TSX Growth Companies With High Insider Ownership And Up To 111 Percent Earnings Growth

Reviewed by Simply Wall St

In the first half of 2025, despite facing significant policy uncertainties and market volatility, both the TSX and S&P 500 managed to reach new all-time highs, driven by easing trade tensions and resilient economic data. In this environment of fluctuating policies and economic resilience, growth companies with high insider ownership can offer unique insights into potential earnings growth opportunities in Canada.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Tenaz Energy (TSX:TNZ) | 10.3% | 151.2% |

| Stingray Group (TSX:RAY.A) | 24.3% | 30.8% |

| Robex Resources (TSXV:RBX) | 24.4% | 90.3% |

| Propel Holdings (TSX:PRL) | 36.3% | 33% |

| goeasy (TSX:GSY) | 21.9% | 18.2% |

| Enterprise Group (TSX:E) | 32.2% | 70.3% |

| Discovery Silver (TSX:DSV) | 15.1% | 39.3% |

| Burcon NutraScience (TSX:BU) | 15.1% | 125.9% |

| Aritzia (TSX:ATZ) | 17.4% | 24.7% |

| Almonty Industries (TSX:AII) | 12.1% | 56.2% |

Here we highlight a subset of our preferred stocks from the screener.

Green Thumb Industries (CNSX:GTII)

Simply Wall St Growth Rating: ★★★★☆☆

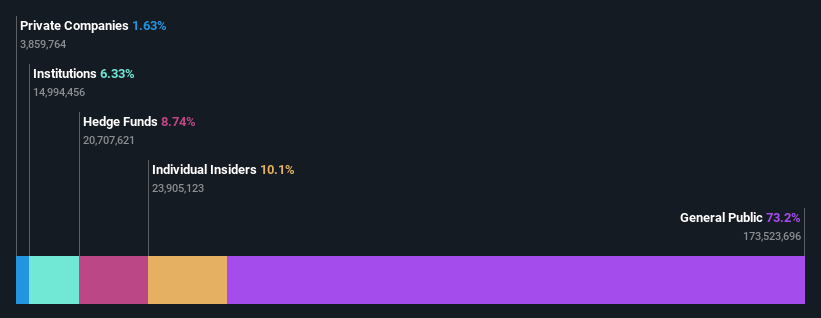

Overview: Green Thumb Industries Inc. is involved in the manufacturing, distribution, marketing, and sale of cannabis products for medical and adult-use in the United States, with a market cap of CA$1.70 billion.

Operations: The company's revenue segments consist of $819.62 million from retail and $668.76 million from consumer packaged goods.

Insider Ownership: 10.2%

Earnings Growth Forecast: 29.6% p.a.

Green Thumb Industries shows potential as a growth company with high insider ownership in Canada. Despite recent earnings showing modest sales growth to US$279.54 million and a decline in net income to US$8.31 million, the company's earnings are projected to grow significantly at 29.63% annually, outpacing the Canadian market's 12.4%. While revenue growth is slower at 5% per year, it still surpasses the Canadian average of 3.9%.

- Get an in-depth perspective on Green Thumb Industries' performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Green Thumb Industries is priced lower than what may be justified by its financials.

Maple Leaf Foods (TSX:MFI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Maple Leaf Foods Inc., along with its subsidiaries, produces food products in Canada, the United States, Japan, China, and internationally and has a market cap of CA$3.55 billion.

Operations: Maple Leaf Foods generates revenue through its production and distribution of food products across Canada, the United States, Japan, China, and other international markets.

Insider Ownership: 39.9%

Earnings Growth Forecast: 38.2% p.a.

Maple Leaf Foods demonstrates potential in the growth sector, with earnings projected to grow significantly at 38.2% annually, outpacing the Canadian market's 12.4%. Despite a modest revenue forecast of 4.1% per year and recent impairments of CAD 866,000, sales increased to CAD 1.24 billion in Q1 2025 from CAD 1.15 billion a year ago. However, its dividend yield is not well covered by earnings and interest payments are inadequately covered by income.

- Click here to discover the nuances of Maple Leaf Foods with our detailed analytical future growth report.

- Our valuation report unveils the possibility Maple Leaf Foods' shares may be trading at a premium.

NFI Group (TSX:NFI)

Simply Wall St Growth Rating: ★★★★☆☆

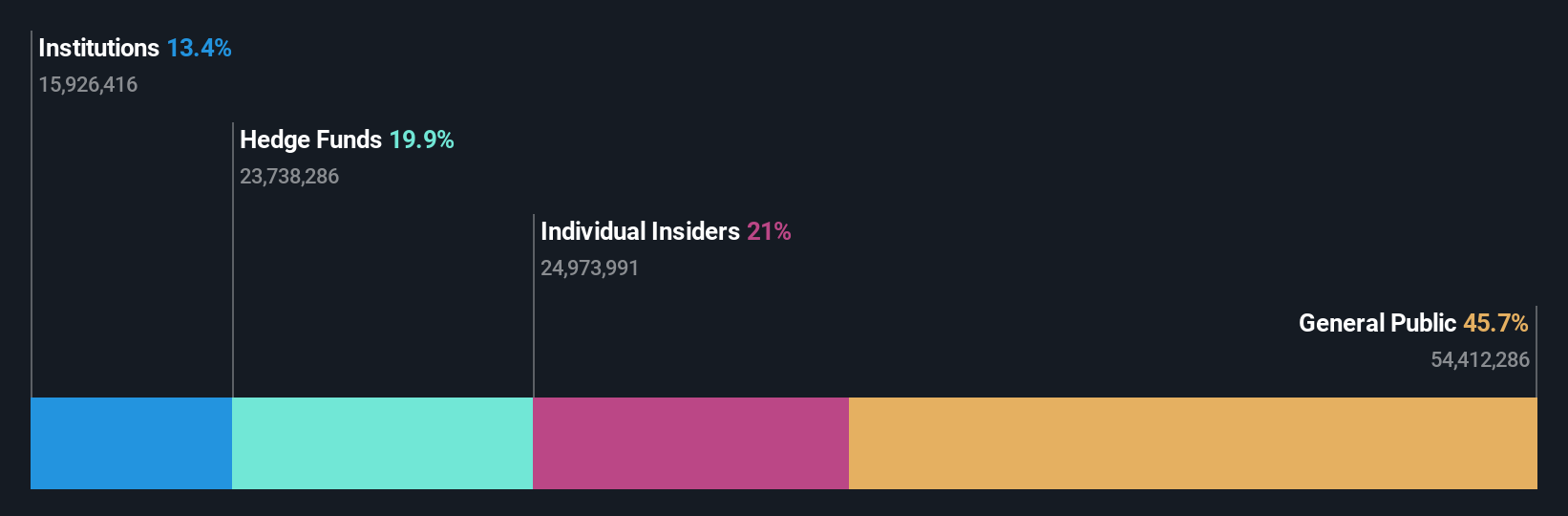

Overview: NFI Group Inc. manufactures and sells buses across North America, the United Kingdom, Europe, and the Asia Pacific, with a market cap of CA$2.21 billion.

Operations: The company's revenue is primarily derived from its Manufacturing Operations, which account for $2.62 billion, and its Aftermarket Operations, contributing $624.09 million.

Insider Ownership: 21%

Earnings Growth Forecast: 111.3% p.a.

NFI Group shows growth potential, with revenue forecasted to increase by 17.6% annually, outpacing the Canadian market's 3.9%. The company is expected to achieve profitability within three years and has seen substantial insider buying recently. Despite trading at a significant discount to its estimated fair value, NFI faces challenges as interest payments are not well covered by earnings. Recent financial maneuvers include a $600 million fixed-income offering and an $845 million revolving credit facility.

- Delve into the full analysis future growth report here for a deeper understanding of NFI Group.

- Insights from our recent valuation report point to the potential undervaluation of NFI Group shares in the market.

Where To Now?

- Dive into all 47 of the Fast Growing TSX Companies With High Insider Ownership we have identified here.

- Ready For A Different Approach? AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MFI

Maple Leaf Foods

Produces food products in Canada, the United States, Japan, China, and internationally.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives