- Canada

- /

- Construction

- /

- TSX:BDGI

Why Badger Infrastructure Solutions (TSX:BDGI) Is Up 7.6% After Announcing a Major Share Buyback Program and What's Next

Reviewed by Simply Wall St

- On August 22, 2025, Badger Infrastructure Solutions Ltd. announced that its Board of Directors had authorized a share repurchase program to buy back up to 2,910,453 shares, or 8.63% of its issued share capital, by August 25, 2026; all repurchased shares will be cancelled.

- This sizable buyback reflects management's intention to return capital to shareholders and could have a direct impact on the company's earnings per share and capital allocation priorities.

- Next, we'll examine how this large-scale buyback program shapes Badger's investment narrative and capital return outlook.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Badger Infrastructure Solutions Investment Narrative Recap

To be a shareholder in Badger Infrastructure Solutions, you need to believe in expanding infrastructure investment across North America, steady demand for hydrovac services, and the company's ability to efficiently scale its fleet and operations. The newly announced buyback may offer incremental support to earnings per share in the short term, but it does not fundamentally change the company's primary catalyst, continued growth in infrastructure project activity, or the biggest current risk, which is rising input costs that could put pressure on margins if not offset by service price adjustments.

The Q2 2025 earnings release is especially relevant, with sales and net income up year-over-year, providing context for Badger's capital return strategy. Consistent earnings growth not only enhances capacity for shareholder returns such as buybacks but also strengthens the case for the company's investment narrative centered on operational efficiency and balance sheet flexibility.

In contrast, investors should also consider the ongoing risk from input cost inflation and how it may impact earnings if Badger cannot adjust its service pricing...

Read the full narrative on Badger Infrastructure Solutions (it's free!)

Badger Infrastructure Solutions is projected to reach $955.0 million in revenue and $105.7 million in earnings by 2028. This outlook assumes annual revenue growth of 7.1% and an increase in earnings of $49.8 million from the current level of $55.9 million.

Uncover how Badger Infrastructure Solutions' forecasts yield a CA$58.64 fair value, in line with its current price.

Exploring Other Perspectives

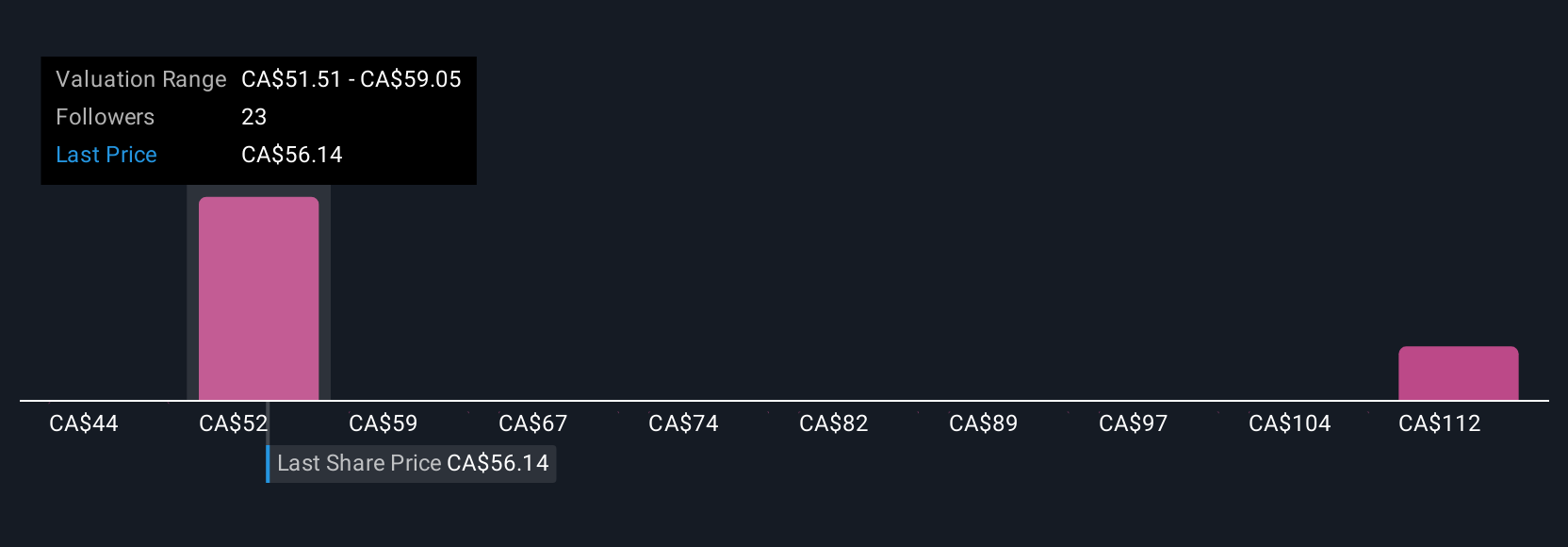

Three Simply Wall St Community fair value estimates for Badger range from CA$43.98 to CA$119.94 per share. Input cost inflation remains a pivotal challenge and could affect performance expectations as infrastructure spending rises, so be sure to compare several viewpoints before making a decision.

Explore 3 other fair value estimates on Badger Infrastructure Solutions - why the stock might be worth over 2x more than the current price!

Build Your Own Badger Infrastructure Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Badger Infrastructure Solutions research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Badger Infrastructure Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Badger Infrastructure Solutions' overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 28 companies in the world exploring or producing it. Find the list for free.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Badger Infrastructure Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BDGI

Badger Infrastructure Solutions

Provides non-destructive excavating and related services in Canada and the United States.

Solid track record and good value.

Market Insights

Community Narratives