Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Inventronics Limited (CVE:IVX) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

What Is Inventronics's Net Debt?

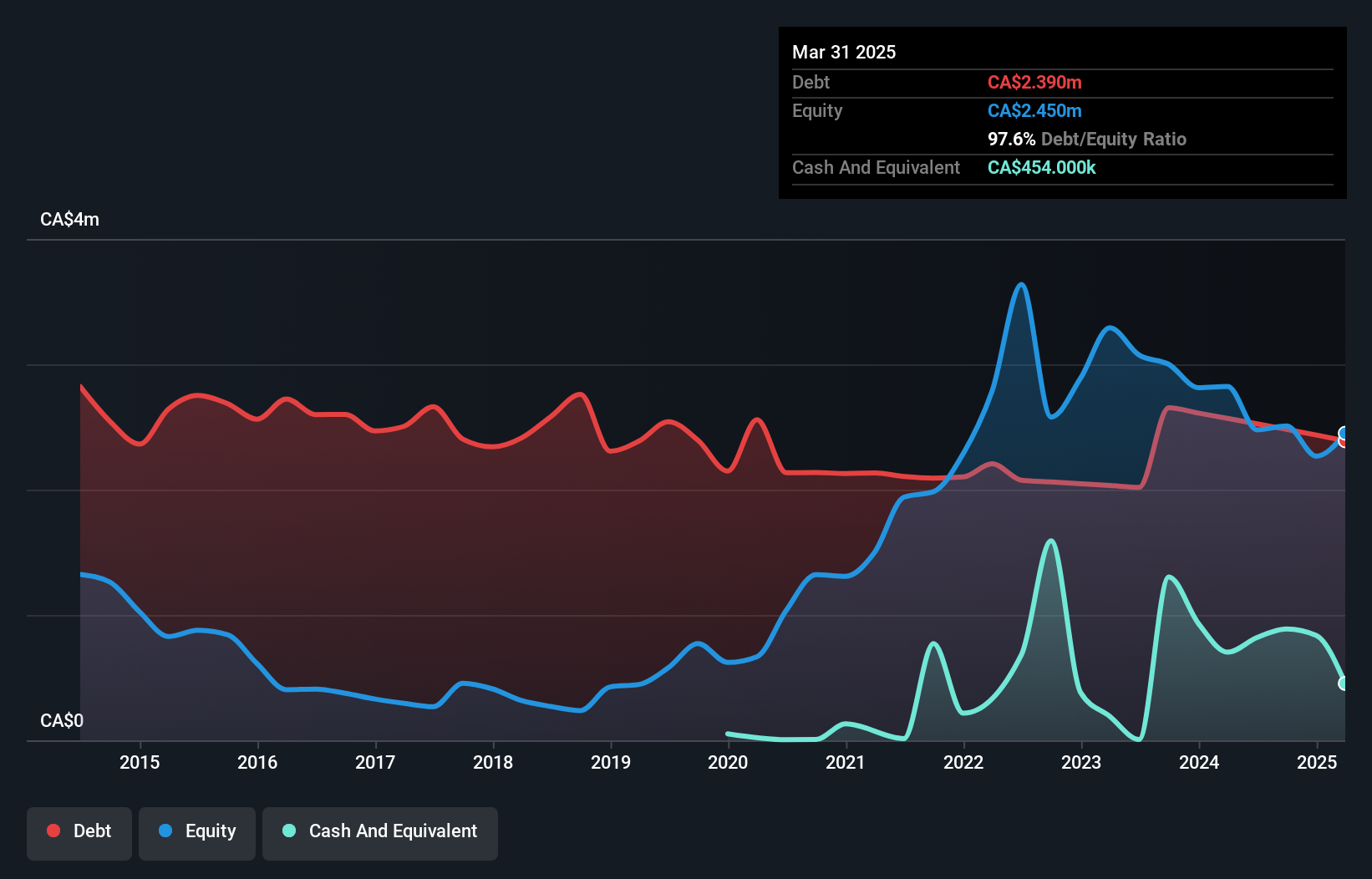

The image below, which you can click on for greater detail, shows that Inventronics had debt of CA$2.39m at the end of March 2025, a reduction from CA$2.57m over a year. However, it also had CA$454.0k in cash, and so its net debt is CA$1.94m.

A Look At Inventronics' Liabilities

We can see from the most recent balance sheet that Inventronics had liabilities of CA$1.26m falling due within a year, and liabilities of CA$2.45m due beyond that. On the other hand, it had cash of CA$454.0k and CA$1.44m worth of receivables due within a year. So it has liabilities totalling CA$1.81m more than its cash and near-term receivables, combined.

This deficit isn't so bad because Inventronics is worth CA$3.75m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

View our latest analysis for Inventronics

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While Inventronics's debt to EBITDA ratio (4.1) suggests that it uses some debt, its interest cover is very weak, at 1.9, suggesting high leverage. It seems clear that the cost of borrowing money is negatively impacting returns for shareholders, of late. On a lighter note, we note that Inventronics grew its EBIT by 22% in the last year. If sustained, this growth should make that debt evaporate like a scarce drinking water during an unnaturally hot summer. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Inventronics will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Happily for any shareholders, Inventronics actually produced more free cash flow than EBIT over the last three years. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

On our analysis Inventronics's conversion of EBIT to free cash flow should signal that it won't have too much trouble with its debt. However, our other observations weren't so heartening. To be specific, it seems about as good at covering its interest expense with its EBIT as wet socks are at keeping your feet warm. Considering this range of data points, we think Inventronics is in a good position to manage its debt levels. Having said that, the load is sufficiently heavy that we would recommend any shareholders keep a close eye on it. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 5 warning signs with Inventronics (at least 4 which are potentially serious) , and understanding them should be part of your investment process.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:IVX

Inventronics

Designs, manufactures, and sells protective enclosures and related products for the telecommunications, electric transmission, cable, energy, and other industries in Canada and the United States.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success