- Canada

- /

- Trade Distributors

- /

- TSX:RUS

Should Russel Metals' Earnings Growth and Dividend Affirmation Prompt a Fresh Look From TSX:RUS Investors?

Reviewed by Sasha Jovanovic

- Russel Metals Inc. recently reported third quarter 2025 earnings, delivering year-over-year growth in both sales (CA$1.17 billion) and net income (CA$35 million), while also affirming its quarterly dividend of CA$0.43 per share payable in December.

- This performance, paired with the company's ongoing share buyback activity, highlights its focus on returning value to shareholders alongside operational growth.

- We'll explore how Russel Metals' steady earnings growth and dividend affirmation influence the company's longer-term investment case.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Russel Metals Investment Narrative Recap

To be a shareholder in Russel Metals, you need to believe in a recovery and sustained demand across North American infrastructure, energy, and industrial markets, along with confidence in the company's ability to protect margins as cyclical pressures and market normalization play out. The latest Q3 earnings, which showed moderate growth in both sales and net income, do not materially affect the short-term catalyst of infrastructure-driven demand, nor do they significantly shift the current biggest risk, potential margin compression as inventory cost benefits unwind.

Among the recent announcements, Russel Metals' affirmation of its quarterly dividend at CA$0.43 per share stands out. This consistency, even as market headwinds linger, underscores management’s commitment to shareholder returns and may reassure investors looking for reliability despite ongoing sector volatility tied to end-market demand cycles.

However, against this backdrop, investors should also be aware of risks from inventory cost "lag effects" reversing in upcoming quarters, as...

Read the full narrative on Russel Metals (it's free!)

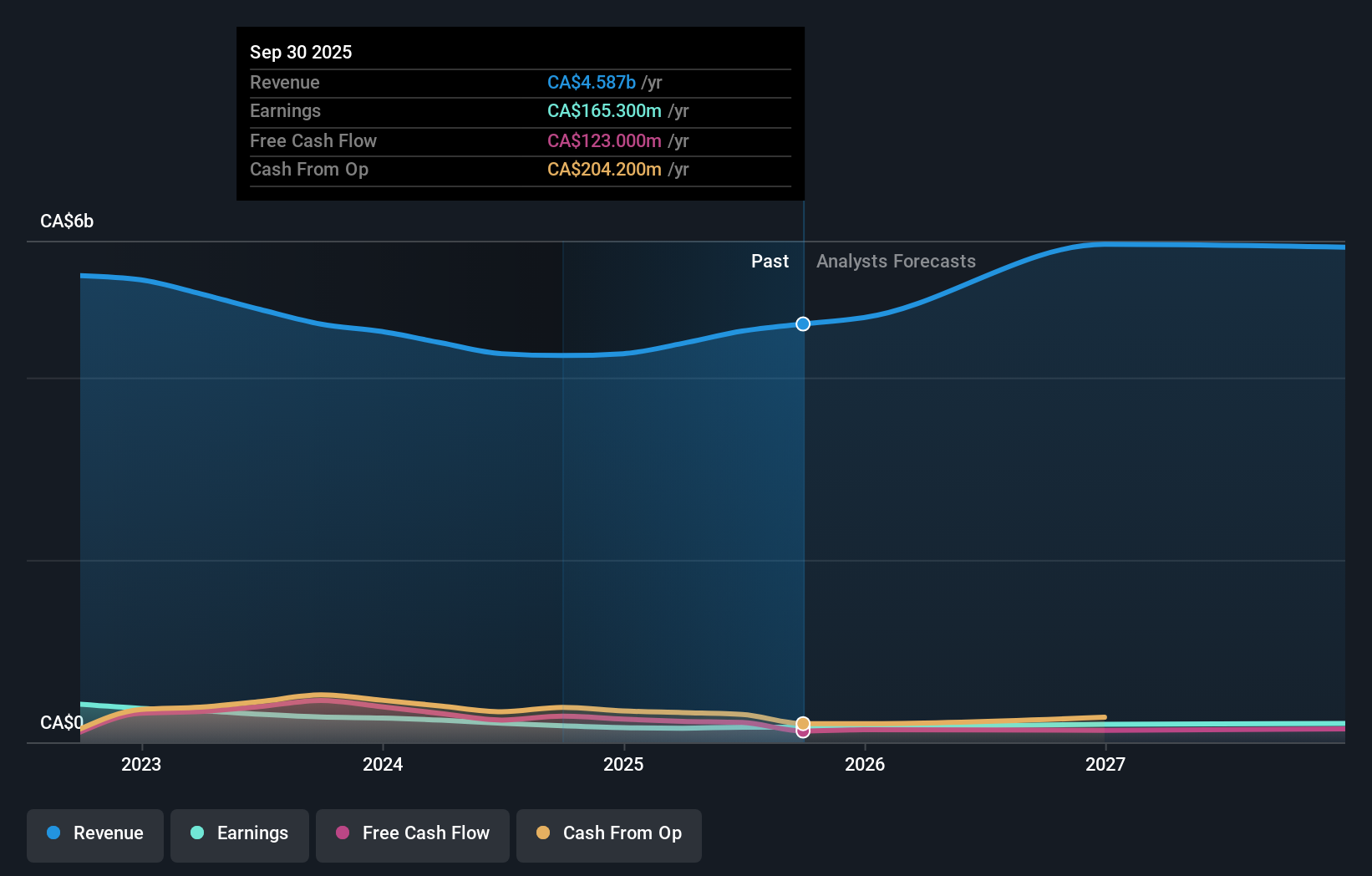

Russel Metals' outlook anticipates CA$5.1 billion in revenue and CA$255.8 million in earnings by 2028. This is based on analysts forecasting 4.5% annual revenue growth and an earnings increase of CA$91 million from the current level of CA$164.8 million.

Uncover how Russel Metals' forecasts yield a CA$51.00 fair value, a 28% upside to its current price.

Exploring Other Perspectives

Seven Simply Wall St Community members estimate Russel Metals’ fair value from CA$40.48 up to CA$174, reflecting highly varied outlooks. These divergent views contrast with analyst concerns about margin headwinds ahead, reminding you to explore several alternative perspectives before making decisions.

Explore 7 other fair value estimates on Russel Metals - why the stock might be worth just CA$40.48!

Build Your Own Russel Metals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Russel Metals research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Russel Metals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Russel Metals' overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:RUS

Russel Metals

Engages in the distribution of steel and other metal products in Canada and the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives