- Canada

- /

- Aerospace & Defense

- /

- TSX:MDA

Why MDA Space (TSX:MDA) Is Down 5.5% After Leading New ESA 5G Satellite Mission and What's Next

Reviewed by Simply Wall St

- Earlier this month, MDA Space announced it would lead SkyPhi, a new mission funded by the European Space Agency and UK Space Agency to enable regenerative 5G direct-to-device satellite communications from low Earth orbit, collaborating with CGI and Open Cosmos as part of the ARTES program.

- This move positions MDA Space at the forefront of next-generation satellite communications and highlights increased government support for commercial satellite technology innovation.

- We'll examine how MDA Space’s leadership in the SkyPhi mission could influence its investment narrative through innovation in satellite communications.

MDA Space Investment Narrative Recap

To be a shareholder in MDA Space, you need to believe in the expanding global need for advanced satellite communications and the company’s ability to secure large, transformational contracts. The new SkyPhi mission is a meaningful addition to MDA’s portfolio, reinforcing its profile in innovative 5G satellite tech, but it does not materially change the near-term focus: timely execution on critical design reviews for Telesat Lightspeed and Globalstar remains the key catalyst, while execution risks on these major projects still pose the biggest short-term threat. Of the recent company developments, the July 9 validation of MDA Space’s AURORATM Ka-band DRA technology stands out as highly relevant. This technological advance directly underpins their leadership in the SkyPhi mission, illustrating how innovation in satellite payloads and broadband connectivity aligns with commercial opportunities and supports the company's ongoing push for operational scale and project wins. By contrast, any disruption to execution timelines for flagship contracts is a risk investors should be aware of...

Read the full narrative on MDA Space (it's free!)

MDA Space's narrative projects CA$2.2 billion in revenue and CA$208.4 million in earnings by 2028. This requires 22.1% yearly revenue growth and a CA$109.9 million increase in earnings from the current CA$98.5 million.

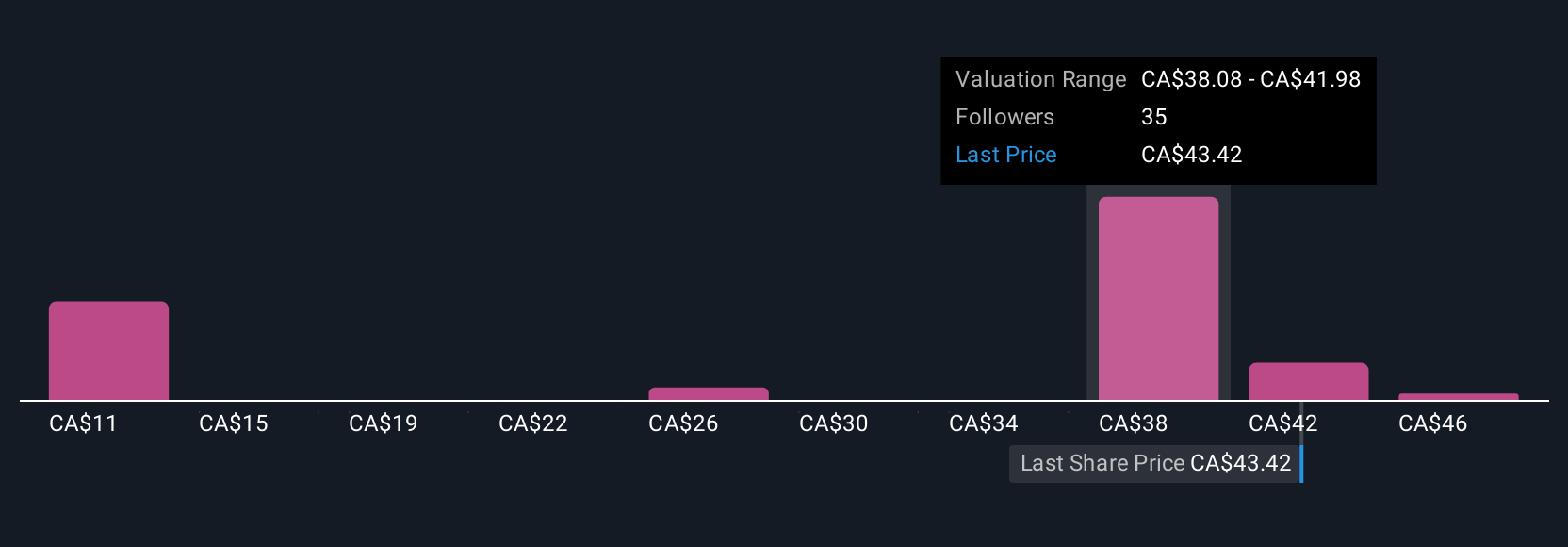

Uncover how MDA Space's forecasts yield a CA$38.81 fair value, a 5% downside to its current price.

Exploring Other Perspectives

The Simply Wall St Community includes 11 unique fair value estimates for MDA Space, ranging widely from CA$10.79 to CA$49.78 per share. While some members see strong upside, maintaining project execution for next-gen satellite constellations will continue to shape sentiment and the company’s future performance.

Build Your Own MDA Space Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MDA Space research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MDA Space research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MDA Space's overall financial health at a glance.

No Opportunity In MDA Space?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MDA

MDA Space

Provides space technology solutions and in Canada, the United States, Europe, Asia, the Middle East, and internationally.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives