- Canada

- /

- Aerospace & Defense

- /

- TSX:XTRA

Market Participants Recognise Xtract One Technologies Inc.'s (TSE:XTRA) Revenues Pushing Shares 47% Higher

Xtract One Technologies Inc. (TSE:XTRA) shares have had a really impressive month, gaining 47% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 16% over that time.

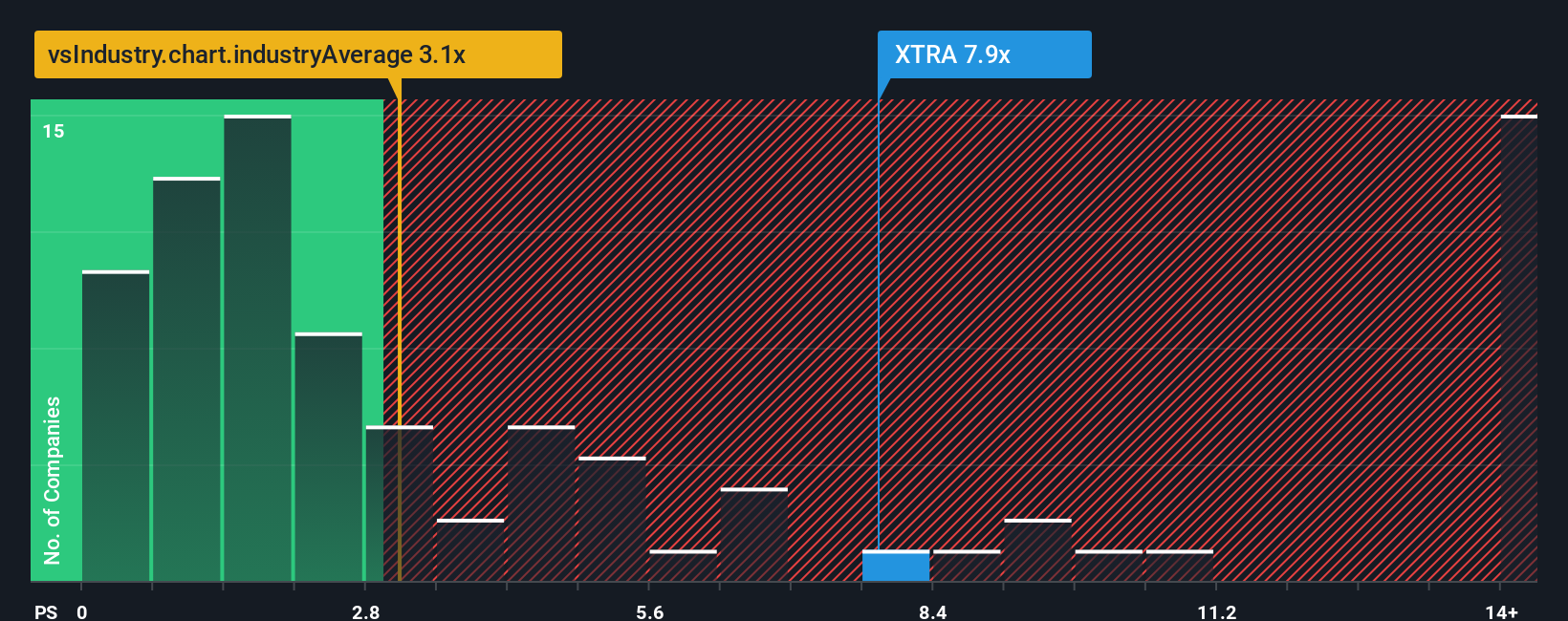

Since its price has surged higher, when almost half of the companies in Canada's Aerospace & Defense industry have price-to-sales ratios (or "P/S") below 3.4x, you may consider Xtract One Technologies as a stock not worth researching with its 7.9x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Xtract One Technologies

How Xtract One Technologies Has Been Performing

Recent times have been advantageous for Xtract One Technologies as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Xtract One Technologies will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

Xtract One Technologies' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered an exceptional 29% gain to the company's top line. This great performance means it was also able to deliver immense revenue growth over the last three years. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 64% during the coming year according to the dual analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 15%, which is noticeably less attractive.

With this information, we can see why Xtract One Technologies is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does Xtract One Technologies' P/S Mean For Investors?

Xtract One Technologies' P/S has grown nicely over the last month thanks to a handy boost in the share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Xtract One Technologies maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Aerospace & Defense industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Having said that, be aware Xtract One Technologies is showing 4 warning signs in our investment analysis, you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:XTRA

Xtract One Technologies

Engages in the research, development, and commercialization integrated, layered, artificial intelligence powered threat detection gateway solutions, with the aim of enhancing public safety in the United States, Japan, France, the United Kingdom, and Canada.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success