- Canada

- /

- Construction

- /

- TSX:BDT

How Investors May Respond To Bird Construction (TSX:BDT) Securing CA$1.2 Billion In New Industrial Contracts

Reviewed by Sasha Jovanovic

- Earlier this year, Bird Construction Inc. announced it had secured multiple project awards and agreements worth about CA$1.20 billion, including a new five-year master service agreement for complex mechanical work with a major Oil and Gas client and additional work at BHP’s Jansen potash project.

- The news highlights how Bird’s 2024 acquisition of NorCan Electric is already supporting higher-value recurring industrial service work and deepening its role on large Canadian resource projects.

- Now we’ll examine how these sizable new awards and recurring industrial contracts may influence Bird Construction’s existing investment narrative and risk profile.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Bird Construction Investment Narrative Recap

To own Bird Construction, you need to believe the company can keep converting a record backlog and recurring contracts into dependable earnings, despite cyclical swings in Canadian construction and resources. The new CA$1.20 billion in awards, including a five year mechanical MSA and more work at Jansen, modestly supports the key short term catalyst of backlog quality, while also slightly easing concerns about project deferrals and underused capacity, but macro and sector specific slowdown risks still matter.

Among recent announcements, the multi hundred million dollar awards disclosed on 21 May 2025 are most relevant here, as they also spanned federal labs, seniors housing and mining infrastructure. Taken together with the latest CA$1.20 billion in industrial and resource focused work, they underline how Bird’s pipeline is increasingly anchored by larger collaborative contracts and recurring maintenance agreements, which can help offset lumpier buildings revenue but still leave the company exposed if clients delay or scale back major projects.

Yet behind these sizeable wins, there is still a risk investors should be aware of if long term capital projects are pushed out or...

Read the full narrative on Bird Construction (it's free!)

Bird Construction's narrative projects CA$4.6 billion revenue and CA$257.8 million earnings by 2028. This requires 10.6% yearly revenue growth and about a CA$159.4 million earnings increase from CA$98.4 million today.

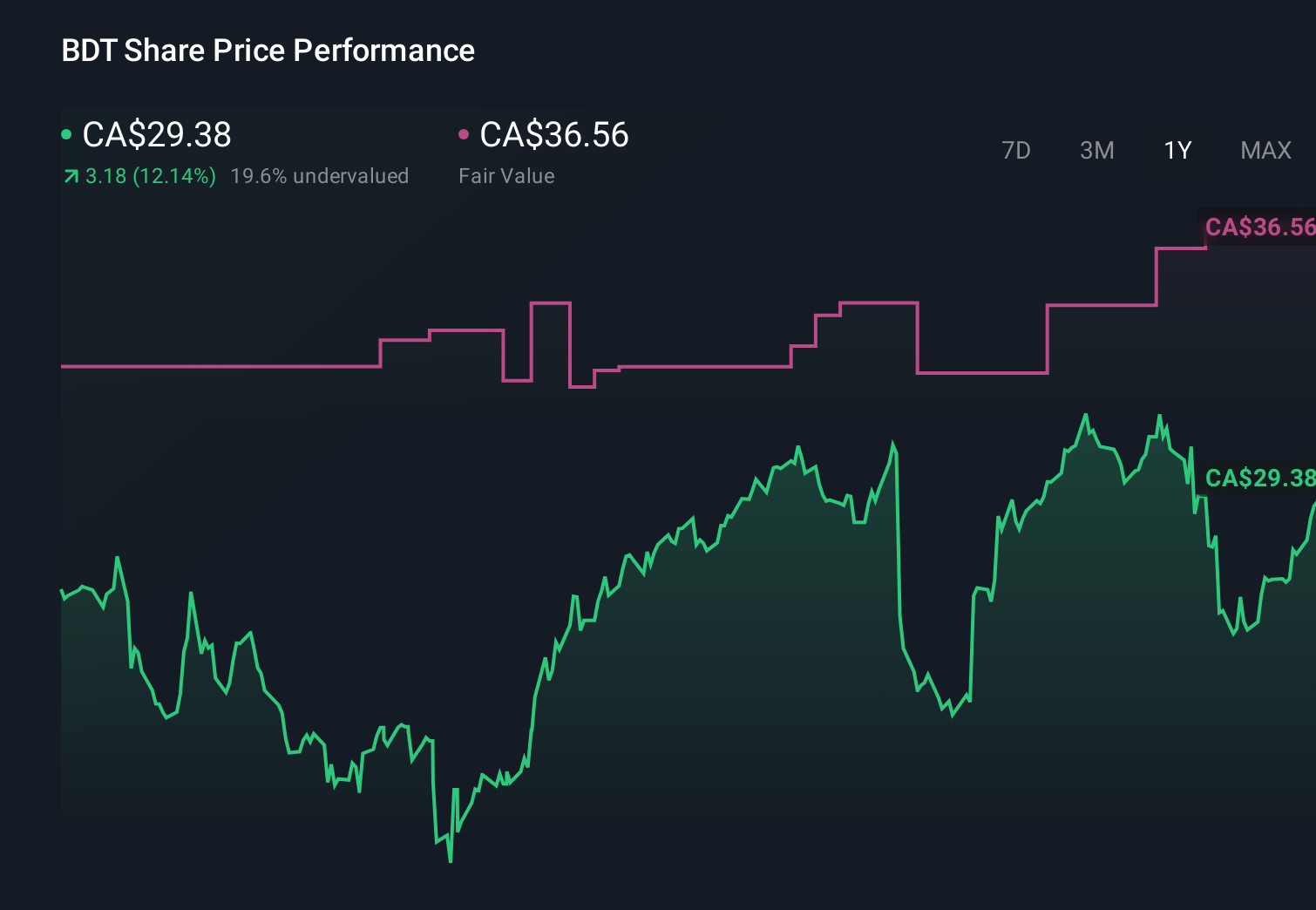

Uncover how Bird Construction's forecasts yield a CA$36.56 fair value, a 30% upside to its current price.

Exploring Other Perspectives

Fourteen members of the Simply Wall St Community currently place Bird’s fair value between CA$28.60 and CA$90.63, reflecting a wide spread of opinions. Against this, the growing share of recurring master service agreements in Bird’s backlog may reassure some readers about earnings resilience if larger project awards slow, so it is worth comparing several of these viewpoints before forming a view.

Explore 14 other fair value estimates on Bird Construction - why the stock might be worth just CA$28.60!

Build Your Own Bird Construction Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bird Construction research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Bird Construction research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bird Construction's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Bird Construction might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BDT

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion