solutions in Canada, the United States, and Australia.

Fair value with acceptable track record.

Similar Companies

Market Insights

Community Narratives