The board of Savaria Corporation (TSE:SIS) has announced that it will pay a dividend on the 9th of August, with investors receiving CA$0.0433 per share. The dividend yield will be 2.8% based on this payment which is still above the industry average.

Check out our latest analysis for Savaria

Savaria's Dividend Is Well Covered By Earnings

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Before this announcement, Savaria was paying out 82% of earnings, but a comparatively small 52% of free cash flows. This leaves plenty of cash for reinvestment into the business.

The next year is set to see EPS grow by 34.9%. If the dividend continues along recent trends, we estimate the payout ratio will be 73%, which would make us comfortable with the sustainability of the dividend, despite the levels currently being quite high.

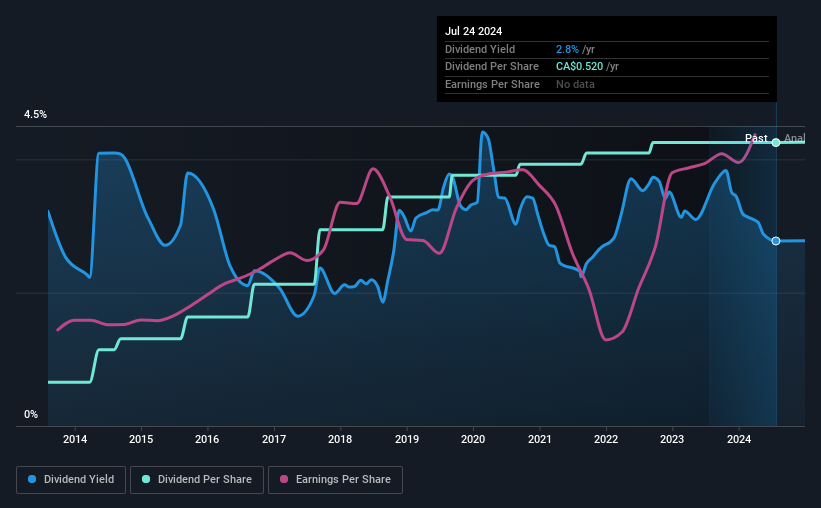

Savaria Has A Solid Track Record

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. The dividend has gone from an annual total of CA$0.08 in 2014 to the most recent total annual payment of CA$0.52. This works out to be a compound annual growth rate (CAGR) of approximately 21% a year over that time. We can see that payments have shown some very nice upward momentum without faltering, which provides some reassurance that future payments will also be reliable.

We Could See Savaria's Dividend Growing

The company's investors will be pleased to have been receiving dividend income for some time. It's encouraging to see that Savaria has been growing its earnings per share at 8.4% a year over the past five years. The payout ratio is very much on the higher end, which could mean that the growth rate will slow down in the future, and that could flow through to the dividend as well.

We should note that Savaria has issued stock equal to 10% of shares outstanding. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

Our Thoughts On Savaria's Dividend

Overall, a consistent dividend is a good thing, and we think that Savaria has the ability to continue this into the future. The dividend is easily covered by cash flows and has a good track record, but we think the payout ratio might be a bit high. The dividend looks okay, but there have been some issues in the past, so we would be a little bit cautious.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Taking the debate a bit further, we've identified 2 warning signs for Savaria that investors need to be conscious of moving forward. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SIS

Savaria

Provides accessibility solutions for the elderly and physically challenged people in Canada, the United States, Europe, and internationally.

Undervalued established dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026