Is Thermal Energy International (CVE:TMG) Weighed On By Its Debt Load?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Thermal Energy International Inc. (CVE:TMG) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Thermal Energy International

What Is Thermal Energy International's Net Debt?

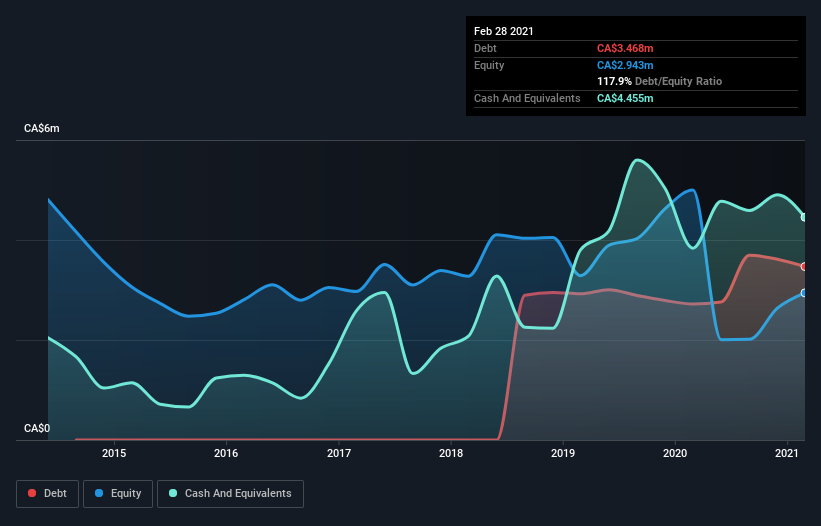

You can click the graphic below for the historical numbers, but it shows that as of February 2021 Thermal Energy International had CA$3.47m of debt, an increase on CA$2.72m, over one year. However, it does have CA$4.46m in cash offsetting this, leading to net cash of CA$986.8k.

How Strong Is Thermal Energy International's Balance Sheet?

The latest balance sheet data shows that Thermal Energy International had liabilities of CA$4.40m due within a year, and liabilities of CA$4.39m falling due after that. Offsetting this, it had CA$4.46m in cash and CA$3.16m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CA$1.18m.

Given Thermal Energy International has a market capitalization of CA$31.0m, it's hard to believe these liabilities pose much threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. Despite its noteworthy liabilities, Thermal Energy International boasts net cash, so it's fair to say it does not have a heavy debt load! There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Thermal Energy International will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Thermal Energy International had a loss before interest and tax, and actually shrunk its revenue by 42%, to CA$14m. To be frank that doesn't bode well.

So How Risky Is Thermal Energy International?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And the fact is that over the last twelve months Thermal Energy International lost money at the earnings before interest and tax (EBIT) line. And over the same period it saw negative free cash outflow of CA$354k and booked a CA$2.7m accounting loss. Given it only has net cash of CA$986.8k, the company may need to raise more capital if it doesn't reach break-even soon. Summing up, we're a little skeptical of this one, as it seems fairly risky in the absence of free cashflow. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Thermal Energy International is showing 4 warning signs in our investment analysis , and 1 of those is a bit unpleasant...

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Thermal Energy International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:TMG

Thermal Energy International

Engages in the development, engineering, and supply of pollution control products, heat recovery systems, and condensate return solutions in North America, Europe, and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives