- Canada

- /

- Trade Distributors

- /

- TSX:E

Enterprise Group, Inc.'s (TSE:E) Share Price Boosted 27% But Its Business Prospects Need A Lift Too

The Enterprise Group, Inc. (TSE:E) share price has done very well over the last month, posting an excellent gain of 27%. The last month tops off a massive increase of 163% in the last year.

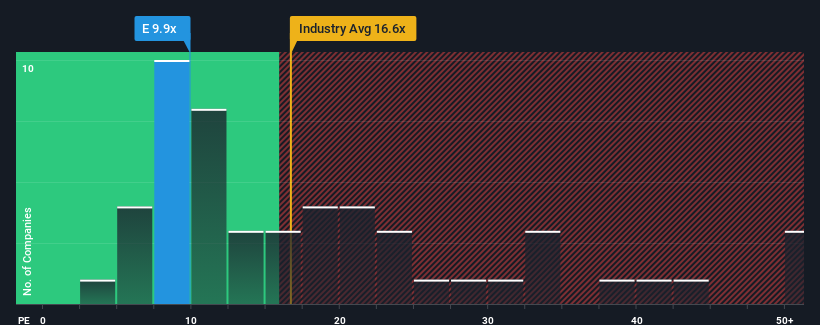

Although its price has surged higher, given about half the companies in Canada have price-to-earnings ratios (or "P/E's") above 14x, you may still consider Enterprise Group as an attractive investment with its 9.9x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Enterprise Group certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Enterprise Group

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Enterprise Group's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered an exceptional 166% gain to the company's bottom line. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the one analyst covering the company suggest earnings growth is heading into negative territory, declining 2.7% over the next year. With the market predicted to deliver 18% growth , that's a disappointing outcome.

With this information, we are not surprised that Enterprise Group is trading at a P/E lower than the market. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

The latest share price surge wasn't enough to lift Enterprise Group's P/E close to the market median. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Enterprise Group's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Having said that, be aware Enterprise Group is showing 3 warning signs in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on Enterprise Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Enterprise Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:E

Enterprise Group

Through its subsidiaries, operates as an equipment rental and construction services company in Canada.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.