- Canada

- /

- Metals and Mining

- /

- TSX:DSV

TSX Value Picks Featuring Badger Infrastructure Solutions And Two More Stocks With Estimated Discounts

Reviewed by Simply Wall St

The Canadian market is currently experiencing subdued growth due to slower consumer spending and population growth, while the U.S. faces uncertainty with interest rates amid economic data disruptions. In this environment, identifying undervalued stocks on the TSX can be an effective strategy for investors seeking potential opportunities, as these stocks may offer value despite broader market challenges.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Topicus.com (TSXV:TOI) | CA$125.74 | CA$228.97 | 45.1% |

| Neo Performance Materials (TSX:NEO) | CA$16.65 | CA$31.92 | 47.8% |

| Lithium Royalty (TSX:LIRC) | CA$6.55 | CA$11.65 | 43.8% |

| Kinaxis (TSX:KXS) | CA$179.62 | CA$294.51 | 39% |

| Haivision Systems (TSX:HAI) | CA$5.06 | CA$8.67 | 41.7% |

| First Majestic Silver (TSX:AG) | CA$17.48 | CA$28.75 | 39.2% |

| Exchange Income (TSX:EIF) | CA$78.63 | CA$130.03 | 39.5% |

| Dexterra Group (TSX:DXT) | CA$11.61 | CA$22.77 | 49% |

| Decisive Dividend (TSXV:DE) | CA$7.13 | CA$14.14 | 49.6% |

| Constellation Software (TSX:CSU) | CA$3396.27 | CA$6012.07 | 43.5% |

Let's uncover some gems from our specialized screener.

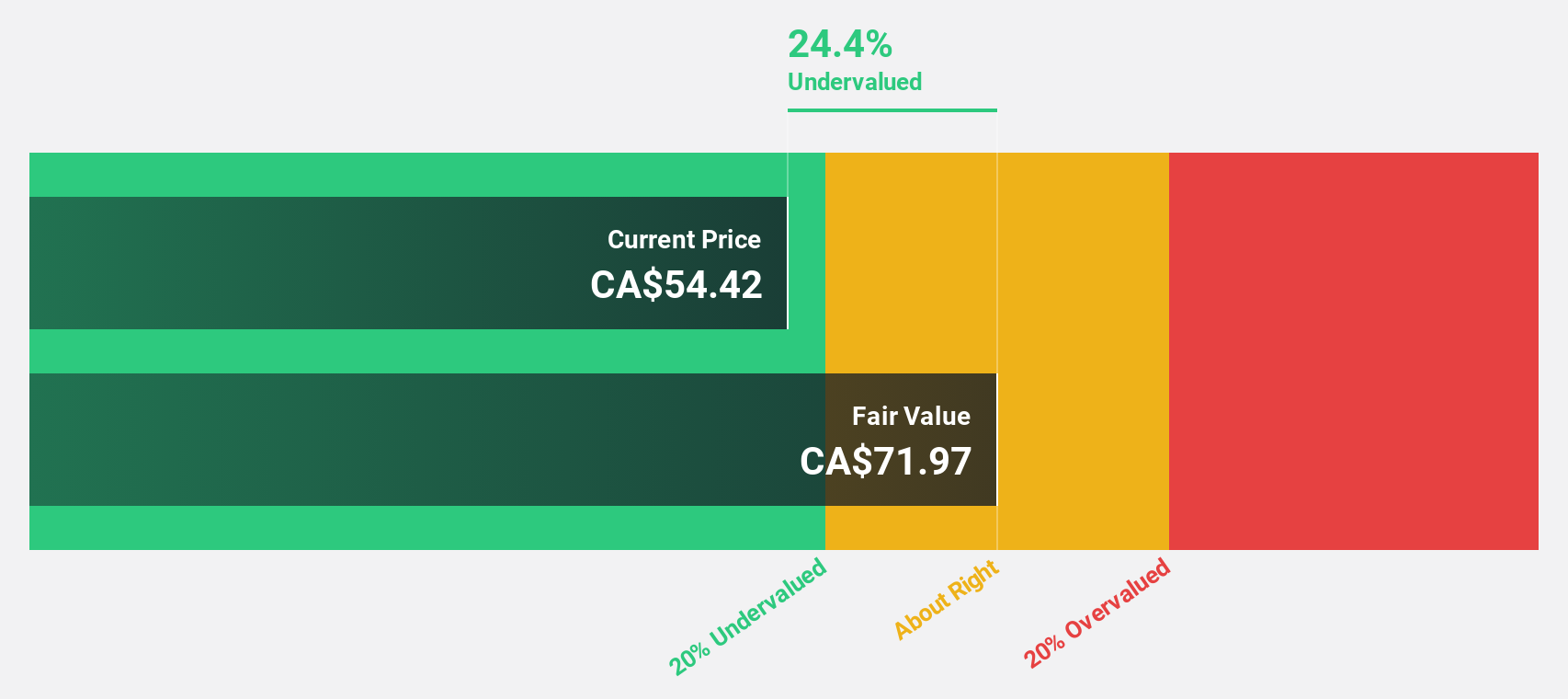

Badger Infrastructure Solutions (TSX:BDGI)

Overview: Badger Infrastructure Solutions Ltd. offers non-destructive excavating and related services across Canada and the United States, with a market cap of CA$2.40 billion.

Operations: The company generates revenue of $805.35 million from its non-destructive excavating and related services in Canada and the United States.

Estimated Discount To Fair Value: 20.2%

Badger Infrastructure Solutions shows potential as an undervalued stock based on cash flows, trading at CA$71.1, below its estimated fair value of CA$89.13. Recent earnings reports highlight robust financial performance with net income rising to US$29.02 million in Q3 2025 from US$23.31 million a year earlier, supporting its expected annual profit growth of 24.3%, outpacing the Canadian market's 11.5%. Despite high debt levels, the company's return on equity is forecasted to reach 25.4%.

- Our expertly prepared growth report on Badger Infrastructure Solutions implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Badger Infrastructure Solutions' balance sheet by reading our health report here.

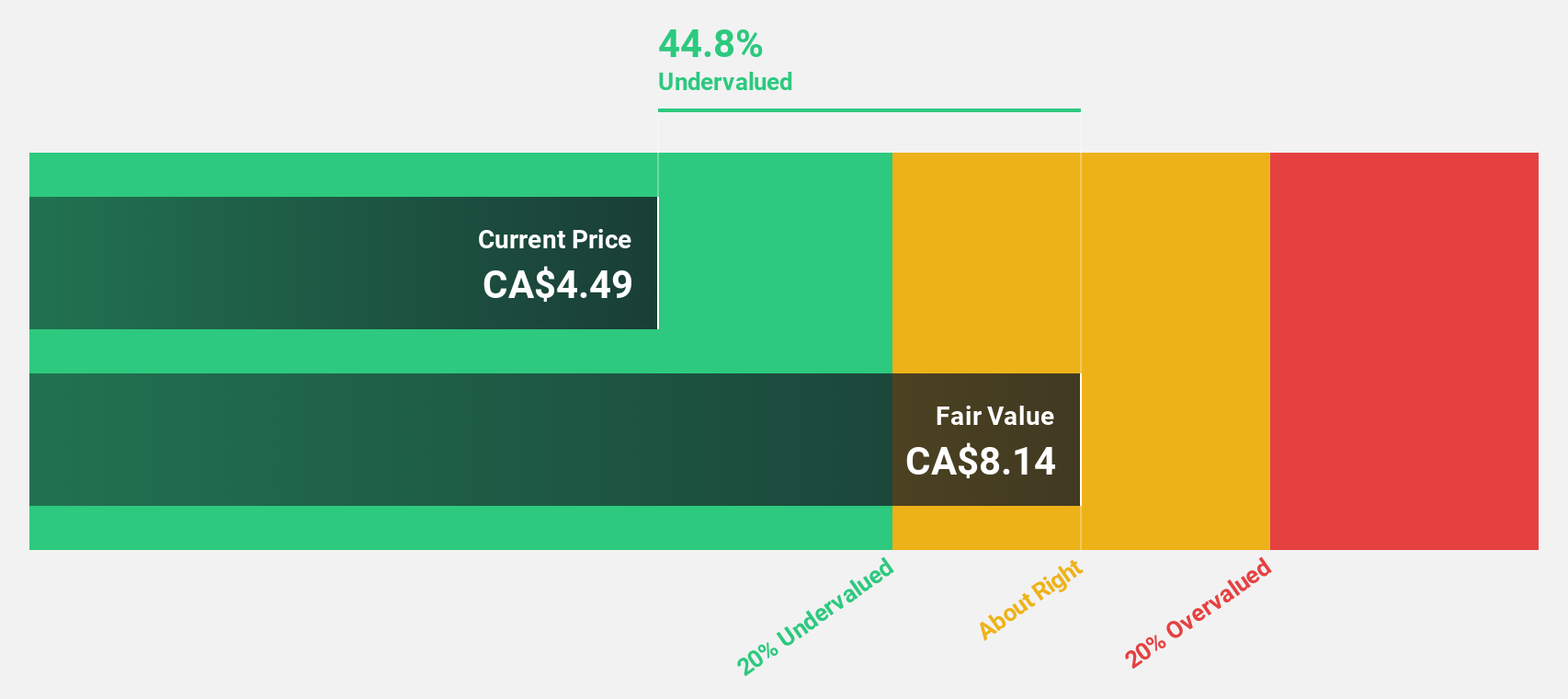

Discovery Silver (TSX:DSV)

Overview: Discovery Silver Corp. is a mineral exploration company focused on acquiring, exploring, and developing mineral properties in Canada with a market cap of CA$5.14 billion.

Operations: Discovery Silver Corp. does not currently report revenue segments in its financial disclosures.

Estimated Discount To Fair Value: 10.3%

Discovery Silver is trading at CA$6.37, slightly below its fair value of CA$7.1, suggesting it may be undervalued based on cash flows. The company's earnings are expected to grow significantly at 69.4% annually, outpacing the Canadian market's growth rate. Despite recent insider selling and shareholder dilution, Discovery Silver has become profitable this year with Q3 net income of US$42.44 million compared to a loss last year, enhancing its investment potential.

- According our earnings growth report, there's an indication that Discovery Silver might be ready to expand.

- Navigate through the intricacies of Discovery Silver with our comprehensive financial health report here.

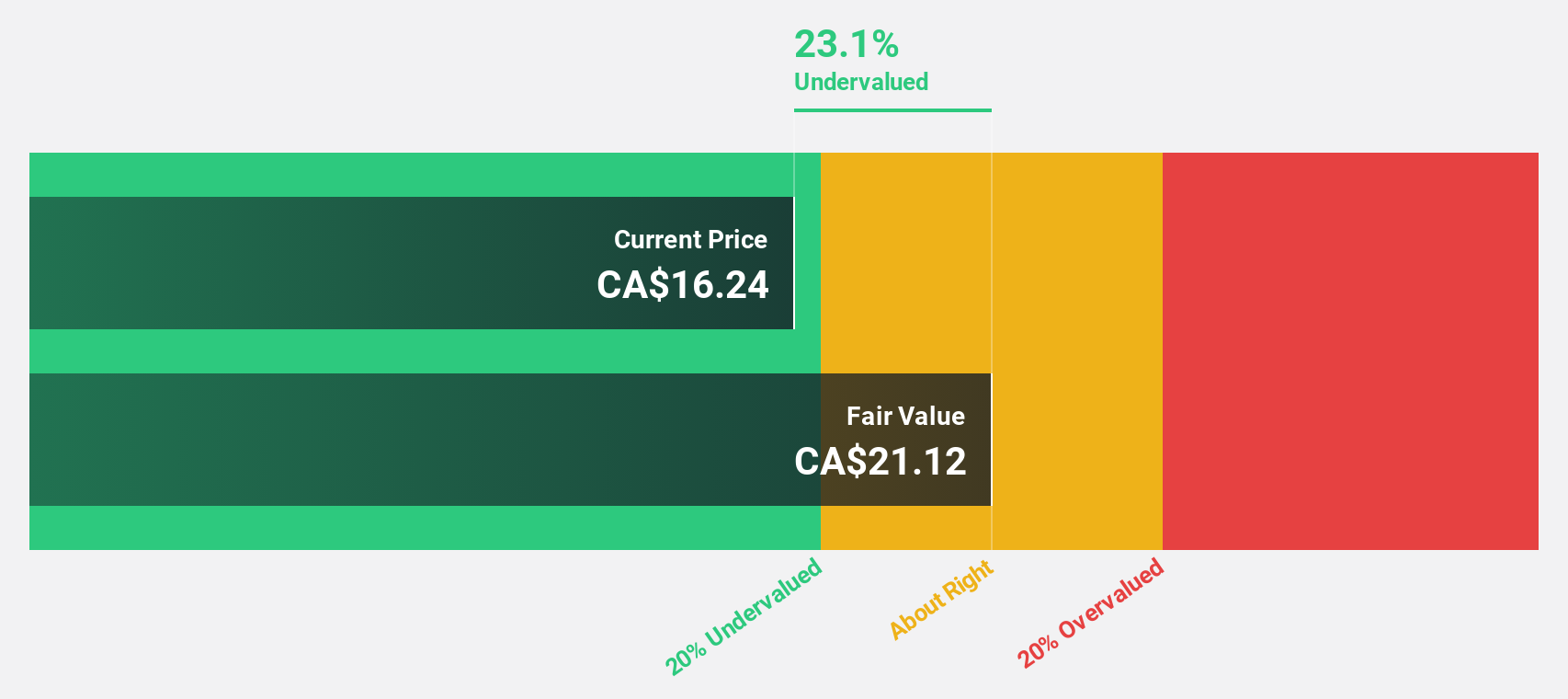

Northland Power (TSX:NPI)

Overview: Northland Power Inc. is a power producer operating in Canada, the Netherlands, Germany, Colombia, Spain, the United States, and internationally with a market cap of CA$4.25 billion.

Operations: The company's revenue segments include CA$1.06 billion from Offshore Wind Facilities, CA$366.29 million from Utility operations in Colombia, CA$344.38 million from Natural Gas Facilities in Canada, CA$315.98 million from Onshore Renewable sources in North America, and CA$199.51 million from Onshore Renewable operations in Spain.

Estimated Discount To Fair Value: 23.1%

Northland Power, trading at CA$16.24, is undervalued based on cash flows with an estimated fair value of CA$21.12. Analysts expect the stock price to rise by 37.4%. The company is forecast to achieve profitability within three years, exceeding average market growth rates. However, interest payments and dividends are not well covered by earnings, posing financial challenges. Recent strategic shifts include regional restructuring and a notable acquisition in Poland's battery storage sector for €200 million, enhancing its European presence.

- The growth report we've compiled suggests that Northland Power's future prospects could be on the up.

- Click here to discover the nuances of Northland Power with our detailed financial health report.

Summing It All Up

- Dive into all 29 of the Undervalued TSX Stocks Based On Cash Flows we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DSV

Discovery Silver

A mineral exploration company, engages in the acquisition, exploration, and development of mineral properties in Canada.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success