- Canada

- /

- Trade Distributors

- /

- TSX:E

Enterprise Group, Inc. (TSE:E) Shares Slammed 26% But Getting In Cheap Might Be Difficult Regardless

Enterprise Group, Inc. (TSE:E) shares have retraced a considerable 26% in the last month, reversing a fair amount of their solid recent performance. The good news is that in the last year, the stock has shone bright like a diamond, gaining 139%.

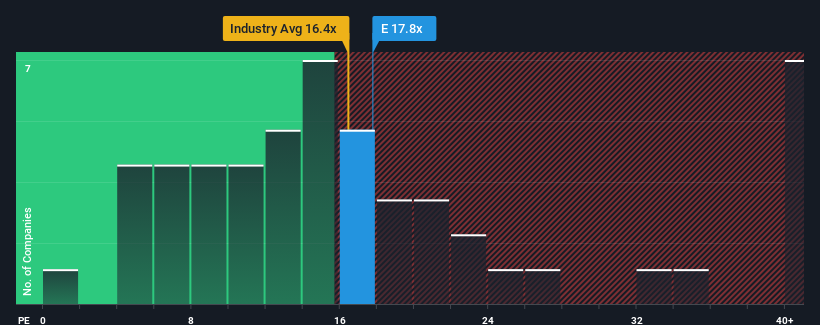

In spite of the heavy fall in price, given around half the companies in Canada have price-to-earnings ratios (or "P/E's") below 14x, you may still consider Enterprise Group as a stock to potentially avoid with its 17.8x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

The recently shrinking earnings for Enterprise Group have been in line with the market. One possibility is that the P/E is high because investors think the company can turn things around and break free from the broader downward trend in earnings. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Enterprise Group

Is There Enough Growth For Enterprise Group?

In order to justify its P/E ratio, Enterprise Group would need to produce impressive growth in excess of the market.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. The longer-term trend has been no better as the company has no earnings growth to show for over the last three years either. Therefore, it's fair to say that earnings growth has definitely eluded the company recently.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 62% over the next year. Meanwhile, the rest of the market is forecast to only expand by 23%, which is noticeably less attractive.

In light of this, it's understandable that Enterprise Group's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Enterprise Group's P/E

There's still some solid strength behind Enterprise Group's P/E, if not its share price lately. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Enterprise Group's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Before you settle on your opinion, we've discovered 3 warning signs for Enterprise Group that you should be aware of.

If these risks are making you reconsider your opinion on Enterprise Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Enterprise Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:E

Enterprise Group

Through its subsidiaries, operates as an equipment rental and construction services company in Canada.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.