- Canada

- /

- Aerospace & Defense

- /

- TSX:MDA

MDA Space (TSX:MDA) Is Up 11.9% After Securing Major EchoStar and Lunar Contracts – What’s Changed

Reviewed by Simply Wall St

- In recent days, MDA Space was chosen by EchoStar Corporation as the prime contractor for a US$1.3 billion+ LEO direct-to-device satellite constellation and by the Canadian Space Agency to lead an early-phase lunar vehicle study.

- These significant projects highlight both the scale of commercial demand for MDA Space’s satellite solutions and its leading technological role in space robotics and lunar logistics innovation.

- We'll examine how the EchoStar constellation contract amplifies MDA Space’s long-term outlook and growth potential in global satellite markets.

These 18 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

MDA Space Investment Narrative Recap

To be a shareholder in MDA Space, you need to believe in the company’s ability to secure and execute large, high-value contracts in the space sector while managing costs from ongoing capital investments. The recently announced EchoStar direct-to-device constellation contract stands out as a key short-term catalyst, potentially supporting revenue visibility and reducing reliance on legacy projects, while the main risk now shifts toward execution on this substantial new contract and the company’s ability to maintain margin discipline amid sustained capital expenditures.

Of the latest announcements, the EchoStar contract is most relevant. This agreement, valued at over US$1.3 billion, not only expands MDA Space’s order backlog but also marks a major step into the rapidly scaling direct-to-device satellite connectivity market, giving the business increased visibility and momentum behind its satellite technology platform. The same contract, however, amplifies the execution risk that comes with successfully delivering hundreds of satellites on schedule and on budget.

In contrast, before considering gains, investors should also be aware of the substantial execution risk tied to…

Read the full narrative on MDA Space (it's free!)

MDA Space's narrative projects CA$2.2 billion revenue and CA$208.4 million earnings by 2028. This requires 22.1% yearly revenue growth and a CA$109.9 million earnings increase from CA$98.5 million today.

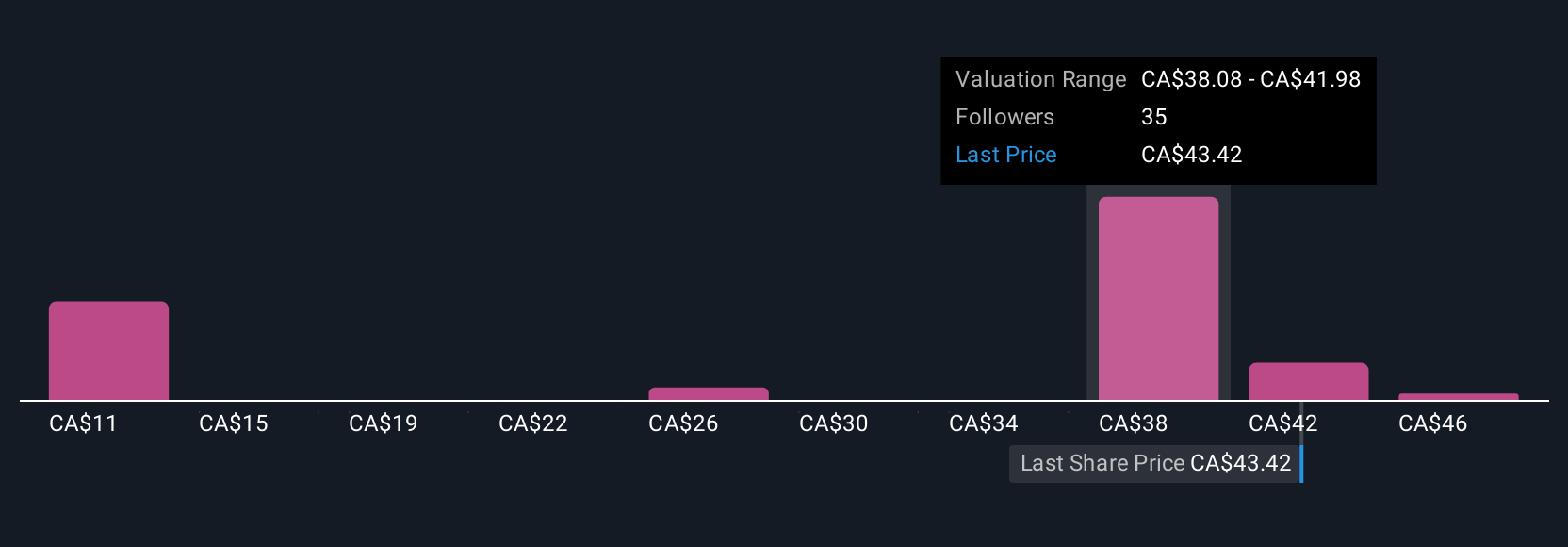

Uncover how MDA Space's forecasts yield a CA$38.81 fair value, a 15% downside to its current price.

Exploring Other Perspectives

Eleven fair value estimates from the Simply Wall St Community range from CA$19.40 to CA$49.78 per share. As you weigh these differing perspectives, consider that successful delivery on new contracts like EchoStar’s could materially impact future returns.

Explore 11 other fair value estimates on MDA Space - why the stock might be worth less than half the current price!

Build Your Own MDA Space Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MDA Space research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MDA Space research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MDA Space's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 21 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MDA

MDA Space

Provides space technology solutions and in Canada, the United States, Europe, Asia, the Middle East, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives