The Bull Case For NFI Group (TSX:NFI) Could Change Following Breakthrough in Hydrogen Bus Range Extension – Learn Why

Reviewed by Simply Wall St

- Earlier this week, New Flyer of America, a subsidiary of NFI Group, unveiled an innovative four-tank hydrogen module that boosts the Xcelsior CHARGE FC bus’s onboard fuel capacity by 17.5 kilograms, extending operational range by up to 120 miles in partnership with the Humboldt Transit Authority.

- This increase in range directly addresses operational challenges on steep and demanding routes, offering transit agencies greater flexibility and efficiency in their zero-emission fleets.

- We'll explore how NFI Group's range-extension for hydrogen buses influences its ability to win and deliver large, diverse transit contracts.

Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

NFI Group Investment Narrative Recap

To own NFI Group stock, investors need conviction in the company’s ability to turn its innovation in zero-emission buses and record order backlog into profitable execution, despite ongoing industry headwinds. While New Flyer of America's hydrogen range extension showcases meaningful product progress, its immediate impact on the biggest short-term catalyst, efficiently fulfilling the $12.8 billion backlog, is modest, given persistent supply chain and funding uncertainties that remain the dominant risks right now.

The recent contract with Suffolk County Transit, for up to 132 hybrid and battery-electric buses, closely aligns with the push for propulsion flexibility seen in the hydrogen bus announcement. Together, these developments reinforce NFI’s strategy to offer a broad mix of propulsion types, reinforcing its revenue backlog and prospects for improving production efficiency, should supplier stability continue to improve.

However, less widely discussed is the effect that potential 25% tariffs on U.S.-Canada shipments could have on...

Read the full narrative on NFI Group (it's free!)

NFI Group's narrative projects $5.1 billion revenue and $298.3 million earnings by 2028. This requires 17.6% yearly revenue growth and a $301.6 million increase in earnings from the current -$3.3 million.

Uncover how NFI Group's forecasts yield a CA$20.36 fair value, a 7% upside to its current price.

Exploring Other Perspectives

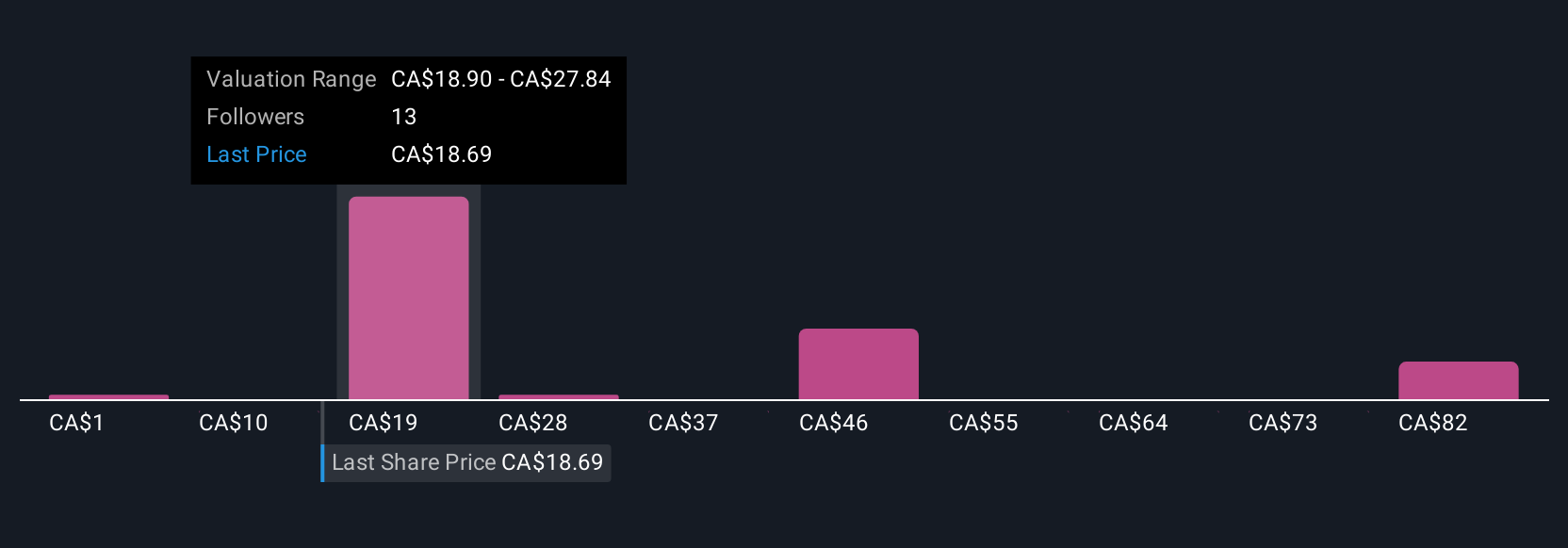

Simply Wall St Community members’ fair value estimates for NFI Group range from CA$1 to CA$90.48, based on eight separate analyses. With supply chain resilience remaining the linchpin for backlog delivery and earnings turnaround, explore how these differing forecasts reflect the range of upside and risk at play.

Build Your Own NFI Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NFI Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free NFI Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NFI Group's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NFI Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NFI

NFI Group

Manufactures and sells buses in North America, the United Kingdom, rest of Europe, and the Asia Pacific.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives