Is Thermal Energy International (CVE:TMG) Using Too Much Debt?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Thermal Energy International Inc. (CVE:TMG) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Thermal Energy International

What Is Thermal Energy International's Net Debt?

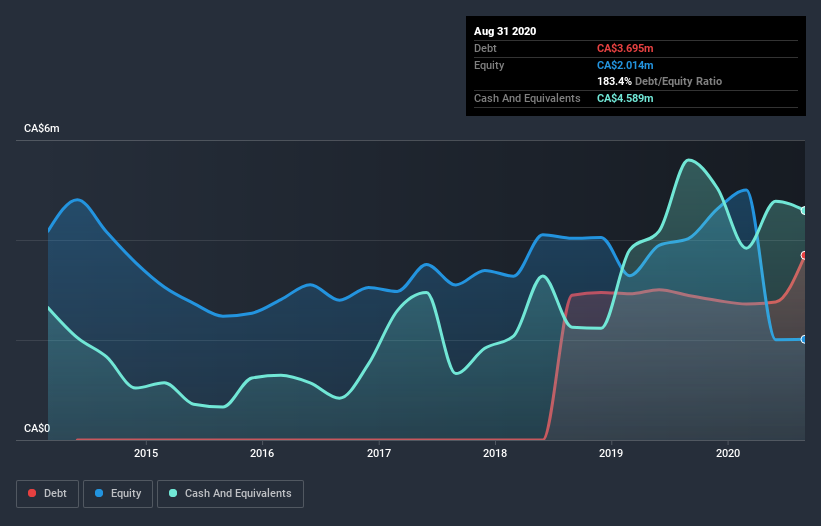

The image below, which you can click on for greater detail, shows that at August 2020 Thermal Energy International had debt of CA$3.69m, up from CA$2.89m in one year. However, it does have CA$4.59m in cash offsetting this, leading to net cash of CA$894.8k.

A Look At Thermal Energy International's Liabilities

We can see from the most recent balance sheet that Thermal Energy International had liabilities of CA$4.20m falling due within a year, and liabilities of CA$3.92m due beyond that. Offsetting these obligations, it had cash of CA$4.59m as well as receivables valued at CA$2.06m due within 12 months. So it has liabilities totalling CA$1.47m more than its cash and near-term receivables, combined.

Given Thermal Energy International has a market capitalization of CA$17.6m, it's hard to believe these liabilities pose much threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. Despite its noteworthy liabilities, Thermal Energy International boasts net cash, so it's fair to say it does not have a heavy debt load!

Pleasingly, Thermal Energy International is growing its EBIT faster than former Australian PM Bob Hawke downs a yard glass, boasting a 104% gain in the last twelve months. There's no doubt that we learn most about debt from the balance sheet. But it is Thermal Energy International's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. Thermal Energy International may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the last three years, Thermal Energy International actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Summing up

We could understand if investors are concerned about Thermal Energy International's liabilities, but we can be reassured by the fact it has has net cash of CA$894.8k. And it impressed us with free cash flow of -CA$1.7m, being 220% of its EBIT. So we don't think Thermal Energy International's use of debt is risky. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Take risks, for example - Thermal Energy International has 3 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you decide to trade Thermal Energy International, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Thermal Energy International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSXV:TMG

Thermal Energy International

Engages in the development, engineering, and supply of pollution control products, heat recovery systems, and condensate return solutions in North America, Europe, and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives