- Canada

- /

- Aerospace & Defense

- /

- TSX:XTRA

We're Keeping An Eye On Xtract One Technologies' (TSE:XTRA) Cash Burn Rate

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

So should Xtract One Technologies (TSE:XTRA) shareholders be worried about its cash burn? In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

Check out our latest analysis for Xtract One Technologies

How Long Is Xtract One Technologies' Cash Runway?

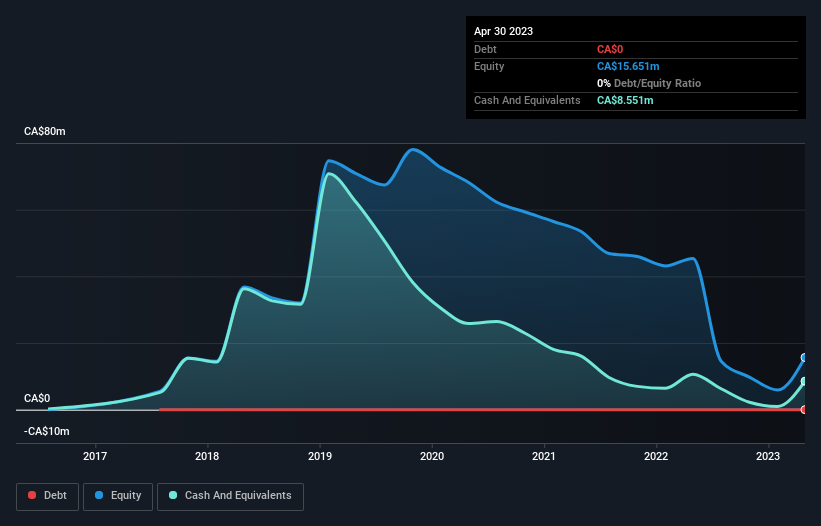

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. In April 2023, Xtract One Technologies had CA$8.6m in cash, and was debt-free. Looking at the last year, the company burnt through CA$15m. So it had a cash runway of approximately 7 months from April 2023. To be frank, this kind of short runway puts us on edge, as it indicates the company must reduce its cash burn significantly, or else raise cash imminently. You can see how its cash balance has changed over time in the image below.

How Well Is Xtract One Technologies Growing?

Xtract One Technologies actually ramped up its cash burn by a whopping 91% in the last year, which shows it is boosting investment in the business. On top of that, the fact that operating revenue was basically flat over the same period compounds the concern. Taken together, we think these growth metrics are a little worrying. In reality, this article only makes a short study of the company's growth data. This graph of historic earnings and revenue shows how Xtract One Technologies is building its business over time.

Can Xtract One Technologies Raise More Cash Easily?

Since Xtract One Technologies has been boosting its cash burn, the market will likely be considering how it can raise more cash if need be. Companies can raise capital through either debt or equity. Commonly, a business will sell new shares in itself to raise cash and drive growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Xtract One Technologies has a market capitalisation of CA$143m and burnt through CA$15m last year, which is 11% of the company's market value. As a result, we'd venture that the company could raise more cash for growth without much trouble, albeit at the cost of some dilution.

So, Should We Worry About Xtract One Technologies' Cash Burn?

On this analysis of Xtract One Technologies' cash burn, we think its cash burn relative to its market cap was reassuring, while its cash runway has us a bit worried. Looking at the factors mentioned in this short report, we do think that its cash burn is a bit risky, and it does make us slightly nervous about the stock. Taking a deeper dive, we've spotted 4 warning signs for Xtract One Technologies you should be aware of, and 2 of them are concerning.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:XTRA

Xtract One Technologies

Engages in the research, development, and commercialization integrated, layered, artificial intelligence powered threat detection gateway solutions, with the aim of enhancing public safety in the United States, Japan, France, the United Kingdom, and Canada.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives