- Canada

- /

- Trade Distributors

- /

- TSX:FTT

Should You Be Adding Finning International (TSE:FTT) To Your Watchlist Today?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Finning International (TSE:FTT). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Finning International

How Quickly Is Finning International Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That means EPS growth is considered a real positive by most successful long-term investors. It certainly is nice to see that Finning International has managed to grow EPS by 32% per year over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

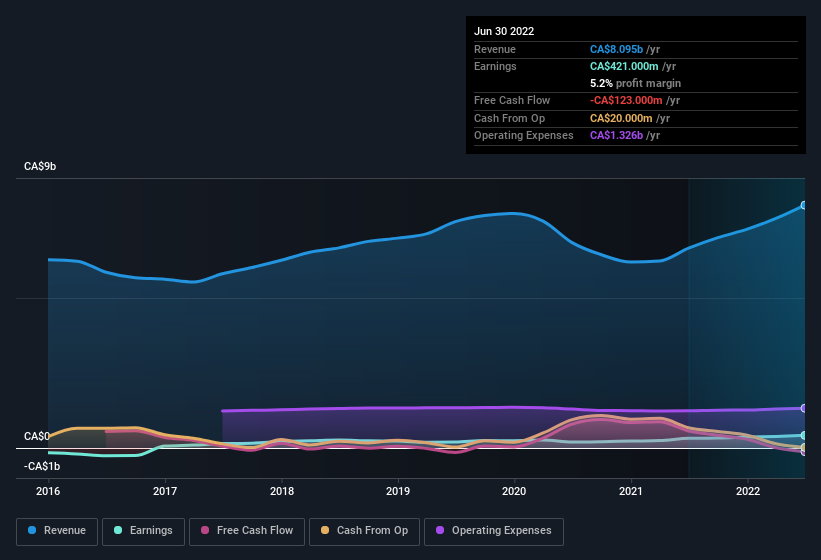

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. EBIT margins for Finning International remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 22% to CA$8.1b. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Finning International.

Are Finning International Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

While Finning International insiders did net CA$293k selling stock over the last year, they invested CA$685k, a much higher figure. This overall confidence in the company at current the valuation signals their optimism. It is also worth noting that it was Independent Chairman of the Board Harold Kvisle who made the biggest single purchase, worth CA$164k, paying CA$32.80 per share.

Along with the insider buying, another encouraging sign for Finning International is that insiders, as a group, have a considerable shareholding. To be specific, they have CA$17m worth of shares. That's a lot of money, and no small incentive to work hard. Despite being just 0.4% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Is Finning International Worth Keeping An Eye On?

You can't deny that Finning International has grown its earnings per share at a very impressive rate. That's attractive. Furthermore, company insiders have been adding to their significant stake in the company. Astute investors will want to keep this stock on watch. Still, you should learn about the 2 warning signs we've spotted with Finning International (including 1 which shouldn't be ignored).

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Finning International, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:FTT

Finning International

Sells, services, and rents heavy equipment, engines, and related products in Canada, Chile, the United Kingdom, Argentina, and internationally.

Outstanding track record average dividend payer.

Similar Companies

Market Insights

Community Narratives