- Canada

- /

- Real Estate

- /

- TSX:GDC

February 2025's Top TSX Penny Stocks To Watch

Reviewed by Simply Wall St

The Canadian market is navigating a complex landscape, with tariffs posing potential challenges to economic growth and inflation, yet the overall backdrop remains positive with above-trend growth and low unemployment. In this context, penny stocks—often smaller or newer companies—can present unique opportunities for investors willing to explore beyond the mainstream. These stocks may still hold value when backed by strong financials, offering a blend of stability and potential upside that can be appealing in today's diverse investment climate.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.98 | CA$182.24M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.73 | CA$444.19M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.50 | CA$124.55M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.36 | CA$237.23M | ★★★★★☆ |

| Silvercorp Metals (TSX:SVM) | CA$5.04 | CA$993.59M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.48 | CA$14.61M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.71 | CA$638.07M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.05 | CA$26.86M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.045 | CA$4.07M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.89 | CA$397.63M | ★★★★★☆ |

Click here to see the full list of 943 stocks from our TSX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Genesis Land Development (TSX:GDC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Genesis Land Development Corp. is an integrated land developer and residential home builder that owns and develops residential lands and serviced lots in the Calgary Metropolitan Area, with a market cap of CA$187.39 million.

Operations: Genesis Land Development's revenue is primarily derived from its Home Building segment, which generated CA$238.33 million, and the Genesis Land Development segment, contributing CA$125.80 million.

Market Cap: CA$187.39M

Genesis Land Development Corp., with a market cap of CA$187.39 million, has shown significant earnings growth over the past year at 268.1%, surpassing both its industry and historical averages. Despite an increasing debt-to-equity ratio over five years, short-term assets sufficiently cover liabilities, and interest payments are well covered by EBIT. The company’s P/E ratio of 5.3x suggests it may be undervalued compared to the broader Canadian market. However, a new management team and unstable dividend history present potential risks. Recently, Genesis announced a share repurchase program to buy back up to 2,839,275 shares by December 2025.

- Jump into the full analysis health report here for a deeper understanding of Genesis Land Development.

- Evaluate Genesis Land Development's historical performance by accessing our past performance report.

Desert Mountain Energy (TSXV:DME)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Desert Mountain Energy Corp. is involved in the exploration and development of oil, gas, helium, natural gas, hydrogen, and mineral properties in the Southwestern United States with a market cap of CA$21.66 million.

Operations: The company generates revenue from its mineral exploration activities, amounting to CA$0.86 million.

Market Cap: CA$21.66M

Desert Mountain Energy Corp., with a market cap of CA$21.66 million, remains pre-revenue, generating only CA$0.86 million from mineral exploration activities. The company recently announced a non-brokered private placement to raise CA$2 million, potentially extending its limited cash runway beyond one month. Despite having no debt for the past five years and experienced management and board teams, the company faces going concern doubts from auditors due to ongoing losses totaling CA$4.58 million last year. While earnings are forecast to grow significantly, short-term assets exceed liabilities but do not cover long-term obligations fully.

- Click here to discover the nuances of Desert Mountain Energy with our detailed analytical financial health report.

- Evaluate Desert Mountain Energy's prospects by accessing our earnings growth report.

Thermal Energy International (TSXV:TMG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Thermal Energy International Inc. develops, engineers, and supplies pollution control products, heat recovery systems, and condensate return solutions across North America, Europe, and internationally with a market cap of CA$25.91 million.

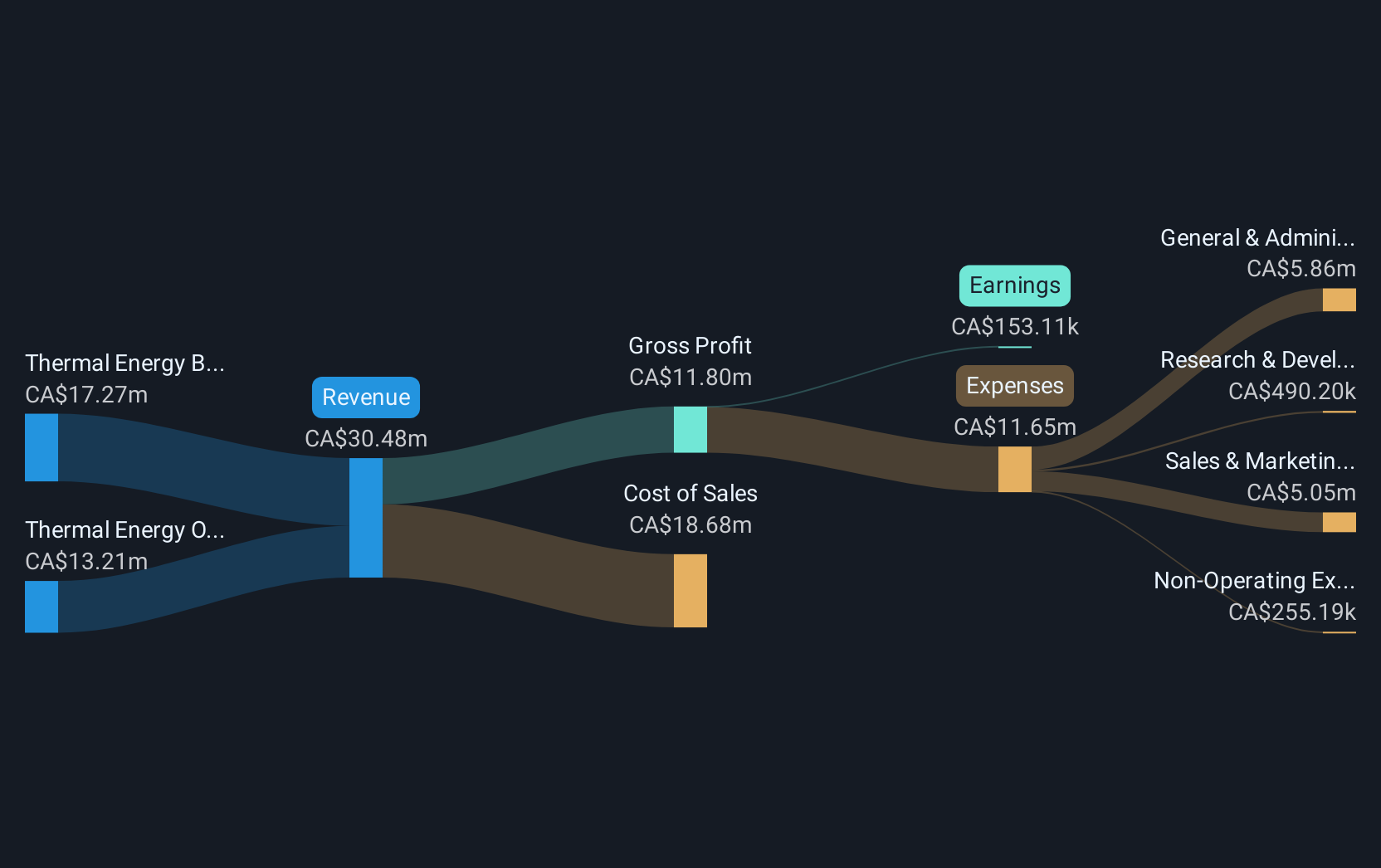

Operations: The company generates revenue from its operations in Ottawa, contributing CA$12.59 million, and Bristol, adding CA$18.14 million.

Market Cap: CA$25.91M

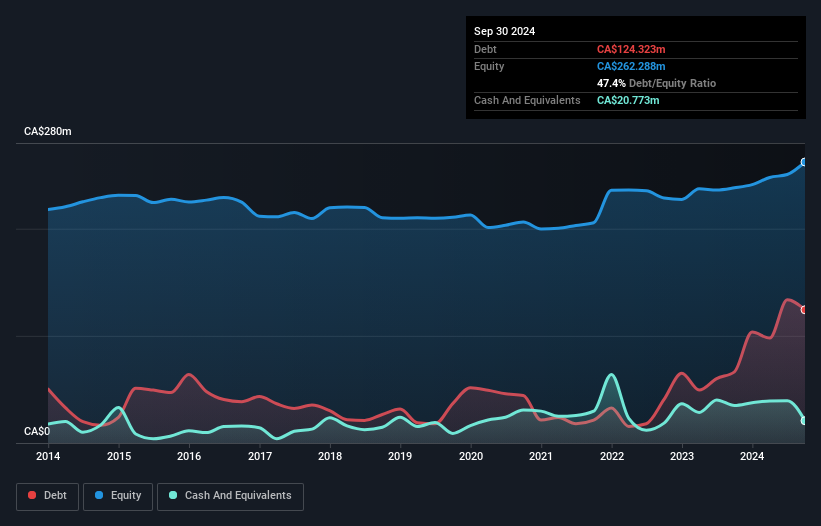

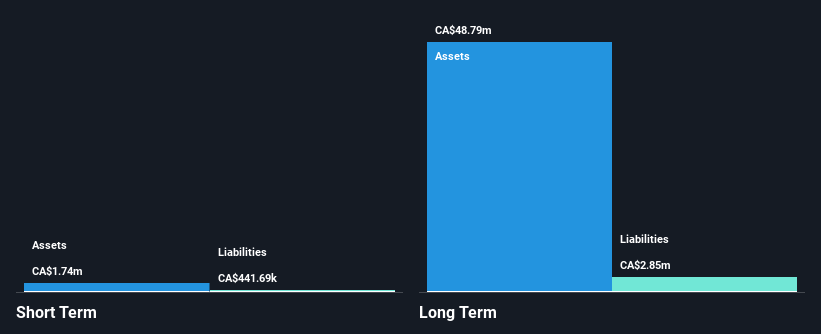

Thermal Energy International Inc., with a market cap of CA$25.91 million, reported sales of CA$17.14 million for the first half of fiscal 2025, reflecting growth from the previous year. Despite a seasoned management and board team, the company faces challenges with declining profit margins and negative earnings growth over the past year. However, its debt is well covered by operating cash flow and interest payments are manageable with EBIT coverage at 3.4x. Trading significantly below estimated fair value, Thermal Energy's short-term assets surpass both short-term and long-term liabilities, suggesting financial stability amidst volatility concerns.

- Get an in-depth perspective on Thermal Energy International's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into Thermal Energy International's future.

Next Steps

- Click here to access our complete index of 943 TSX Penny Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GDC

Genesis Land Development

An integrated land developer and residential home builder, owns and develops residential lands and serviced lots in the Calgary Metropolitan Area, Canada.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives