- Canada

- /

- Metals and Mining

- /

- TSXV:GPG

Kelso Technologies And 2 Other TSX Penny Stocks To Watch

Reviewed by Simply Wall St

The Canadian market is navigating a complex landscape, with the Bank of Canada cutting rates amid tariff uncertainties and a recent contraction in GDP, while the U.S. economy continues to show resilience. In such times, investors often seek opportunities in areas that offer potential for growth at lower price points. Penny stocks, despite their outdated name, represent a unique investment opportunity by focusing on smaller or newer companies that may possess strong financial foundations and the potential for significant returns.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$5.00 | CA$184.62M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.73 | CA$1.02B | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.68 | CA$440.43M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.38 | CA$122.01M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.36 | CA$236.24M | ★★★★★☆ |

| PetroTal (TSX:TAL) | CA$0.70 | CA$619.87M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.50 | CA$15.18M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.00 | CA$26.86M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$1.01 | CA$140.31M | ★★★★★☆ |

Click here to see the full list of 933 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Kelso Technologies (TSX:KLS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Kelso Technologies Inc. is involved in the development, production, and distribution of proprietary transportation equipment in the United States and Canada, with a market cap of CA$9.38 million.

Operations: The company generates revenue of $11.14 million from the design, production, and distribution of various proprietary products for the rail sector.

Market Cap: CA$9.38M

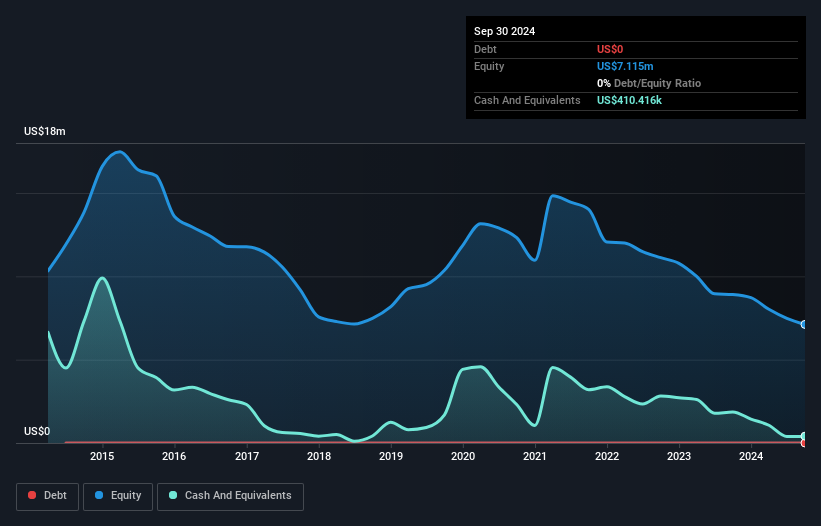

Kelso Technologies Inc., with a market cap of CA$9.38 million, generates US$11.14 million in revenue from its proprietary rail sector products. Despite being debt-free and having short-term assets exceeding liabilities, the company faces challenges with less than a year of cash runway and high share price volatility. The management team is relatively new, averaging 0.6 years in tenure, contrasting with an experienced board averaging 8.6 years. Kelso's unprofitability and negative return on equity (-24.89%) highlight financial difficulties as earnings have declined by 39.4% annually over the past five years without meaningful shareholder dilution recently.

- Navigate through the intricacies of Kelso Technologies with our comprehensive balance sheet health report here.

- Examine Kelso Technologies' past performance report to understand how it has performed in prior years.

Grande Portage Resources (TSXV:GPG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Grande Portage Resources Ltd. is an exploration stage company focused on exploring and developing natural resource properties in the United States, with a market capitalization of CA$25.21 million.

Operations: Grande Portage Resources Ltd. has not reported any revenue segments as it is currently in the exploration stage, focusing on developing natural resource properties in the United States.

Market Cap: CA$25.21M

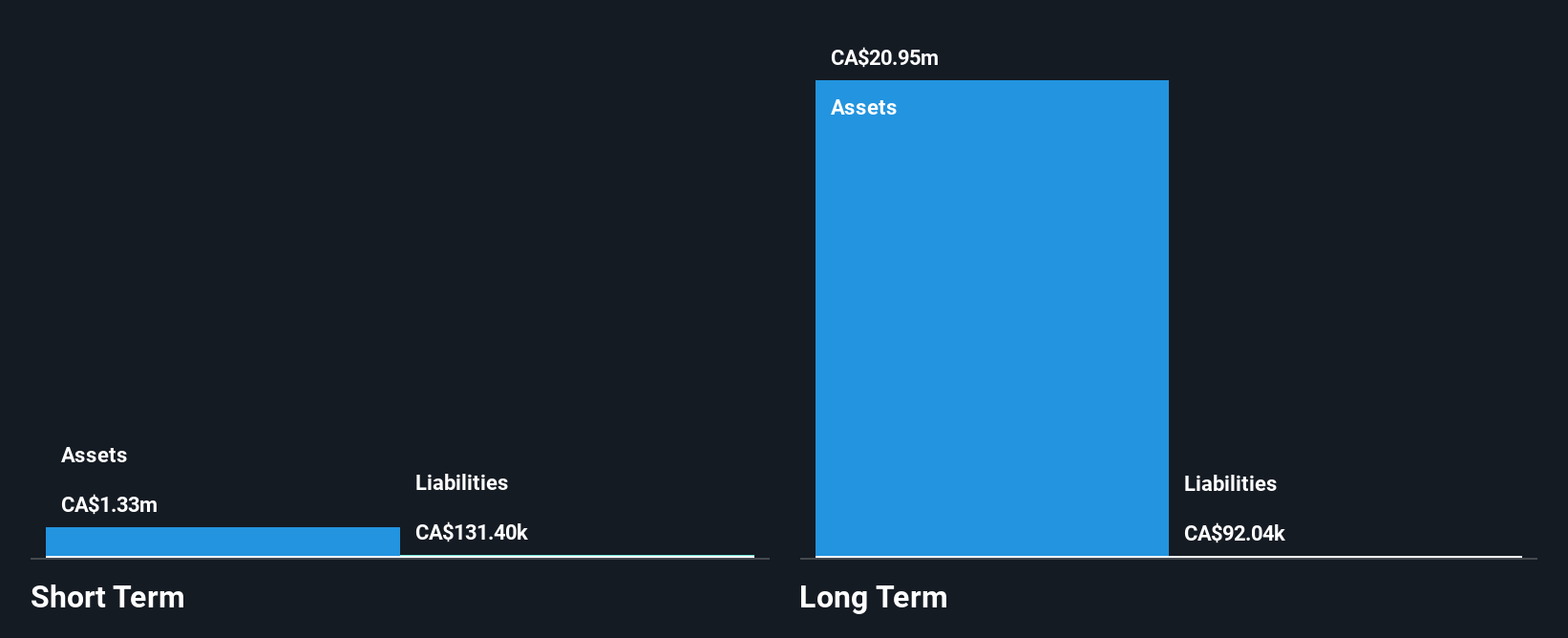

Grande Portage Resources Ltd., with a market cap of CA$25.21 million, is pre-revenue and focused on mineral exploration in the U.S. The company's seasoned management and board contribute to its strategic direction, though it remains unprofitable with increasing losses over five years. GPG's recent private placement has bolstered its financial position despite high share price volatility and insufficient short-term asset coverage for liabilities. Its 2025 exploration plan at New Amalga Mine aims to expand mineral resources through extensive diamond drilling, pending regulatory approval, highlighting potential growth opportunities amidst financial challenges typical of penny stocks in the mining sector.

- Dive into the specifics of Grande Portage Resources here with our thorough balance sheet health report.

- Learn about Grande Portage Resources' historical performance here.

Mongolia Growth Group (TSXV:YAK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Mongolia Growth Group Ltd. functions as a merchant bank with real estate investments in Mongolia and has a market cap of CA$33.76 million.

Operations: The company's revenue is primarily derived from Subscription Products, generating CA$2.72 million, with an additional CA$0.11 million from Corporate activities.

Market Cap: CA$33.76M

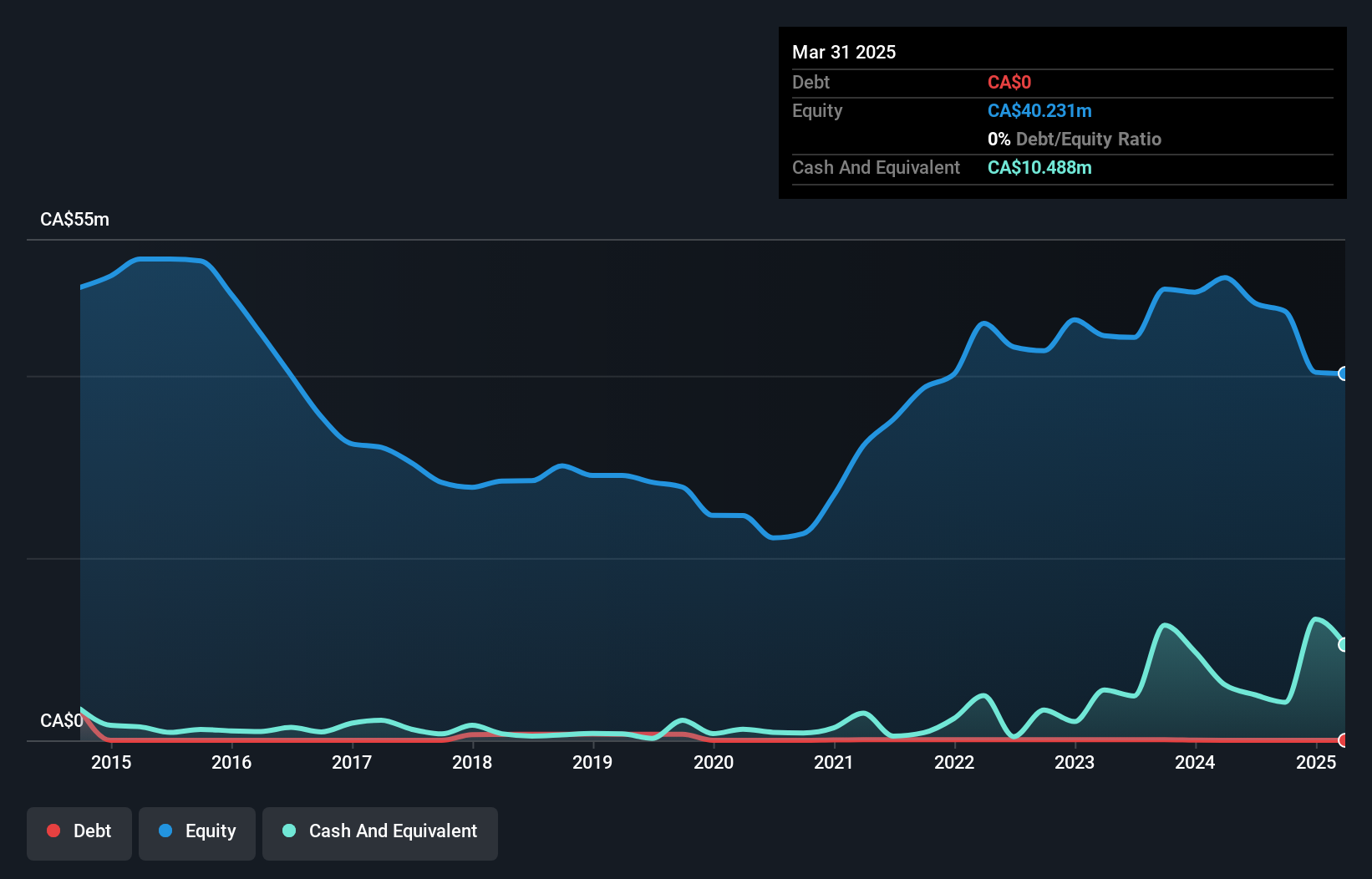

Mongolia Growth Group Ltd., with a market cap of CA$33.76 million, operates in real estate investments in Mongolia and is currently pre-revenue, generating CA$3 million primarily from Subscription Products. The company remains unprofitable but has reduced its losses over the past five years by 16.8% annually. Despite a net loss of CA$0.61 million for the nine months ending September 2024, it benefits from having no debt and strong asset coverage over liabilities, indicating financial stability amidst challenges typical of penny stocks. Its seasoned board adds strategic value while maintaining stable weekly volatility at 5%.

- Take a closer look at Mongolia Growth Group's potential here in our financial health report.

- Assess Mongolia Growth Group's previous results with our detailed historical performance reports.

Key Takeaways

- Take a closer look at our TSX Penny Stocks list of 933 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:GPG

Grande Portage Resources

An exploration stage company, explores for, and develops natural resource properties in the United States.

Flawless balance sheet slight.

Market Insights

Community Narratives