- Canada

- /

- Commercial Services

- /

- TSX:BDI

Black Diamond Group (TSE:BDI) Seems To Be Really Weighed Down By Its Debt

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Black Diamond Group Limited (TSE:BDI) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Black Diamond Group

What Is Black Diamond Group's Debt?

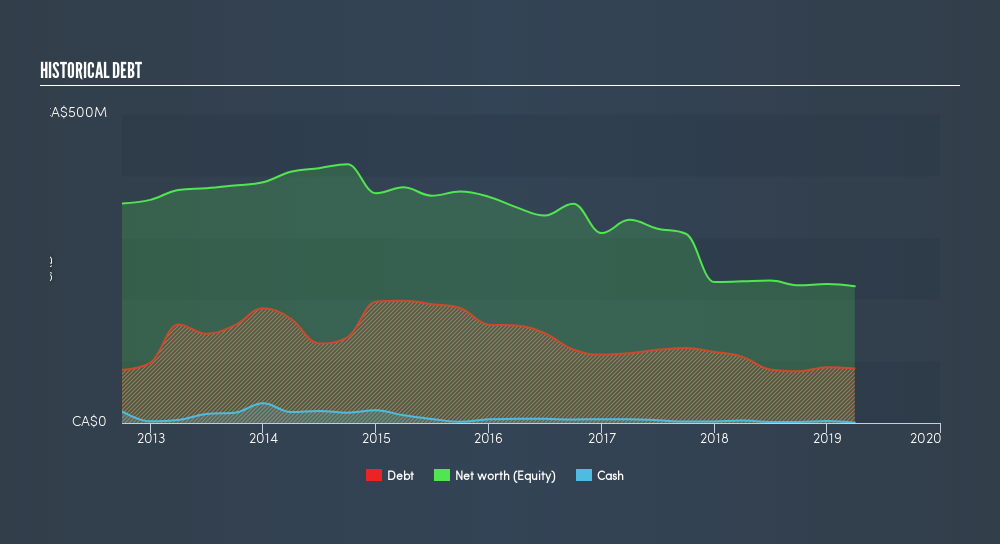

You can click the graphic below for the historical numbers, but it shows that Black Diamond Group had CA$88.3m of debt in March 2019, down from CA$107.5m, one year before And it doesn't have much cash, so its net debt is about the same.

A Look At Black Diamond Group's Liabilities

We can see from the most recent balance sheet that Black Diamond Group had liabilities of CA$41.1m falling due within a year, and liabilities of CA$155.8m due beyond that. Offsetting this, it had CA$246.0k in cash and CA$37.4m in receivables that were due within 12 months. So its liabilities total CA$159.3m more than the combination of its cash and short-term receivables.

Given this deficit is actually higher than the company's market capitalization of CA$112.0m, we think shareholders really should watch Black Diamond Group's debt levels, like a parent watching their child ride a bike for the first time. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price. Since Black Diamond Group does have net debt, we think it is worthwhile for shareholders to keep an eye on the balance sheet, over time. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Black Diamond Group can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, Black Diamond Group reported revenue of CA$170m, which is a gain of 9.1%. We usually like to see faster growth from unprofitable companies, but each to their own.

Caveat Emptor

Over the last twelve months Black Diamond Group produced an earnings before interest and tax (EBIT) loss. Indeed, it lost CA$10m at the EBIT level. When we look at that alongside the significant liabilities, we're not particularly confident about the company. It would need to improve its operations quickly for us to be interested in it. For example, we would not want to see a repeat of last year's loss of-CA$12.2m. And until that time we think this is a risky stock. For riskier companies like Black Diamond Group I always like to keep an eye on whether insiders are buying or selling. So click here if you want to find out for yourself.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:BDI

Black Diamond Group

Black Diamond Group Limited rents and sells modular space and workforce accommodation solutions in Canada, the United States, and Australia.

Fair value with acceptable track record.

Similar Companies

Market Insights

Community Narratives