- Canada

- /

- Electrical

- /

- TSXV:GMG

Graphene Manufacturing Group (TSXV:GMG) Valuation After Rapid-Charging Graphene Aluminium-Ion Battery Progress

Reviewed by Simply Wall St

Recent updates from Graphene Manufacturing Group (TSXV:GMG) on its fast charging Graphene Aluminium Ion Battery technology, now reportedly reaching a full charge in under six minutes, have sharpened investor focus on the company’s path toward commercial deployment.

See our latest analysis for Graphene Manufacturing Group.

Those battery milestones seem to be feeding directly into sentiment, with the share price up strongly in recent months. This includes a triple digit 90 day share price return that suggests momentum is building despite a weaker three year total shareholder return.

If GMG’s story has you looking for the next potential mover in electrification and materials tech, this could be a good moment to explore high growth tech and AI stocks.

With the share price already surging and analyst targets still implying further upside, the key question now is whether GMG remains undervalued on its long term battery potential or whether markets are already pricing in that future growth.

Price-to-Book of 20.6x: Is it justified?

GMG last closed at CA$1.74, and that price currently embeds a steep price-to-book ratio of 20.6 times, hinting at elevated expectations versus fundamentals.

The price-to-book multiple compares a company’s market value to the net assets on its balance sheet. It is a common yardstick for early stage and asset light innovators like GMG. In this case, investors are paying a substantial premium to the company’s book value, suggesting the market is heavily discounting future graphene and battery commercialisation rather than present day financials.

That premium stands out starkly next to the North American Electrical industry’s average price-to-book of 2.7 times. This implies GMG trades at a level usually reserved for the most aggressively valued growth stories in the space. Even when compared with a peer group average of 36.1 times, GMG screens as cheaper, but still firmly in high expectation territory where execution on growth will be closely watched.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-book of 20.6x (OVERVALUED)

However, significant execution risk around scaling commercial production and persistent losses from net income of approximately A$9.4 million could quickly undermine today’s lofty expectations.

Find out about the key risks to this Graphene Manufacturing Group narrative.

Another View: What Does Our DCF Say?

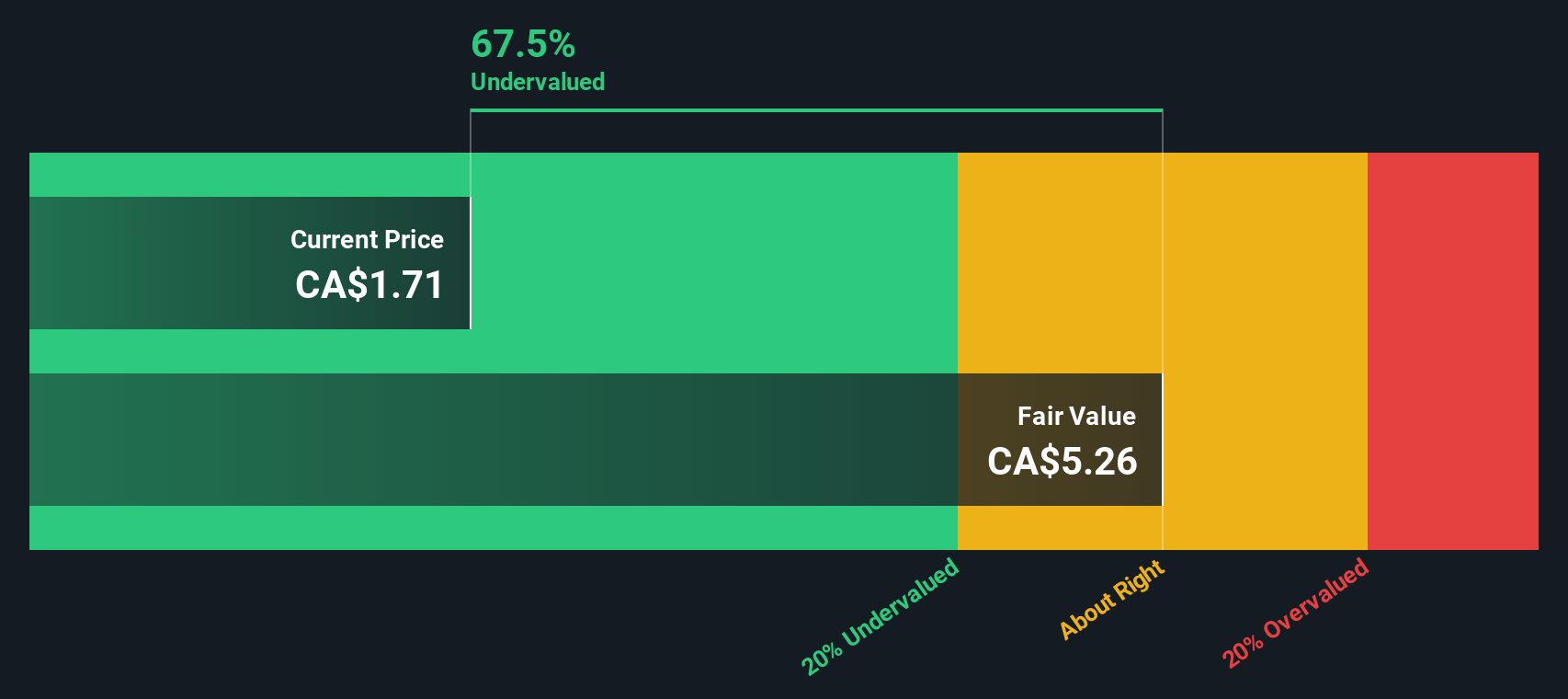

While the rich 20.6 times price-to-book ratio suggests optimism, our DCF model paints a very different picture, indicating that GMG is trading about 67% below its estimated fair value. If the cash flows eventually follow the battery story, could today’s premium multiple still represent a long-term bargain?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Graphene Manufacturing Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 911 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Graphene Manufacturing Group Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a tailored view in just minutes: Do it your way.

A great starting point for your Graphene Manufacturing Group research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Before momentum in GMG moves on without you, lock in your next opportunities using the Simply Wall St Screener so you are never short of compelling ideas.

- Capture early growth stories with potential by scanning these 3640 penny stocks with strong financials that already show strong balance sheets and improving fundamentals.

- Position yourself ahead of the next technology wave by targeting these 26 AI penny stocks shaping automation, data intelligence, and next generation platforms.

- Secure a margin of safety by filtering for these 911 undervalued stocks based on cash flows where market prices still lag behind long term cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:GMG

Graphene Manufacturing Group

A clean-technology company, engages in the manufacture of graphene powder and energy saving and energy storage solutions enabled by graphene in Australia.

Excellent balance sheet with slight risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion