- Canada

- /

- Construction

- /

- TSX:STN

Stantec (TSX:STN) Secures Thames Water Contract, Enhancing Growth Prospects in Water Sector

Reviewed by Simply Wall St

Stantec (TSX:STN) has recently been selected by Thames Water to provide services for its £400 million Asset, Capital, and Engineering Professional Services Framework, marking a significant development in its Water and Infrastructure sectors. This announcement aligns with Stantec's Q3 2024 financial performance, where net revenue surged by 16% to $1.5 billion, driven by organic and acquisition growth. In the following discussion, we will explore Stantec's competitive advantages, challenges, future prospects, and external factors impacting its market position.

Click here to discover the nuances of Stantec with our detailed analytical report.

Competitive Advantages That Elevate Stantec

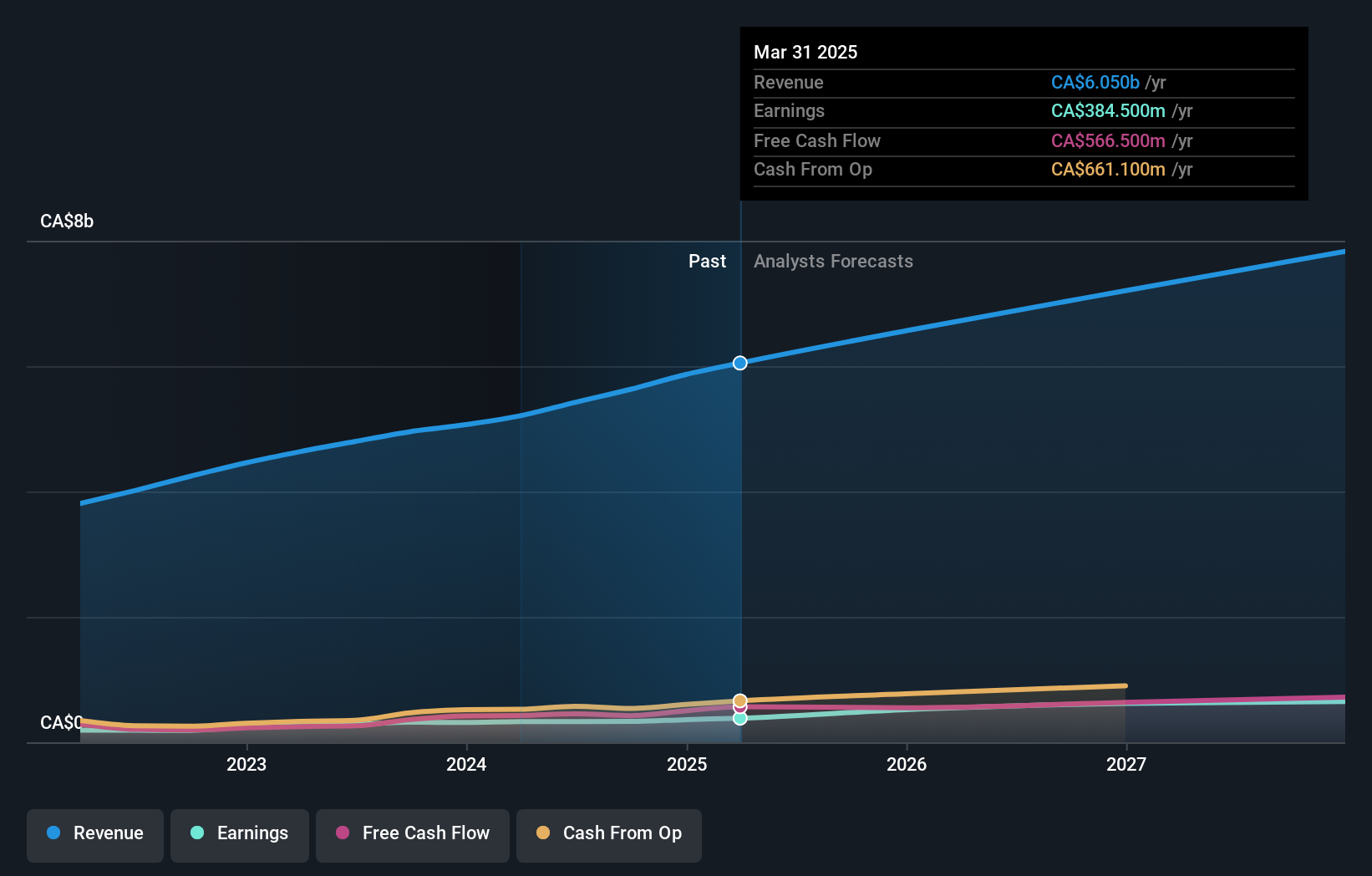

Stantec has demonstrated strong financial performance, with Q3 2024 net revenue reaching $1.5 billion, a 16% increase from the previous year. This growth was fueled by 6.5% organic and nearly 8% acquisition growth, as highlighted by CEO Gordon Johnston. The company's adjusted EBITDA rose to $275 million, reflecting a 14% increase with an 18% margin, showcasing operational efficiency. Geographic and sectoral expansion has been a significant driver, with the U.S. market experiencing a 9% revenue increase, particularly in Infrastructure and Water. In Canada, revenue grew by 18%, driven by substantial projects across Infrastructure, Buildings, and Water sectors. Stantec's commitment to sustainability and responsible governance has been recognized, as it was ranked #1 on Newsweek's list of Canada's Most Responsible Companies for 2025.

Challenges Constraining Stantec's Potential

Stantec faces challenges, particularly in its Energy & Resources segment, which saw a slight retraction in the global mining business. This was noted by Johnston, who pointed out the offsetting growth in the U.S. and Canada. Additionally, administrative and marketing expenses increased slightly as a percentage of net revenue, partly due to labor training and integration costs from recent acquisitions. The company's current net profit margin of 6.2% is lower than last year's 6.4%, and its return on equity stands at 12.8%, below the industry threshold of 20%. Furthermore, Stantec's high Price-To-Earnings Ratio of 40.1x indicates it is trading at a premium compared to its peers and the North American Construction industry averages.

Future Prospects for Stantec in the Market

Stantec is poised for significant growth opportunities, particularly in the Water and Buildings sectors, where it sees strong tailwinds. The recent selection by Thames Water to provide services for its Asset, Capital, and Engineering Professional Services Framework underscores this potential. This £400 million framework will allow Stantec to deliver interdisciplinary engineering and environmental services, enhancing its market position. Additionally, the company's M&A pipeline offers expansion opportunities in Canada, the U.S., U.K., Nordics, and Australia/New Zealand. Strategic projects like the AMP8 frameworks in the U.K. and the MSA with LUMA Energy in Puerto Rico further bolster growth prospects.

External Factors Threatening Stantec

Stantec must navigate several external threats, including potential regulatory and political changes in the U.S. that could impact infrastructure project funding. The competitive environment in M&A processes and broader economic conditions also pose challenges to growth strategies. Additionally, the Energy & Resources segment, particularly in mining, continues to face hurdles that could affect future performance. These sector-specific challenges require careful management to maintain Stantec's growth trajectory and market share.

To learn about how Stantec's valuation metrics are shaping its market position, check out our detailed analysis of Stantec's Valuation.

Conclusion

Stantec's financial performance, marked by a 16% increase in net revenue and strong EBITDA growth, underscores its operational efficiency and strategic geographic expansion, particularly in the U.S. and Canada. However, challenges in the Energy & Resources segment and rising administrative costs highlight the need for strategic management to sustain growth. Stantec's future prospects in the Water and Buildings sectors, supported by significant contracts like the Thames Water framework, present substantial growth opportunities. The company's current high Price-To-Earnings Ratio of 40.1x suggests that investors have high expectations for its future earnings, reflecting confidence in its strategic initiatives and market position, albeit at a premium compared to industry averages. This premium valuation indicates that while Stantec is well-positioned for future growth, it must effectively navigate external threats and internal challenges to justify investor confidence and maintain its competitive edge.

Taking Advantage

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

```New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:STN

Stantec

Provides professional services in the areas of infrastructure and facilities to the public and private sectors in Canada, the United States, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives