In Canada, the labor market showed signs of stabilization in August, while inflation figures remained within the Bank of Canada's target range, reflecting a steady economic environment. With recent gains in the TSX and potential market volatility on the horizon, dividend stocks can offer investors a measure of stability and income amidst these conditions.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Sun Life Financial (TSX:SLF) | 4.26% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.16% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.01% | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | 13.17% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 4.14% | ★★★★★☆ |

| Pizza Pizza Royalty (TSX:PZA) | 6.02% | ★★★★☆☆ |

| National Bank of Canada (TSX:NA) | 3.17% | ★★★★★☆ |

| Magna International (TSX:MG) | 4.13% | ★★★★★☆ |

| Canadian Imperial Bank of Commerce (TSX:CM) | 3.50% | ★★★★★☆ |

| Bank of Montreal (TSX:BMO) | 3.61% | ★★★★★☆ |

Click here to see the full list of 23 stocks from our Top TSX Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Russel Metals (TSX:RUS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Russel Metals Inc. is involved in the distribution of steel and other metal products across Canada and the United States, with a market cap of CA$2.23 billion.

Operations: Russel Metals Inc. generates revenue through its Steel Distributors segment at CA$381.20 million, Energy Field Stores at CA$981 million, and Metals Service Centers at CA$3.13 billion.

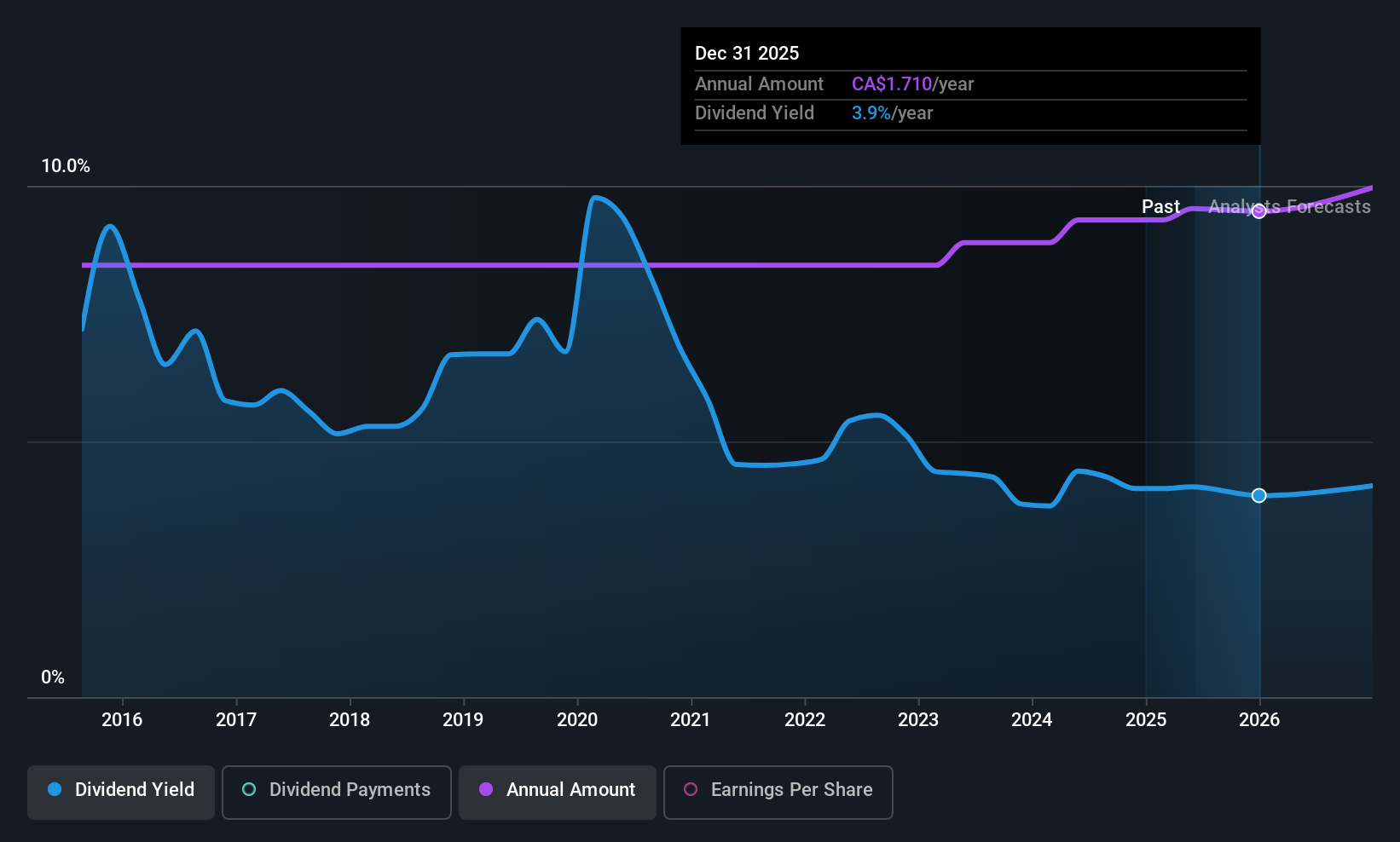

Dividend Yield: 4.2%

Russel Metals offers a stable dividend yield of 4.16%, supported by a reasonable payout ratio of 58.7% and a cash payout ratio of 44.2%, indicating coverage by earnings and cash flows. Recent developments include the acquisition of seven service center locations, which may enhance its operational scale, while the closure and reorganization at certain sites could optimize resources. The company also initiated a share repurchase program, suggesting confidence in its financial position and future prospects.

- Delve into the full analysis dividend report here for a deeper understanding of Russel Metals.

- Upon reviewing our latest valuation report, Russel Metals' share price might be too pessimistic.

Sun Life Financial (TSX:SLF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sun Life Financial Inc. is a financial services company offering asset management, wealth, insurance, and health solutions to individual and institutional customers across various countries including Canada, the United States, and several others in Asia and Europe, with a market cap of approximately CA$46.02 billion.

Operations: Sun Life Financial Inc.'s revenue segments are comprised of Asia (CA$2.16 billion), Canada (CA$11.63 billion), Asset Management (CA$6.80 billion), and the United States (CA$13.85 billion).

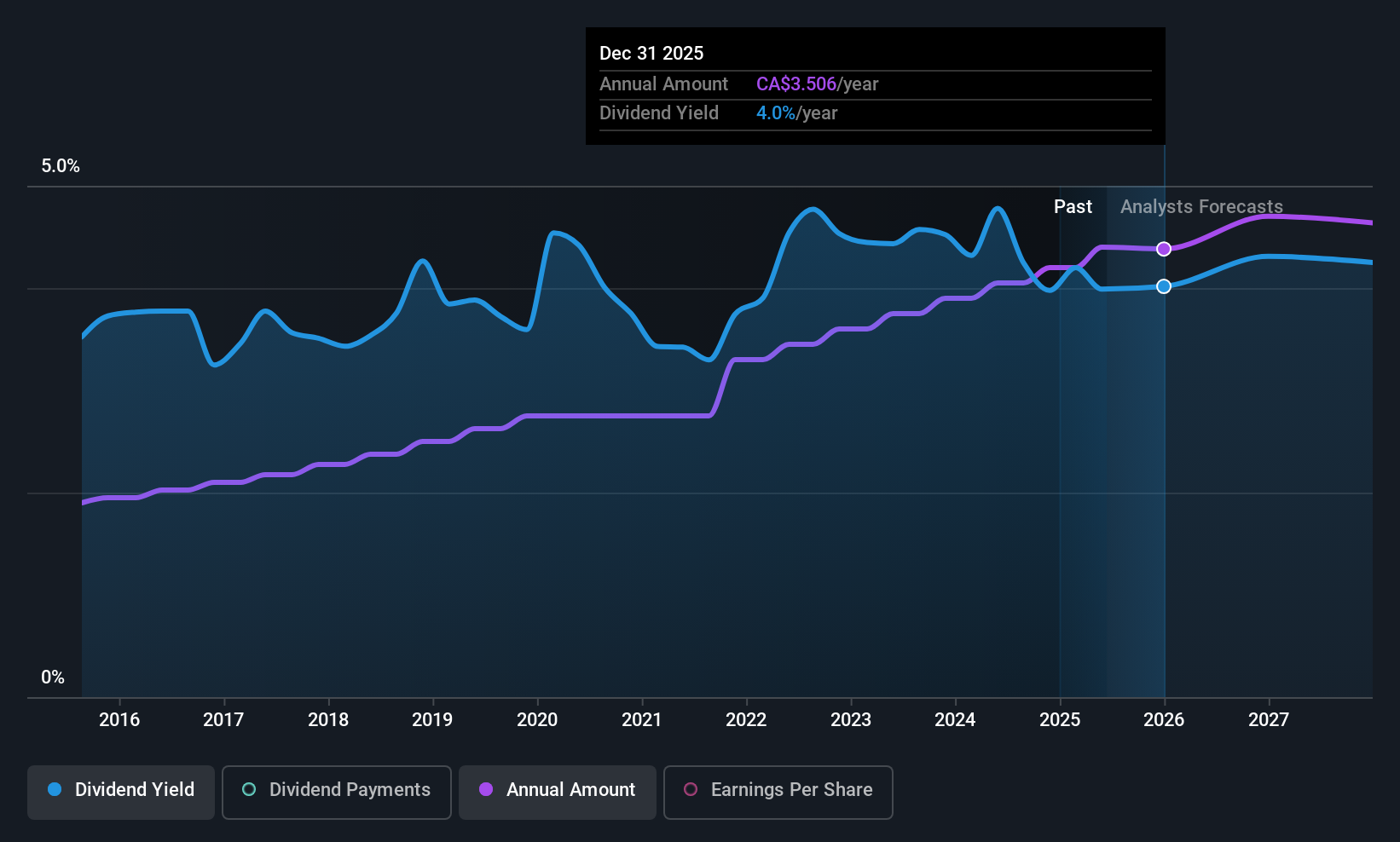

Dividend Yield: 4.3%

Sun Life Financial maintains a stable dividend yield of 4.26%, underpinned by a payout ratio of 59.7% and cash payout ratio of 47.7%, indicating strong coverage by earnings and cash flows. The company recently issued CAD 1 billion in debentures for strategic investments, signaling robust financial management. Leadership changes, including the appointment of new executives in key roles, reflect ongoing efforts to strengthen its business operations and growth strategy across various markets.

- Unlock comprehensive insights into our analysis of Sun Life Financial stock in this dividend report.

- Our expertly prepared valuation report Sun Life Financial implies its share price may be lower than expected.

Wajax (TSX:WJX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wajax Corporation supplies industrial products and services across Canada, with a market cap of CA$522.55 million.

Operations: Wajax Corporation's revenue from its wholesale machinery and industrial equipment segment is CA$2.15 billion.

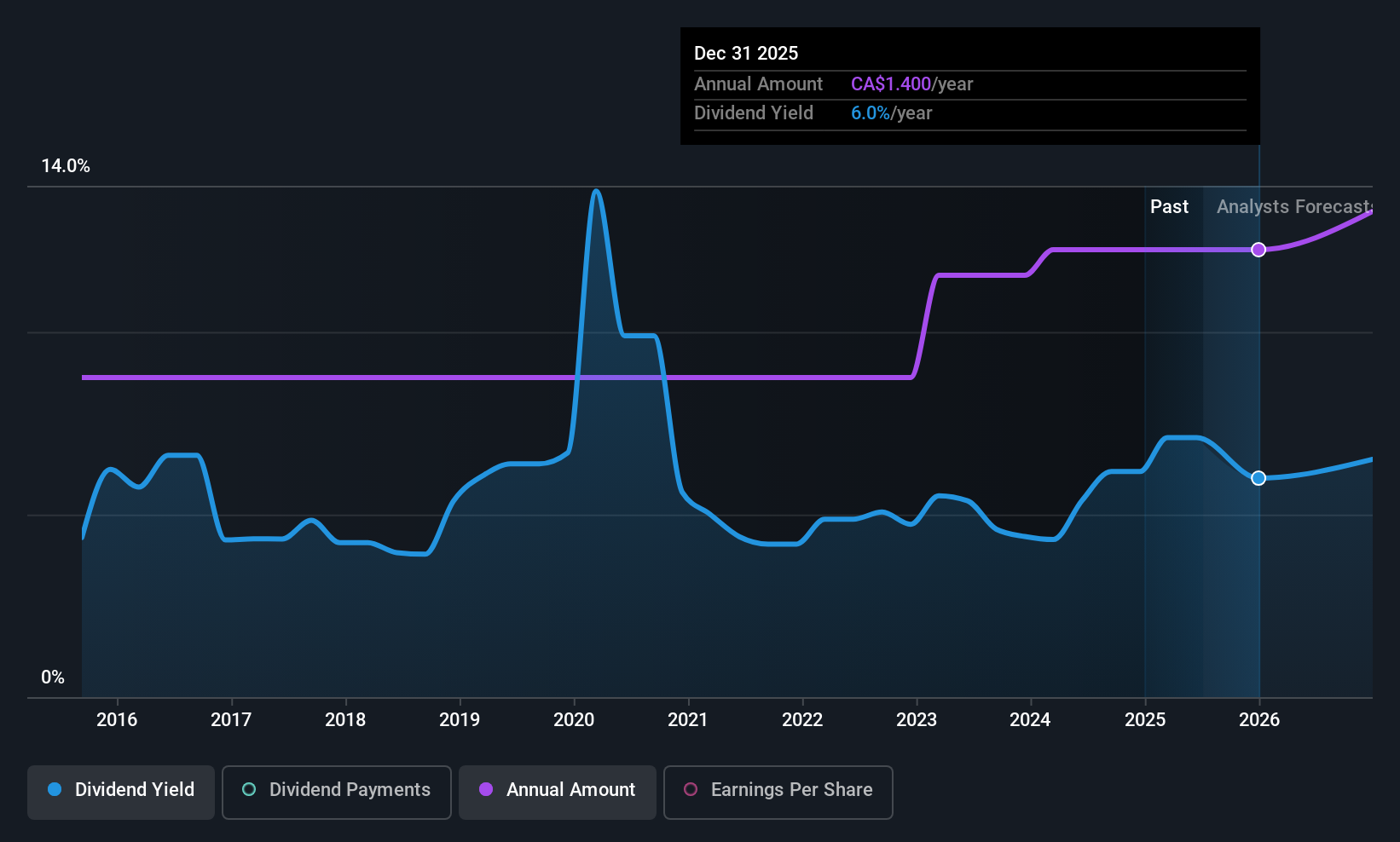

Dividend Yield: 5.8%

Wajax's dividend yield of 5.8% ranks it among the top 25% in Canada, though its track record is volatile, with dividends decreasing over the past decade. Despite this instability, its current payout ratio of 84.6% suggests dividends are covered by earnings and cash flows, with a low cash payout ratio of 23.4%. Recent earnings showed a decline in net income to C$15.48 million for Q2 2025 from C$20.63 million a year ago, impacting profit margins negatively.

- Dive into the specifics of Wajax here with our thorough dividend report.

- The valuation report we've compiled suggests that Wajax's current price could be inflated.

Next Steps

- Investigate our full lineup of 23 Top TSX Dividend Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SLF

Sun Life Financial

A financial services company, provides asset management, wealth, insurance and health solutions to individual and institutional customers in Canada, the United States, the United Kingdom, Ireland, Hong Kong, the Philippines, Japan, Indonesia, India, China, Australia, Singapore, Vietnam, Malaysia, and Bermuda.

Average dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion