- Canada

- /

- Trade Distributors

- /

- TSX:DBM

If You Had Bought CanWel Building Materials Group Stock A Year Ago, You'd Be Sitting On A 24% Loss, Today

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. Investors in CanWel Building Materials Group Ltd. (TSE:CWX) have tasted that bitter downside in the last year, as the share price dropped 24%. That falls noticeably short of the market return of around 4.4%. On the bright side, the stock is actually up 9.3% in the last three years.

Check out our latest analysis for CanWel Building Materials Group

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Even though the CanWel Building Materials Group share price is down over the year, its EPS actually improved. It could be that the share price was previously over-hyped. It seems quite likely that the market was expecting higher growth from the stock. But looking to other metrics might better explain the share price change.

We don't see any weakness in the CanWel Building Materials Group's dividend so the steady payout can't really explain the share price drop. From what we can see, revenue is pretty flat, so that doesn't really explain the share price drop. Unless, of course, the market was expecting a revenue uptick.

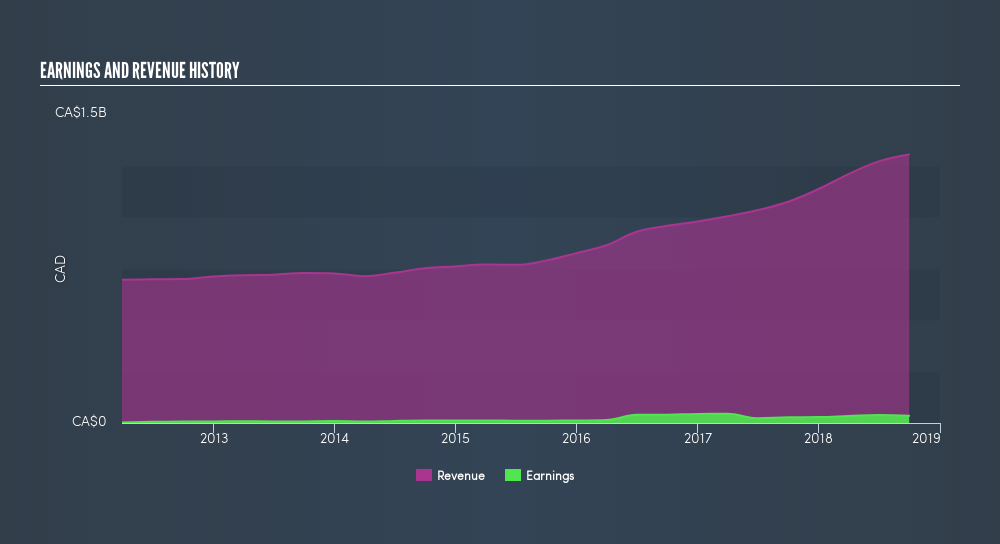

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. If you are thinking of buying or selling CanWel Building Materials Group stock, you should check out this freereport showing analyst profit forecasts.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, CanWel Building Materials Group's TSR for the last year was -17%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While the broader market gained around 4.4% in the last year, CanWel Building Materials Group shareholders lost 17% (even including dividends). Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 6.0%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

CanWel Building Materials Group is not the only stock that insiders are buying. For those who like to find winning investments this freelist of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:DBM

Doman Building Materials Group

Through its subsidiaries, engages in the wholesale distribution of building materials and home renovation products in the United States and Canada.

Undervalued average dividend payer.

Market Insights

Community Narratives