- Canada

- /

- Electrical

- /

- TSX:ELVA

Electrovaya Inc. (TSE:ELVA) Stock Rockets 26% But Many Are Still Ignoring The Company

Electrovaya Inc. (TSE:ELVA) shares have continued their recent momentum with a 26% gain in the last month alone. Unfortunately, despite the strong performance over the last month, the full year gain of 8.4% isn't as attractive.

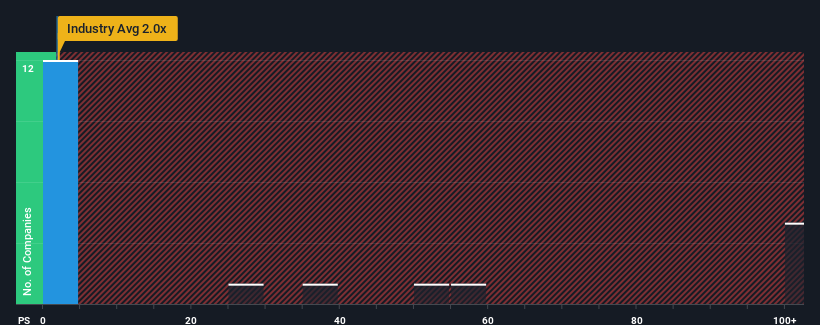

Although its price has surged higher, Electrovaya may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.8x, since almost half of all companies in the Electrical industry in Canada have P/S ratios greater than 4.1x and even P/S higher than 241x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Check out our latest analysis for Electrovaya

How Electrovaya Has Been Performing

Electrovaya could be doing better as it's been growing revenue less than most other companies lately. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Electrovaya will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Electrovaya would need to produce anemic growth that's substantially trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 45% last year. The strong recent performance means it was also able to grow revenue by 245% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 57% per annum as estimated by the five analysts watching the company. With the industry only predicted to deliver 18% per year, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that Electrovaya's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Electrovaya's P/S

Shares in Electrovaya have risen appreciably however, its P/S is still subdued. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Electrovaya's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Electrovaya (1 shouldn't be ignored!) that you should be aware of before investing here.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Electrovaya might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:ELVA

Electrovaya

Engages in the design, development, manufacture, and sale of lithium-ion batteries, battery management systems, and battery-related products for energy storage, clean electric transportation, and other specialized applications in North America.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success