- Canada

- /

- Electrical

- /

- TSXV:EGT

Shareholders May Not Be So Generous With Eguana Technologies Inc.'s (CVE:EGT) CEO Compensation And Here's Why

Key Insights

- Eguana Technologies' Annual General Meeting to take place on 2nd of November

- Salary of CA$347.0k is part of CEO Justin Holland's total remuneration

- Total compensation is similar to the industry average

- Eguana Technologies' three-year loss to shareholders was 73% while its EPS was down 14% over the past three years

The underwhelming share price performance of Eguana Technologies Inc. (CVE:EGT) in the past three years would have disappointed many shareholders. In addition, the company's per-share earnings growth is not looking good, despite growing revenues. The AGM coming up on 2nd of November will be an opportunity for shareholders to have their concerns addressed by the board and for them to exercise their influence on management through voting on resolutions such as executive remuneration. Here's why we think shareholders should hold off on a raise for the CEO at the moment.

See our latest analysis for Eguana Technologies

Comparing Eguana Technologies Inc.'s CEO Compensation With The Industry

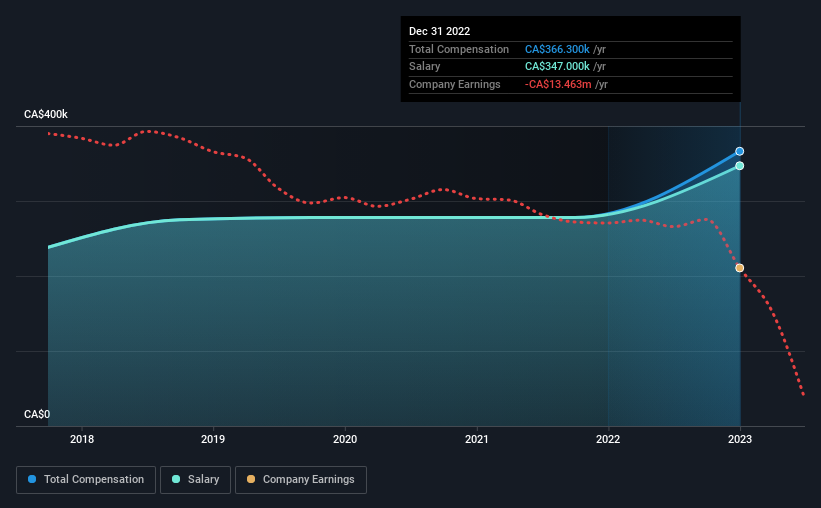

At the time of writing, our data shows that Eguana Technologies Inc. has a market capitalization of CA$20m, and reported total annual CEO compensation of CA$366k for the year to December 2022. Notably, that's an increase of 32% over the year before. In particular, the salary of CA$347.0k, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the Canadian Electrical industry with market capitalizations under CA$277m, the reported median total CEO compensation was CA$477k. So it looks like Eguana Technologies compensates Justin Holland in line with the median for the industry. Moreover, Justin Holland also holds CA$211k worth of Eguana Technologies stock directly under their own name.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | CA$347k | CA$278k | 95% |

| Other | CA$19k | - | 5% |

| Total Compensation | CA$366k | CA$278k | 100% |

Talking in terms of the industry, salary represented approximately 62% of total compensation out of all the companies we analyzed, while other remuneration made up 38% of the pie. It's interesting to note that Eguana Technologies pays out a greater portion of remuneration through salary, compared to the industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Eguana Technologies Inc.'s Growth

Over the last three years, Eguana Technologies Inc. has shrunk its earnings per share by 14% per year. It achieved revenue growth of 169% over the last year.

The reduction in EPS, over three years, is arguably concerning. On the other hand, the strong revenue growth suggests the business is growing. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Eguana Technologies Inc. Been A Good Investment?

With a total shareholder return of -73% over three years, Eguana Technologies Inc. shareholders would by and large be disappointed. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

The company's earnings haven't grown and possibly because of that, the stock has performed poorly, resulting in a loss for the company's shareholders. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We identified 6 warning signs for Eguana Technologies (3 make us uncomfortable!) that you should be aware of before investing here.

Important note: Eguana Technologies is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Eguana Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:EGT

Eguana Technologies

Designs, manufactures, and markets energy storage solutions for residential and commercial markets in Australia, Europe, and North America.

Moderate risk with imperfect balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026