- Canada

- /

- Electrical

- /

- TSXV:SWAN

Here's Why We're Not At All Concerned With Black Swan Graphene's (CVE:SWAN) Cash Burn Situation

We can readily understand why investors are attracted to unprofitable companies. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

Given this risk, we thought we'd take a look at whether Black Swan Graphene (CVE:SWAN) shareholders should be worried about its cash burn. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

Check out our latest analysis for Black Swan Graphene

Does Black Swan Graphene Have A Long Cash Runway?

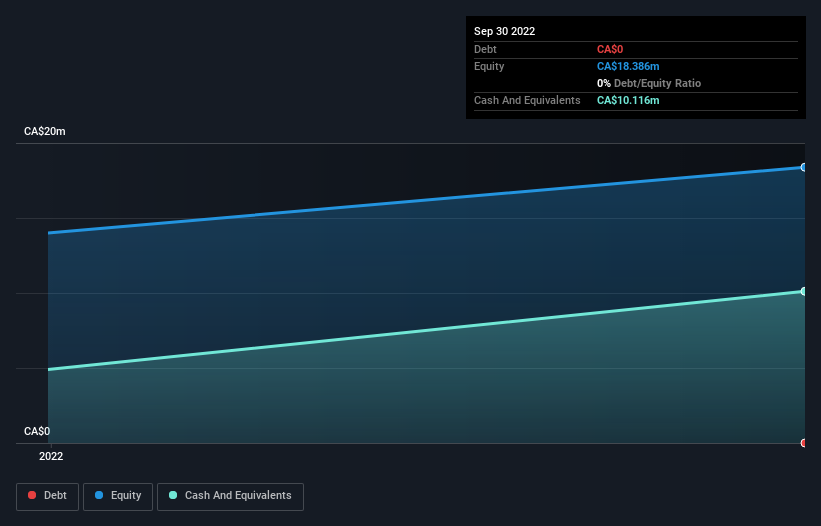

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. When Black Swan Graphene last reported its balance sheet in September 2022, it had zero debt and cash worth CA$10m. Looking at the last year, the company burnt through CA$2.3m. So it had a cash runway of about 4.5 years from September 2022. There's no doubt that this is a reassuringly long runway. You can see how its cash balance has changed over time in the image below.

How Hard Would It Be For Black Swan Graphene To Raise More Cash For Growth?

Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Black Swan Graphene's cash burn of CA$2.3m is about 3.8% of its CA$59m market capitalisation. Given that is a rather small percentage, it would probably be really easy for the company to fund another year's growth by issuing some new shares to investors, or even by taking out a loan.

How Risky Is Black Swan Graphene's Cash Burn Situation?

Because Black Swan Graphene is an early stage company, we don't have a great deal of data on which to form an opinion of its cash burn. Certainly, we'd be more confident in the stock if it was generating operating revenue. Having said that, we can say that its cash runway was a real positive. Overall, we think its cash burn seems perfectly reasonable, and we are not concerned by it. Taking a deeper dive, we've spotted 4 warning signs for Black Swan Graphene you should be aware of, and 1 of them can't be ignored.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

Valuation is complex, but we're here to simplify it.

Discover if Black Swan Graphene might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:SWAN

Black Swan Graphene

Engages in the production and commercialization of patented graphene products for industrial sectors in Canada.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success