Thermal Energy International Inc. (CVE:TMG) Investors Are Less Pessimistic Than Expected

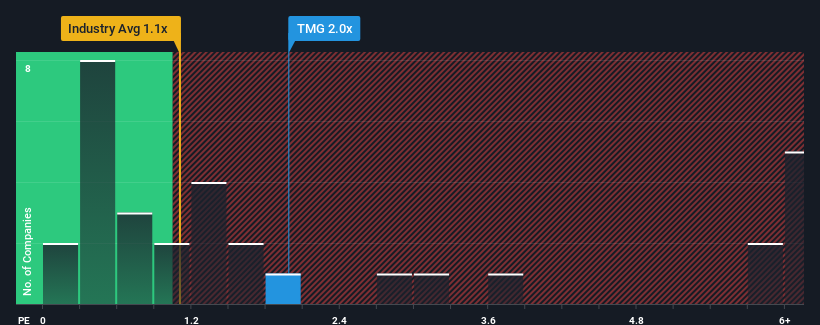

When close to half the companies in the Machinery industry in Canada have price-to-sales ratios (or "P/S") below 1.1x, you may consider Thermal Energy International Inc. (CVE:TMG) as a stock to potentially avoid with its 2x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Thermal Energy International

What Does Thermal Energy International's Recent Performance Look Like?

Recent times have been advantageous for Thermal Energy International as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Thermal Energy International's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Thermal Energy International?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Thermal Energy International's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 71% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 59% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 13% over the next year. That's shaping up to be similar to the 11% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Thermal Energy International's P/S is higher than its industry peers. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

What We Can Learn From Thermal Energy International's P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Analysts are forecasting Thermal Energy International's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. A positive change is needed in order to justify the current price-to-sales ratio.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Thermal Energy International (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on Thermal Energy International, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Thermal Energy International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:TMG

Thermal Energy International

Engages in the development, engineering, and supply of pollution control products, heat recovery systems, and condensate return solutions in North America, Europe, and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives