- Canada

- /

- Trade Distributors

- /

- TSX:WJX

Wajax (TSX:WJX) Margin Contraction Challenges Value Narrative Despite Five-Year Earnings Growth

Reviewed by Simply Wall St

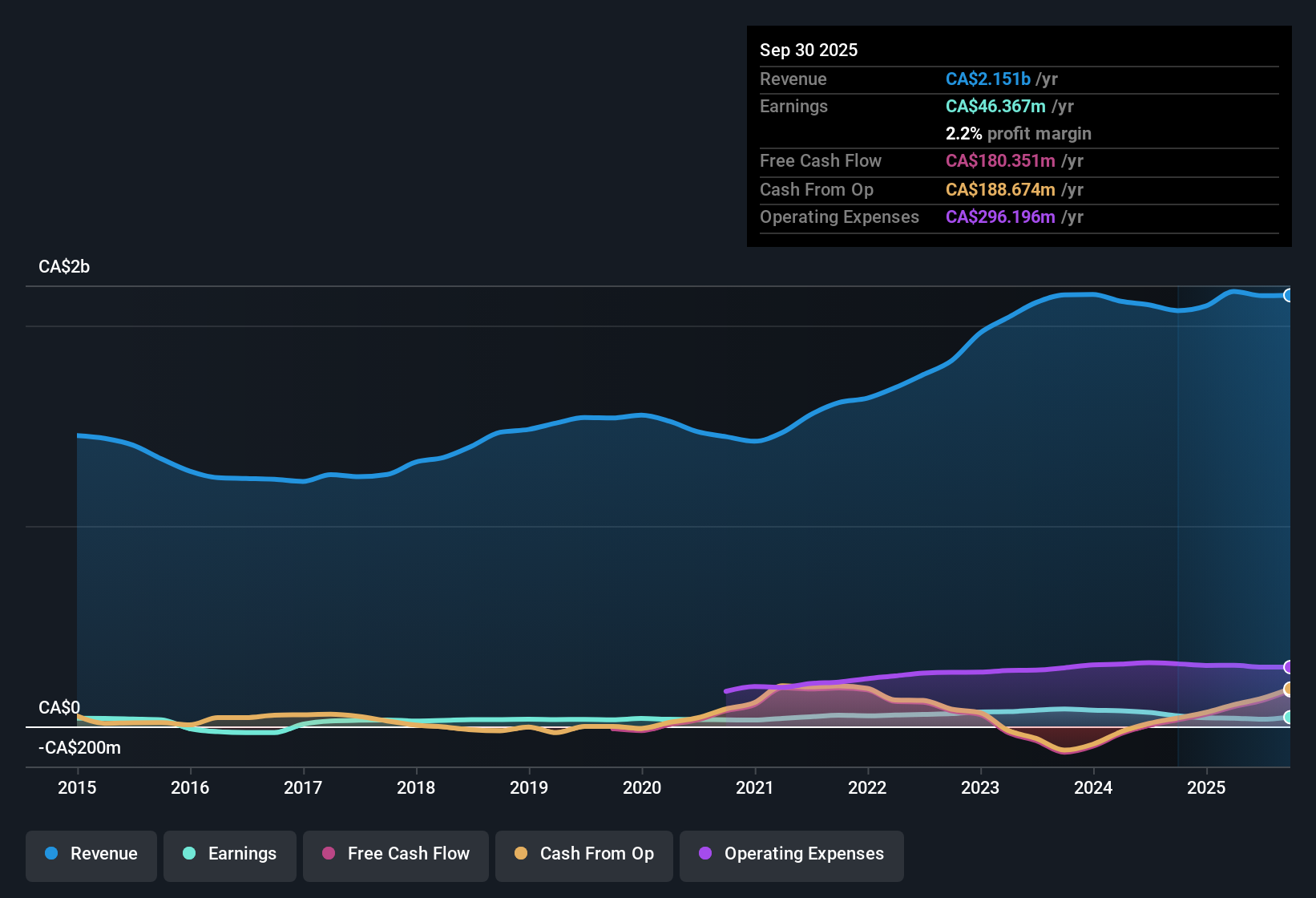

Wajax (TSX:WJX) reported net profit margins of 2.2%, down from 2.5% in the prior year, as the company faced a contraction in margin performance. Over the past twelve months, earnings growth turned negative, and revenue is projected to decline at a rate of 0.2% per year over the next three years. Still, Wajax has built a 3.7% annual earnings growth rate over the last five years, which highlights a longer-term trend of improvement despite recent setbacks.

See our full analysis for Wajax.Up next, we will see how these headline numbers measure up against the market’s prevailing narratives. Some familiar perspectives may be confirmed, while others could be up for debate.

Curious how numbers become stories that shape markets? Explore Community Narratives

Valuation Undercuts Sector but Sits Above DCF Fair Value

- Wajax’s price-to-earnings ratio of 11.8x is not only below the wider North American Trade Distributors industry average of 19.7x, but also sits just above its peer group average of 11x. At a share price of $25.06, the stock trades well above its estimated DCF fair value of $19.55. This highlights ongoing debate about intrinsic worth compared to what investors are willing to pay.

- While the prevailing market view spotlights Wajax’s apparent value relative to broader industry benchmarks, there is tension between that discount and the stock’s premium to its DCF fair value:

- Some investors are drawn to the idea that the lower earnings multiple and recognized dividend attractiveness strengthen the case for value, especially when compared to the sector as a whole.

- The fact that the market is valuing Wajax at a premium to DCF signals caution even among bargain-hunters, as the market may be pricing in higher quality earnings or dividend stability over pure fundamental value.

Dividends and Quality Buffer Margin Pressures

- Despite compressed net profit margins (now at 2.2% versus 2.5% last year), Wajax maintains a reputation for attractive dividends, which continue to appeal to income seekers navigating a challenging operating environment.

- Prevailing analysis suggests dividends provide a stabilizing anchor for investor sentiment around Wajax, pushing back against margin and earnings declines:

- The combination of established profit growth over five years (3.7% CAGR) and ongoing dividend payments contrasts with the current margin contraction, offering reassurance to income-focused and long-term investors.

- However, the persistence of margin pressure may limit the size of future dividend increases, prompting watchfulness from those who view income consistency as the defining investment case.

Long-Term Earnings Record Competes With Revenue Outlook

- Across the last five years, Wajax has delivered a 3.7% annual earnings growth rate, a milestone that stands out against a projected 0.2% annual revenue decline over the next three years, according to management forecasts and filings.

- The prevailing market view highlights the lasting influence of this growth record on investor confidence, even as the sales outlook turns negative:

- Optimists will point to the durability of multi-year profit growth as a counterbalance to softer short-term trends, suggesting that operational discipline or key business segments may continue to outperform.

- Realists, on the other hand, will focus on guidance that forecasts a top-line contraction, questioning whether Wajax can continue to generate earnings advances if revenue shrinks across a prolonged period.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Wajax's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Wajax’s declining profit margins, negative earnings growth, and projected revenue contraction suggest the company may lack the stable performance some investors want.

If consistent financial results are your priority, shift your focus to stable growth stocks screener (2077 results), where you will find companies that consistently deliver steady revenue and earnings growth regardless of market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Wajax might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WJX

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion