- Canada

- /

- Construction

- /

- TSX:STN

Stantec (TSX:STN) Valuation After Major €27.7m European Commission Sustainable Energy Contract Win

Reviewed by Simply Wall St

Stantec (TSX:STN) just landed a major win in Europe, securing the second phase of the European Commission’s Global Technical Assistance Facility for Sustainable Energy, a multiyear contract worth roughly €27.7 million.

See our latest analysis for Stantec.

Despite the recent pullback, with a 1 month share price return of negative 15.62 percent, Stantec’s year to date share price return of 16.3 percent and 5 year total shareholder return of 231.28 percent suggest long term momentum is still firmly intact. This new European Commission contract reinforces that growth story rather than changing it.

If this kind of durable growth backed by real contracts interests you, it is worth exploring fast growing stocks with high insider ownership as a way to uncover other under the radar opportunities with strong alignment between management and shareholders.

With shares still up solidly this year and trading at a steep discount to analyst targets, investors now face a key question: is Stantec quietly undervalued after the pullback, or is the market already baking in years of growth?

Most Popular Narrative Narrative: 22.2% Undervalued

Compared with Stantec's last close at CA$131.55, the most followed narrative points to a higher fair value anchored in steady growth and expanding margins.

Strengthening mix from higher margin environmental and consulting services, plus operational discipline in project execution, is already raising adjusted EBITDA margins and earnings, with further upside as organic growth accelerates and integration synergies from recent acquisitions are realized.

Want to see what powers this optimistic view? The narrative leans on accelerating earnings, richer margins, and a premium future multiple. Curious how those pieces fit together?

Result: Fair Value of $169.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated integration risk from recent acquisitions, along with any slowdown in government backed infrastructure spending, could easily puncture this optimistic undervaluation case.

Find out about the key risks to this Stantec narrative.

Another Angle on Valuation

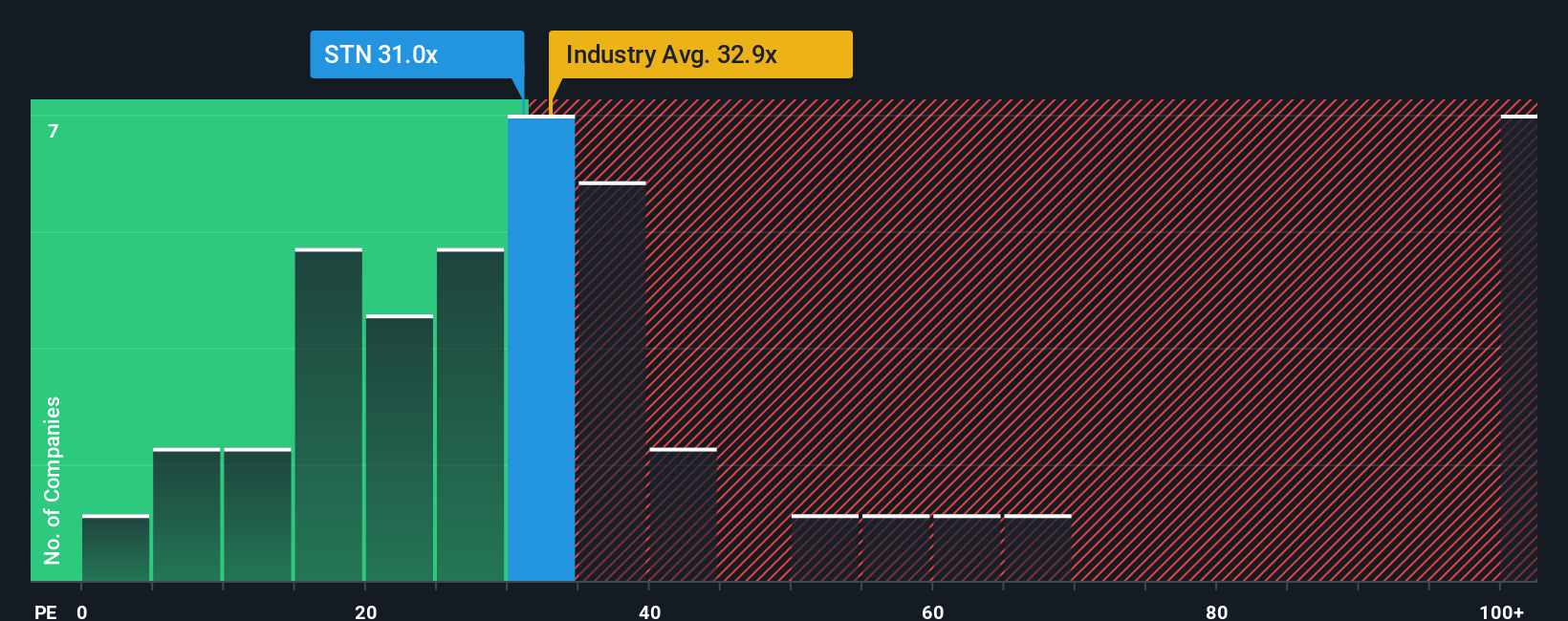

That optimistic narrative leans on future earnings and a richer multiple, but today Stantec already trades at about 31 times earnings, above its estimated fair ratio of 25 times and pricier than local peers on this metric, even if roughly in line with the broader North American construction group. Is the market giving you much margin of safety at this entry point?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Stantec Narrative

If you see things differently or prefer to dive into the numbers yourself, you can craft a custom Stantec view in just minutes: Do it your way.

A great starting point for your Stantec research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next potential winner by putting Simply Wall Street’s powerful screener to work on a fresh set of opportunities today.

- Target resilient income by reviewing these 15 dividend stocks with yields > 3% that aim to balance solid yields with dependable business quality.

- Ride structural growth trends by scanning these 30 healthcare AI stocks pushing the boundaries of medical diagnostics, treatment, and efficiency.

- Capture deep value potential by assessing these 905 undervalued stocks based on cash flows where market prices may lag behind robust underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:STN

Stantec

Provides professional services in the areas of infrastructure and facilities to the public and private sectors in Canada, the United States, and internationally.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026