- Canada

- /

- Construction

- /

- TSX:STN

Does Record Backlog Growth and Insider Buying Change The Bull Case For Stantec (TSX:STN)?

Reviewed by Simply Wall St

- Earlier this week, Stantec reported record backlog growth across its U.S., Canadian, and global operations, alongside notable insider buying activity over the last three months.

- This combination of rising project backlogs and positive insider sentiment signals heightened market confidence in Stantec's longer-term business outlook.

- We'll examine how Stantec's strengthened backlog positions the company for future revenue visibility and influences its investment narrative.

Stantec Investment Narrative Recap

To be a Stantec shareholder, you need to believe in enduring global demand for infrastructure and the company’s ability to convert record backlogs into consistent, profitable growth. While the latest update of heightened backlog and insider buying helps amplify short-term optimism, it does not fundamentally address the biggest risk: disruptions in funding or execution of large-scale projects, which could materially alter earnings expectations if delays occur.

Recent news on Stantec’s partnership with the City of Mississauga, where the company will lead a major bus rapid transit corridor design, illustrates how growing backlog and high-value project wins provide solid near-term revenue visibility. This fits squarely into the view that robust North American public-sector spending can support Stantec’s pipeline even if other regions experience macroeconomic volatility.

However, despite this project pipeline, investors should also be aware that seasonality and potential macroeconomic swings can cause backlog volatility and impact revenue consistency...

Read the full narrative on Stantec (it's free!)

Stantec’s outlook anticipates CA$8.1 billion in revenue and CA$748.7 million in earnings by 2028. This is underpinned by a 10.0% annual revenue growth rate and a CA$364.2 million earnings increase from the current CA$384.5 million.

Uncover how Stantec's forecasts yield a CA$153.82 fair value, in line with its current price.

Exploring Other Perspectives

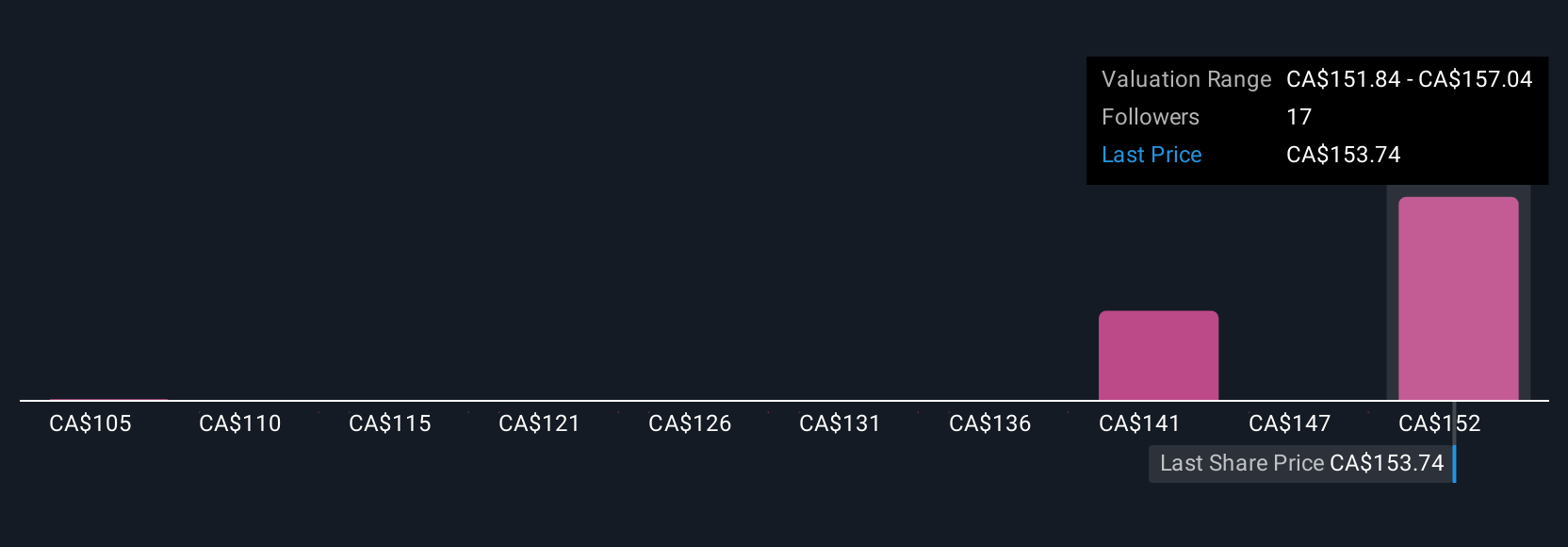

Four Simply Wall St Community members place Stantec’s fair value between CA$105 and CA$157.04, a spread that showcases strong differences in outlook. While recent backlog growth supports positive revenue catalysts, the divergence in valuations reflects how project execution and timing could still affect Stantec’s long-term performance and invites you to compare several viewpoints.

Build Your Own Stantec Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Stantec research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Stantec research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Stantec's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 26 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:STN

Stantec

Provides professional services in the areas of infrastructure and facilities to the public and private sectors in Canada, the United States, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives