- Canada

- /

- Aerospace & Defense

- /

- TSX:XTRA

After Leaping 25% Xtract One Technologies Inc. (TSE:XTRA) Shares Are Not Flying Under The Radar

Those holding Xtract One Technologies Inc. (TSE:XTRA) shares would be relieved that the share price has rebounded 25% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 19% in the last twelve months.

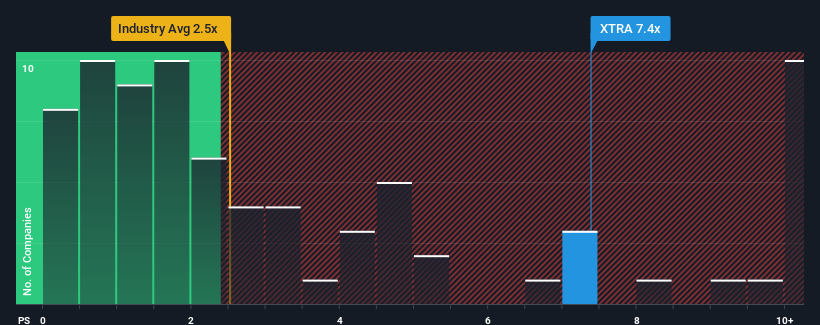

After such a large jump in price, given around half the companies in Canada's Aerospace & Defense industry have price-to-sales ratios (or "P/S") below 2.5x, you may consider Xtract One Technologies as a stock to avoid entirely with its 7.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Xtract One Technologies

How Has Xtract One Technologies Performed Recently?

With revenue growth that's superior to most other companies of late, Xtract One Technologies has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Xtract One Technologies' future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Xtract One Technologies?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Xtract One Technologies' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 156%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 35% during the coming year according to the lone analyst following the company. That's shaping up to be materially higher than the 15% growth forecast for the broader industry.

With this information, we can see why Xtract One Technologies is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Xtract One Technologies' P/S has grown nicely over the last month thanks to a handy boost in the share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Xtract One Technologies' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Xtract One Technologies (of which 1 doesn't sit too well with us!) you should know about.

If these risks are making you reconsider your opinion on Xtract One Technologies, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:XTRA

Xtract One Technologies

Engages in the research, development, and commercialization integrated, layered, artificial intelligence powered threat detection gateway solutions, with the aim of enhancing public safety in the United States, Japan, France, the United Kingdom, and Canada.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives