- Canada

- /

- Trade Distributors

- /

- TSX:TBL

Should You Worry About Taiga Building Products Ltd.'s (TSE:TBL) CEO Salary Level?

In 2015, Trent Balog was appointed CEO of Taiga Building Products Ltd. (TSE:TBL). First, this article will compare CEO compensation with compensation at similar sized companies. After that, we will consider the growth in the business. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. This method should give us information to assess how appropriately the company pays the CEO.

Check out our latest analysis for Taiga Building Products

How Does Trent Balog's Compensation Compare With Similar Sized Companies?

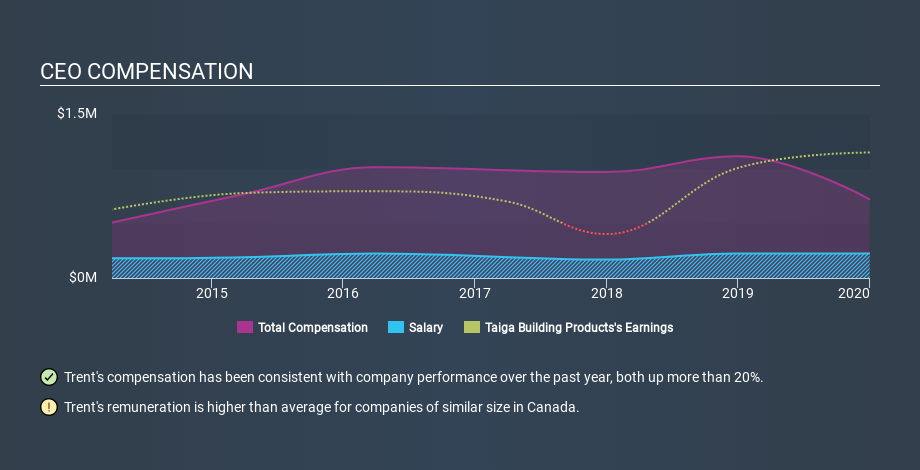

According to our data, Taiga Building Products Ltd. has a market capitalization of CA$94m, and paid its CEO total annual compensation worth CA$720k over the year to December 2019. That's actually a decrease on the year before. While this analysis focuses on total compensation, it's worth noting the salary is lower, valued at CA$225k. Importantly, there may be performance hurdles relating to the non-salary component of the total compensation. We looked at a group of companies with market capitalizations under CA$284m, and the median CEO total compensation was CA$220k.

Next, let's break down remuneration compositions to understand how the industry and company compare with each other. On an industry level, roughly 54% of total compensation represents salary and 46% is other remuneration. Taiga Building Products sets aside a smaller share of compensation for salary, in comparison to the overall industry.

As you can see, Trent Balog is paid more than the median CEO pay at companies of a similar size, in the same market. However, this does not necessarily mean Taiga Building Products Ltd. is paying too much. A closer look at the performance of the underlying business will give us a better idea about whether the pay is particularly generous. You can see, below, how CEO compensation at Taiga Building Products has changed over time.

Is Taiga Building Products Ltd. Growing?

Over the last three years Taiga Building Products Ltd. has shrunk its earnings per share by an average of 12% per year (measured with a line of best fit). In the last year, its revenue is down 10%.

Few shareholders would be pleased to read that earnings per share are lower over three years. And the impression is worse when you consider revenue is down year-on-year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Although we don't have analyst forecasts you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Taiga Building Products Ltd. Been A Good Investment?

Given the total loss of 18% over three years, many shareholders in Taiga Building Products Ltd. are probably rather dissatisfied, to say the least. It therefore might be upsetting for shareholders if the CEO were paid generously.

In Summary...

We compared total CEO remuneration at Taiga Building Products Ltd. with the amount paid at companies with a similar market capitalization. As discussed above, we discovered that the company pays more than the median of that group.

We think many shareholders would be underwhelmed with the business growth over the last three years. Arguably worse, investors are without a positive return for the last three years. In our opinion the CEO might be paid too generously! Shifting gears from CEO pay for a second, we've picked out 3 warning signs for Taiga Building Products that investors should be aware of in a dynamic business environment.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies, that have HIGH return on equity and low debt.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:TBL

Taiga Building Products

Operates as a wholesale distributor of building products in Canada and the United States.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026