EnWave Corporation (CVE:ENW) Analysts Are Cutting Their Estimates: Here's What You Need To Know

It's shaping up to be a tough period for EnWave Corporation (CVE:ENW), which a week ago released some disappointing quarterly results that could have a notable impact on how the market views the stock. It was not a great statutory result, with revenues coming in 52% lower than the analysts predicted. Unsurprisingly, earnings also fell seriously short of forecasts, turning into a per-share loss of CA$0.02. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

See our latest analysis for EnWave

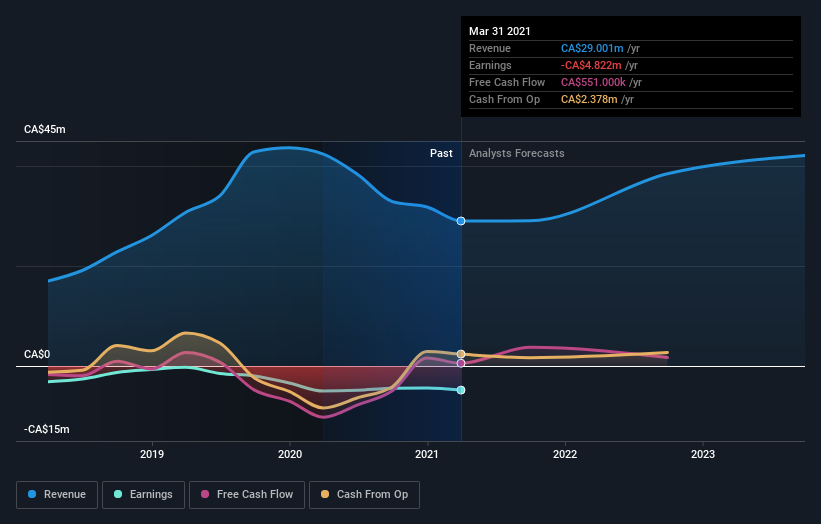

Following last week's earnings report, EnWave's three analysts are forecasting 2021 revenues to be CA$29.0m, approximately in line with the last 12 months. Statutory losses are predicted to increase slightly, to CA$0.04 per share. Before this earnings report, the analysts had been forecasting revenues of CA$39.7m and break-even in 2021. It looks like sentiment has declined substantially in the aftermath of these results, with a pretty serious reduction to revenue estimates and a earnings per share numbers as well.

The average price target fell 27% to CA$1.15, implicitly signalling that lower earnings per share are a leading indicator for EnWave's valuation. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. Currently, the most bullish analyst values EnWave at CA$1.45 per share, while the most bearish prices it at CA$0.90. Analysts definitely have varying views on the business, but the spread of estimates is not wide enough in our view to suggest that extreme outcomes could await EnWave shareholders.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. It's pretty clear that there is an expectation that EnWave's revenue growth will slow down substantially, with revenues to the end of 2021 expected to display 0.2% growth on an annualised basis. This is compared to a historical growth rate of 24% over the past five years. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 17% per year. Factoring in the forecast slowdown in growth, it seems obvious that EnWave is also expected to grow slower than other industry participants.

The Bottom Line

The most important thing to note is the forecast of increased losses next year, suggesting all may not be well at EnWave. Unfortunately, they also downgraded their revenue estimates, and our data indicates revenues are expected to perform worse than the wider industry. Even so, earnings per share are more important to the intrinsic value of the business. Furthermore, the analysts also cut their price targets, suggesting that the latest news has led to greater pessimism about the intrinsic value of the business.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. We have estimates - from multiple EnWave analysts - going out to 2023, and you can see them free on our platform here.

That said, it's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with EnWave (at least 1 which shouldn't be ignored) , and understanding them should be part of your investment process.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if EnWave might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:ENW

EnWave

Designs, constructs, markets, and sells vacuum-microwave dehydration machinery for the food, cannabis, and biomaterial industries in Canada, the United States, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives