- Canada

- /

- Trade Distributors

- /

- TSXV:ZDC

How Investors May Respond To Zedcor (TSXV:ZDC) Q3 2025 Earnings Call And Growth Outlook

Reviewed by Sasha Jovanovic

- Zedcor Inc. held its Q3 2025 earnings call on November 13, 2025, providing updates on its financial and operational outlook.

- Anticipation ahead of the earnings call led to heightened interest from investors, reflecting the significance these quarterly updates have on future expectations and business direction.

- We’ll explore how anticipation around Zedcor’s Q3 results may influence views on its future growth and competitive progress.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Zedcor Investment Narrative Recap

To be a Zedcor shareholder, you need to believe in its ability to expand profitably in the U.S. market while continuing to differentiate through technology and client service. The Q3 2025 earnings call was anticipated for clues on short-term revenue growth and margin trends. However, the results do not appear to materially change the company’s most significant catalyst, U.S. fleet and client expansion, or the risk that sustained high capital expenditures might not be matched by proportional revenue growth, putting free cash flow under pressure.

Among recent announcements, Zedcor's new $50 million revolving credit facility stands out as especially relevant. Securing additional growth capital is an important step for supporting U.S. deployment and scaling operations but also reinforces the importance of managing leverage if revenue growth does not keep pace, a key consideration as expansion accelerates.

In contrast, there are meaningful implications for investors if capital intensity rises ahead of returns, especially as...

Read the full narrative on Zedcor (it's free!)

Zedcor's narrative projects CA$191.5 million revenue and CA$32.5 million earnings by 2028. This requires 62.7% yearly revenue growth and a CA$30.7 million increase in earnings from the current CA$1.8 million.

Uncover how Zedcor's forecasts yield a CA$5.60 fair value, a 17% downside to its current price.

Exploring Other Perspectives

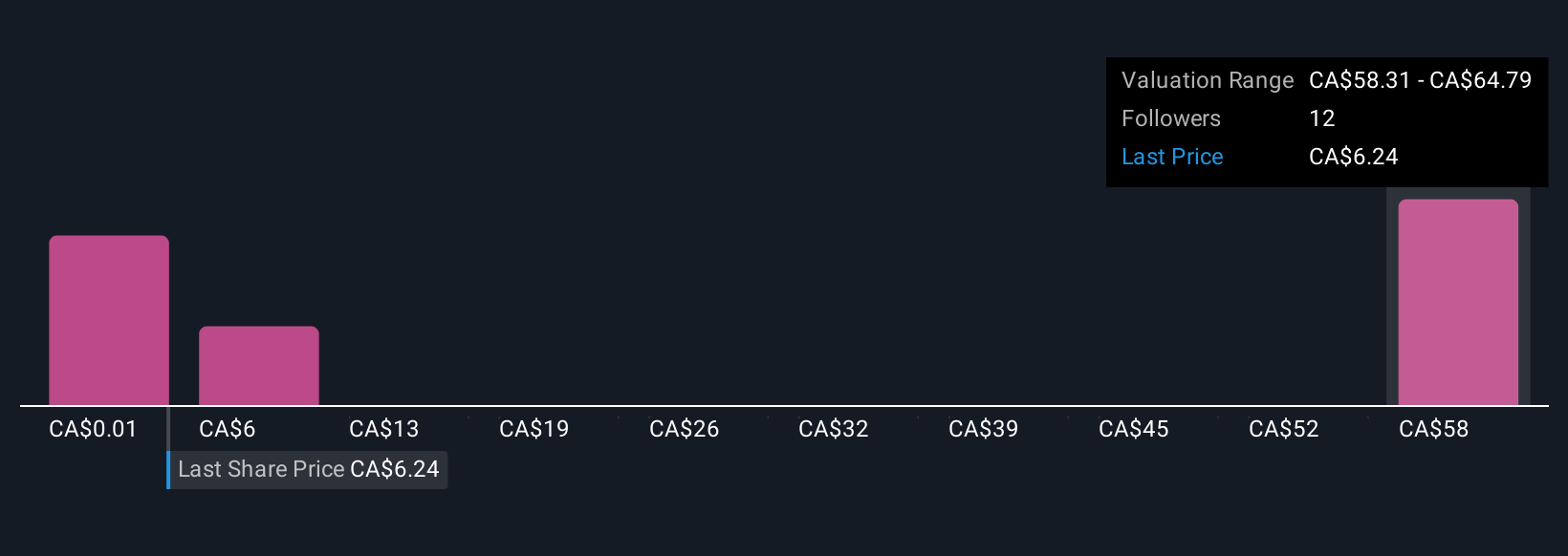

Eight fair value estimates from the Simply Wall St Community range from CA$0.01 to CA$65.51, spanning several distinctive opinion buckets. As Zedcor continues its ambitious U.S. rollout, many are focused on the challenge of ensuring revenue growth offsets mounting asset and debt commitments, so consider how your expectations compare to this broad set of views.

Explore 8 other fair value estimates on Zedcor - why the stock might be worth over 9x more than the current price!

Build Your Own Zedcor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zedcor research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Zedcor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zedcor's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zedcor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ZDC

Zedcor

Provides turnkey and customized mobile surveillance and live monitoring solutions in Canada and the United States.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives