- Canada

- /

- Trade Distributors

- /

- TSX:FTT

It Might Be Better To Avoid Finning International Inc.'s (TSE:FTT) Upcoming 0.8% Dividend

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Finning International Inc. (TSE:FTT) is about to go ex-dividend in just 4 days. This means that investors who purchase shares on or after the 20th of November will not receive the dividend, which will be paid on the 5th of December.

Finning International's next dividend payment will be CA$0.20 per share. Last year, in total, the company distributed CA$0.82 to shareholders. Based on the last year's worth of payments, Finning International has a trailing yield of 3.4% on the current stock price of CA$24.47. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to check whether the dividend payments are covered, and if earnings are growing.

View our latest analysis for Finning International

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Finning International is paying out an acceptable 54% of its profit, a common payout level among most companies. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. Over the past year it paid out 200% of its free cash flow as dividends, which is uncomfortably high. It's hard to consistently pay out more cash than you generate without either borrowing or using company cash, so we'd wonder how the company justifies this payout level.

While Finning International's dividends were covered by the company's reported profits, cash is somewhat more important, so it's not great to see that the company didn't generate enough cash to pay its dividend. Cash is king, as they say, and were Finning International to repeatedly pay dividends that aren't well covered by cashflow, we would consider this a warning sign.

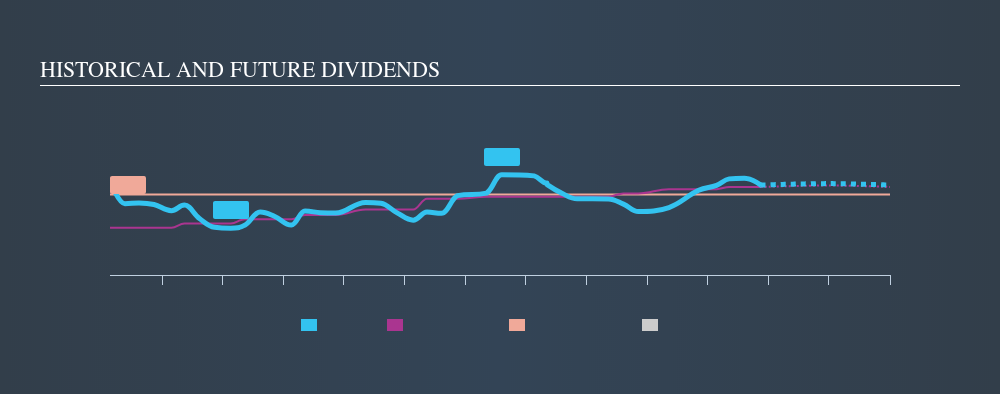

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. If earnings fall far enough, the company could be forced to cut its dividend. Readers will understand then, why we're concerned to see Finning International's earnings per share have dropped 5.1% a year over the past five years. Such a sharp decline casts doubt on the future sustainability of the dividend.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. In the past ten years, Finning International has increased its dividend at approximately 6.4% a year on average. Growing the dividend payout ratio while earnings are declining can deliver nice returns for a while, but it's always worth checking for when the company can't increase the payout ratio any more - because then the music stops.

Final Takeaway

Is Finning International worth buying for its dividend? It's definitely not great to see earnings per share shrinking. The company paid out an acceptable percentage of its income, but an uncomfortably high percentage of its cash flow over the past year. With the way things are shaping up from a dividend perspective, we'd be inclined to steer clear of Finning International.

Curious what other investors think of Finning International? See what analysts are forecasting, with this visualisation of its historical and future estimated earnings and cash flow.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:FTT

Finning International

Sells, services, and rents heavy equipment, engines, and related products in Canada, Chile, the United Kingdom, Argentina, and internationally.

Outstanding track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026