- Canada

- /

- Trade Distributors

- /

- TSX:FTT

Why Finning International (TSX:FTT) Is Up 5.4% After Strong Q3 Results and Boosted Shareholder Returns

Reviewed by Sasha Jovanovic

- Finning International Inc. recently announced its third-quarter 2025 results, reporting revenue of C$2.84 billion, net income of C$154 million, higher year-over-year earnings per share, a quarterly dividend of C$0.3025 per share, and an update on its share buyback program.

- The company outperformed analyst expectations, delivering significant growth in revenue and profitability while reinforcing ongoing shareholder returns through both dividends and share repurchases.

- We'll explore how Finning International's strong earnings growth and shareholder-friendly actions influence its long-term investment outlook.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Finning International Investment Narrative Recap

To be a Finning International shareholder, you need to believe in the company's ability to convert its robust order backlog and strong industrial demand across mining, construction, and power systems into ongoing earnings growth. The latest results affirm top-line and margin strength, but while this significantly boosts confidence in execution and cash flow, it doesn’t materially alter the key short-term risk: that high working capital or slower equipment utilization in core geographies could constrain free cash flow and limit near-term flexibility.

Among the recent announcements, the update on Finning's share buyback program stands out as directly relevant to the strong quarterly results. Accelerated share repurchases following earnings outperformance highlight ongoing capital returns, but also underscore management’s confidence in sustaining profitable growth and offsetting possible inventory or margin challenges as order backlogs are gradually realized.

However, investors should be aware that despite recent margin gains, persistent working capital build-up, especially if equipment utilization trends soften, could still ...

Read the full narrative on Finning International (it's free!)

Finning International's narrative projects CA$10.6 billion revenue and CA$700.0 million earnings by 2028. This requires a 2.4% annual revenue decline and a CA$175.0 million increase in earnings from the current CA$525.0 million.

Uncover how Finning International's forecasts yield a CA$70.89 fair value, a 9% downside to its current price.

Exploring Other Perspectives

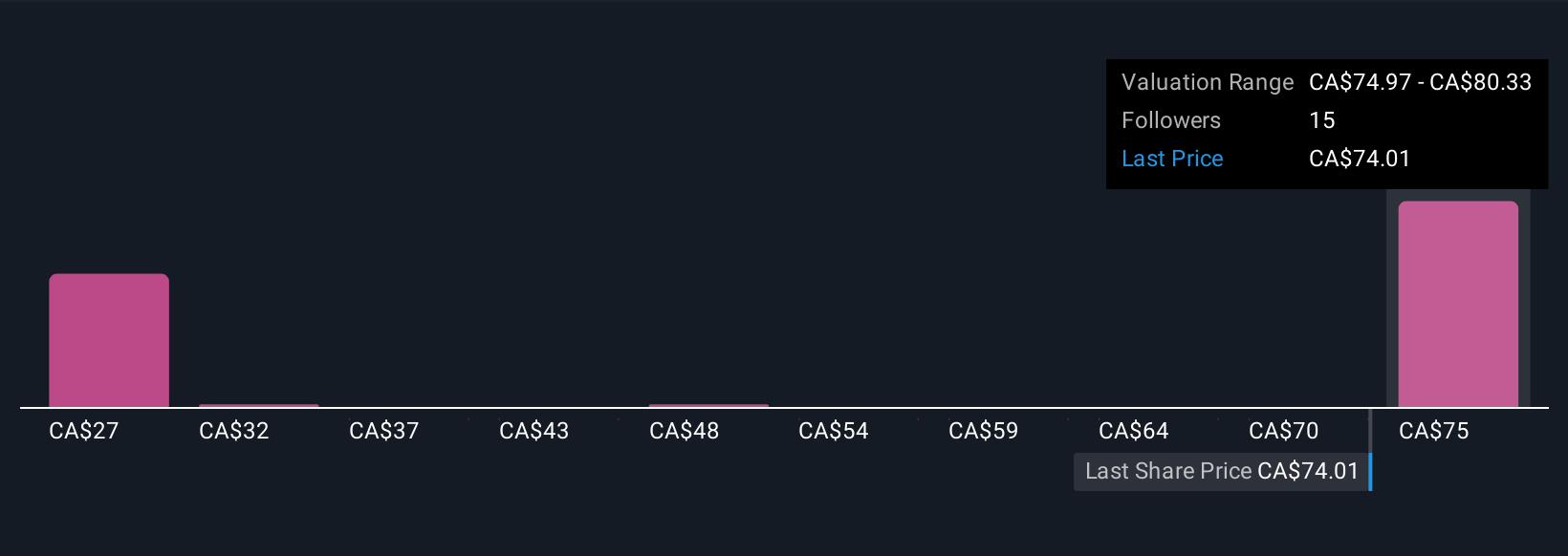

Five members of the Simply Wall St Community have fair value estimates for Finning International ranging from C$32 to C$92.30 per share. While many see opportunity in the C$3 billion equipment backlog, some caution that high inventory levels and volatile used equipment demand could present near-term challenges for maintaining this momentum, giving you several perspectives to consider.

Explore 5 other fair value estimates on Finning International - why the stock might be worth as much as 19% more than the current price!

Build Your Own Finning International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Finning International research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Finning International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Finning International's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FTT

Finning International

Sells, services, and rents heavy equipment, engines, and related products in Canada, Chile, the United Kingdom, Argentina, and internationally.

Outstanding track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives