Investors Holding Back On Westport Fuel Systems Inc. (TSE:WPRT)

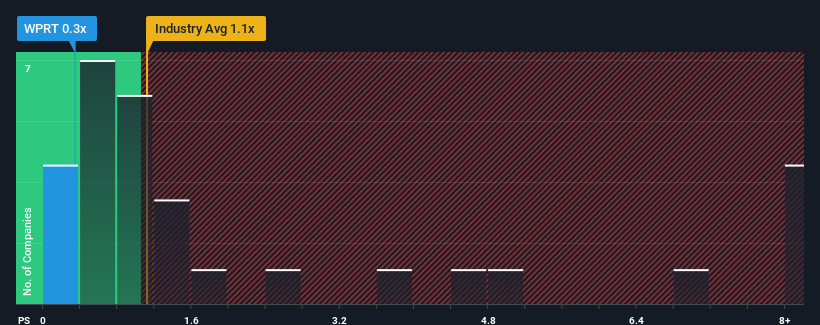

With a price-to-sales (or "P/S") ratio of 0.3x Westport Fuel Systems Inc. (TSE:WPRT) may be sending bullish signals at the moment, given that almost half of all the Machinery companies in Canada have P/S ratios greater than 1.1x and even P/S higher than 5x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Westport Fuel Systems

How Has Westport Fuel Systems Performed Recently?

With revenue growth that's inferior to most other companies of late, Westport Fuel Systems has been relatively sluggish. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Westport Fuel Systems' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Westport Fuel Systems' to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 5.1%. The latest three year period has also seen a 25% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 13% per year over the next three years. With the industry only predicted to deliver 7.6% per year, the company is positioned for a stronger revenue result.

With this information, we find it odd that Westport Fuel Systems is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A look at Westport Fuel Systems' revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

It is also worth noting that we have found 1 warning sign for Westport Fuel Systems that you need to take into consideration.

If these risks are making you reconsider your opinion on Westport Fuel Systems, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Westport Fuel Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WPRT

Westport Fuel Systems

Engages in the engineering, manufacturing, and supplying alternative fuel systems and components for use in transportation applications in Europe, Asia, North America, South America, and internationally.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives