- Canada

- /

- Trade Distributors

- /

- TSX:FTT

Here's Why We Think Finning International (TSE:FTT) Is Well Worth Watching

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Finning International (TSE:FTT). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Finning International

How Quickly Is Finning International Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Recognition must be given to the that Finning International has grown EPS by 48% per year, over the last three years. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

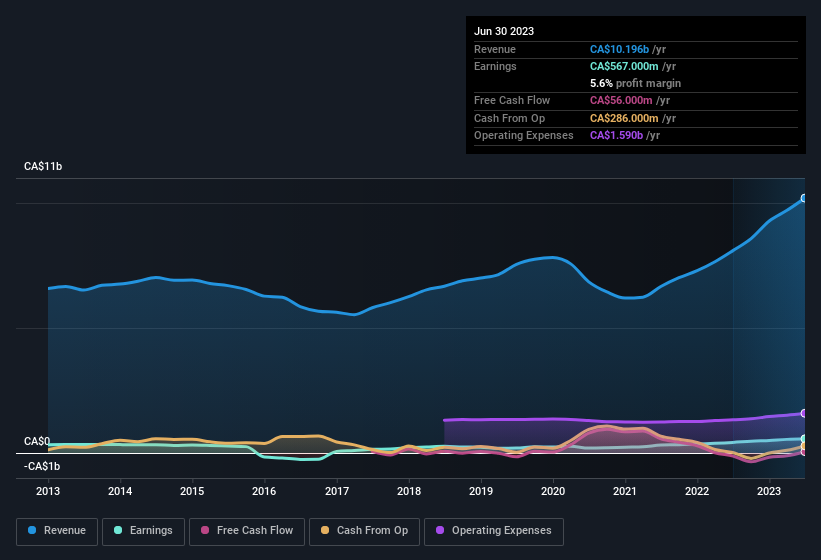

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. EBIT margins for Finning International remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 26% to CA$10b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Finning International's future EPS 100% free.

Are Finning International Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

In the last year insider at Finning International were both selling and buying shares; but happily, as a group they spent CA$105k more on stock, than they netted from selling it. Although some people may hesitate due to the share sales, the fact that insiders bought more than they sold, is a positive thing to note. We also note that it was the President of Finning Canada, David F. Primrose, who made the biggest single acquisition, paying CA$232k for shares at about CA$44.00 each.

It's commendable to see that insiders have been buying shares in Finning International, but there is more evidence of shareholder friendly management. Specifically, the CEO is paid quite reasonably for a company of this size. The median total compensation for CEOs of companies similar in size to Finning International, with market caps between CA$2.8b and CA$8.9b, is around CA$4.7m.

The Finning International CEO received CA$2.5m in compensation for the year ending December 2022. That is actually below the median for CEO's of similarly sized companies. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Does Finning International Deserve A Spot On Your Watchlist?

Finning International's earnings per share have been soaring, with growth rates sky high. The company can also boast of insider buying, and reasonable remuneration for the CEO. It could be that Finning International is at an inflection point, given the EPS growth. If so, then its potential for further gains probably merit a spot on your watchlist. You should always think about risks though. Case in point, we've spotted 3 warning signs for Finning International you should be aware of, and 1 of them is a bit unpleasant.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Finning International, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:FTT

Finning International

Sells, services, and rents heavy equipment, engines, and related products in Canada, Chile, the United Kingdom, Argentina, and internationally.

Outstanding track record average dividend payer.

Similar Companies

Market Insights

Community Narratives