- Canada

- /

- Construction

- /

- TSX:BDT

Bird Construction's (TSE:BDT) Shareholders Will Receive A Bigger Dividend Than Last Year

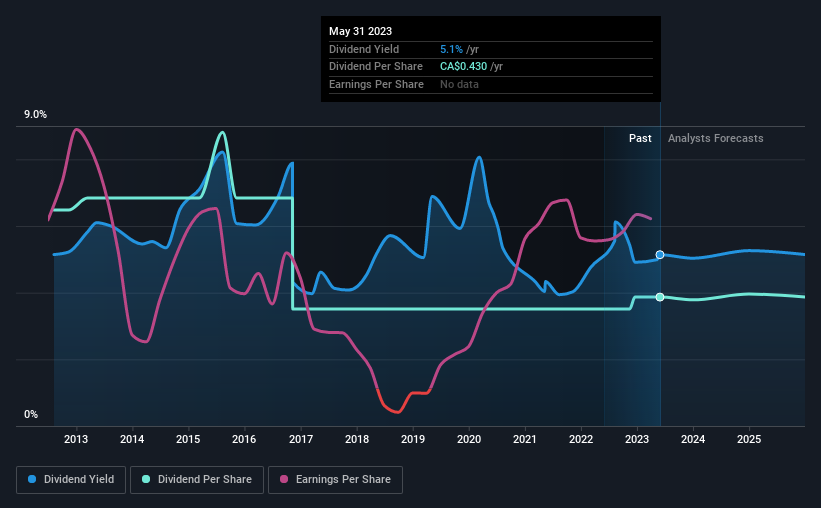

Bird Construction Inc.'s (TSE:BDT) periodic dividend will be increasing on the 20th of July to CA$0.0358, with investors receiving 10% more than last year's CA$0.0325. This will take the annual payment to 5.1% of the stock price, which is above what most companies in the industry pay.

See our latest analysis for Bird Construction

Bird Construction's Payment Has Solid Earnings Coverage

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Based on the last payment, Bird Construction's earnings were much higher than the dividend, but it wasn't converting those earnings into cash flow. No cash flows could definitely make returning cash to shareholders difficult, or at least mean the balance sheet will come under pressure.

The next year is set to see EPS grow by 54.1%. If the dividend continues along recent trends, we estimate the payout ratio will be 26%, which is in the range that makes us comfortable with the sustainability of the dividend.

Bird Construction's Track Record Isn't Great

The dividend hasn't seen any major cuts in the last 10 years, but it has slowly been decreasing. Since 2013, the dividend has gone from CA$0.72 total annually to CA$0.43. The dividend has shrunk at around 5.0% a year during that period. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

The Dividend Looks Likely To Grow

Given that the track record hasn't been stellar, we really want to see earnings per share growing over time. It's encouraging to see that Bird Construction has been growing its earnings per share at 53% a year over the past five years. The company's earnings per share has grown rapidly in recent years, and it has a good balance between reinvesting and paying dividends to shareholders, so we think that Bird Construction could prove to be a strong dividend payer.

In Summary

In summary, while it's always good to see the dividend being raised, we don't think Bird Construction's payments are rock solid. With cash flows lacking, it is difficult to see how the company can sustain a dividend payment. We would probably look elsewhere for an income investment.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Just as an example, we've come across 2 warning signs for Bird Construction you should be aware of, and 1 of them makes us a bit uncomfortable. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Bird Construction might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:BDT

Very undervalued with flawless balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026